JP Morgan to Investors: Dump Overheated US Markets, Pivot to European Stocks Now

Wall Street’s favorite flip-floppers at JP Morgan just signaled the exit for US equities—time to chase those ’boring’ European valuations instead.

The rotation play no one’s talking about

While retail traders pile into meme stocks and crypto, the smart money’s quietly shifting to Stoxx 600 companies trading at 2018 multiples. Frankfurt never looked so sexy.

A cynical take?

Translation: after extracting every last cent from the Fed’s liquidity crack pipe, even the suits know this party’s over. Europe’s the only table left with chips—and they’re priced in euros, so good luck with that FX risk.

European Stocks More Favorable Than the US Markets: JP Morgan

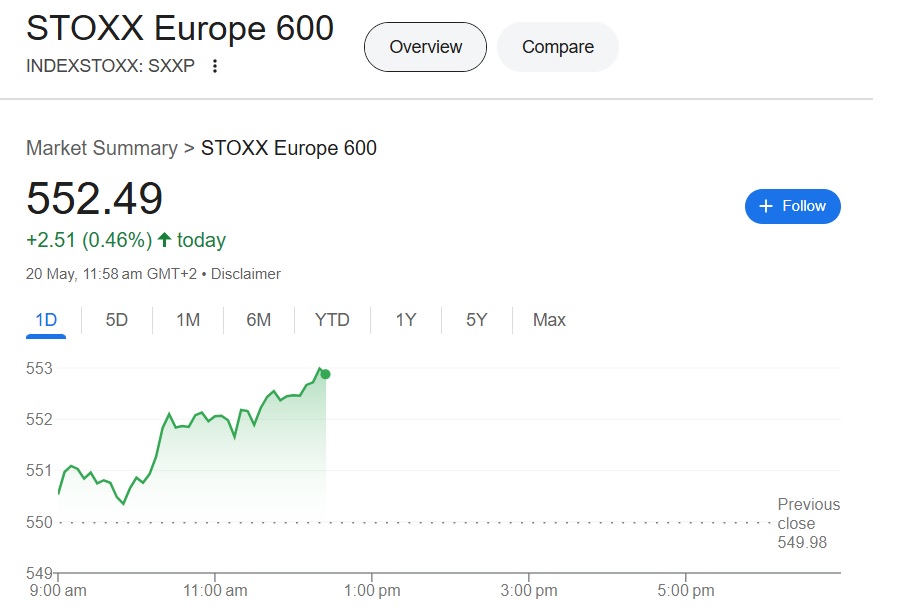

The European stocks Stoxx 600 index will outperform the S&P 500 index by 25 percentage points in 2025, predicts JP Morgan. This makes investing in STOXX a prime strategy that could deliver better returns than the broader US-based financial assets. While the SXXP index is up more than 8% year-to-date, the S&P 500 index is up only 1.6% YTD.

Not just JP Morgan, even Citigroup wrote in its latest research piece that European stocks will perform better than the US. Citigroup predicted that STOXX will reach 570 points next, which is an uptick of 3.5%.said Citigroup strategist Beata Manthey.

The outlook marks a major turnaround in US financial assets for the first time in decades. Not just European stocks, the inflow of funds into the Chinese markets touched $17.3 billion, reported JP Morgan. The US-based assets are in danger due to tariffs and trade wars, and investors don’t want to risk their portfolios.