The Dollar’s Grip Slips: Global Reserves Now Just 60% USD as Alternatives Rise

Central banks are quietly diversifying away from the greenback—gold, yuan, and yes, even crypto creeping into vaults. The exorbitant privilege isn’t what it used to be.

Wake-up call: When even the IMF starts hedging, you know the game’s changing. BRICS currencies, CBDCs, and Bitcoin ETFs now nibble at the edges of dollar dominance. Don’t expect a sudden collapse—just a slow bleed as trust gets algorithmic.

Funny how ’risk-free’ assets keep needing bailouts, isn’t it?

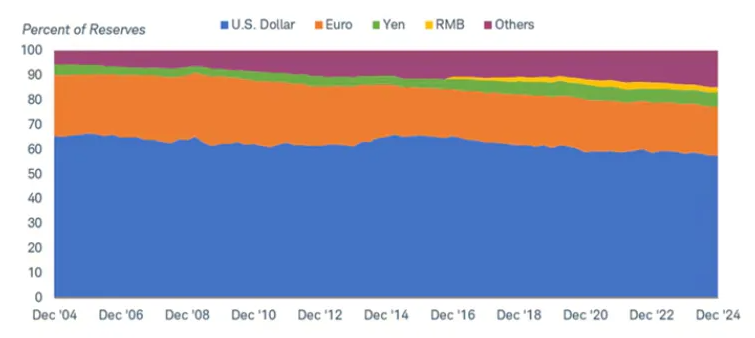

The Decline of Dollar Dominance in Numbers

The dollar’s position in global reserves has eroded steadily over the past 20 years. This shift reflects a deliberate diversification strategy by central banks worldwide as they seek to reduce dependency on any single currency and also to protect themselves from potential geopolitical risks.

Historical Context of the Dollar’s Weakening

Ever since the introduction of the euro in 1999, central banks have actively reduced their dollar reserves. The British pound and Canadian dollar have slightly increased their share of global reserves as well. Recent disputes and conflicts in world trade have moved the world toward rejecting US dollar dominance.

Economically stressed nations and countries that desire greater freedom with their money, have mused about discontinuing using the US dollar as their main currency for trade. At the moment, “de-dollarization” is a major topic of discussion in financial markets.

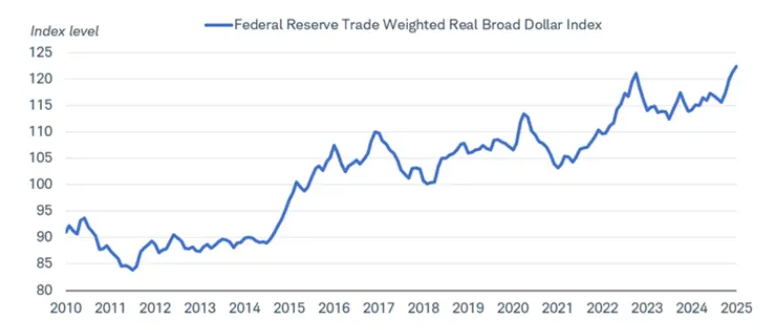

Paradox of Dollar Strength Amid Declining Reserve Status

Although the reserve status of the dollar is slowly decreasing, the currency has remained extremely durable in the last few years, resulting in a confusing situation for everyone in global markets.

During the past decade, the US dollar has been propelled higher by relatively high US interest rates compared to other major countries, strong capital inflows, and its status as a perceived SAFE haven in times of turmoil. It has risen to a new high in real terms as shown in the Federal Reserve Trade Weighted Real Broad Dollar Index.

Market Reactions to Dollar Uncertainty

Recent financial market developments have raised questions about the dollar’s long-term stability. The USD losing power has become evident as it weakened 8% this year against a basket of foreign currencies.

Morgan Stanley strategist Vishwanath Tirupattur stated:

Global investors are reconsidering putting their assets in the United States. Amid the market swings, people have turned to Gold and German bonds as secure investments. More capital is also moving into emerging markets as investors search for ways to branch out from investing only in dollars.

Structural Challenges for Alternative Currencies

Even though the dollar’s dominance is decreasing, stopping the dollar is not easy. Only a few candidates can compare to the basic characteristics required by the reserve currency position.

Brent Coggins, chief investment officer at Triad Wealth Partners in Kansas, explained:

A reserve currency needs to be freely convertible with DEEP and liquid bond markets. Central banks must be confident that their money is easily accessible when needed, particularly during times of stress. The US, with its large, open, and liquid market for Treasury securities, continues to fit that role despite recent challenges.

Future Outlook for the Global Reserve System

While immediate wholesale abandonment of the dollar seems unlikely, global financial trends have clearly established the path toward a more multipolar currency system.

Wells Fargo international economist Nick Bennenbroek was clear about the fact that:

What concerns WHITE House economists most is not short-term market volatility but rather the risk of fueling a longer-term trend: a structural flight from US assets. A large-scale reallocation of global savings away from the US could lead to a new monetary equilibrium in which global demand for dollars shrinks dramatically, challenging America’s “exorbitant privilege” of borrowing without much concern over interest rates.

Major financial and economic power shifts across the globe have now overtaken the ascendancy of the US dollar. In the short run, there are no better reserve currencies than the dollar, but strengthening trend of de-dollarization is happening globally.