Morgan Stanley Doubles Down on US Stocks—Even as Moody’s Drops Credit Bomb

Wall Street’s latest plot twist: Morgan Stanley tells investors to buy the dip while Moody’s plays the bear. Classic finance—where ’strong fundamentals’ meet ’selective amnesia.’

Why now? The bank’s analysts claim US equities are oversold, with tech and cyclicals primed for rebound. Never mind that pesky credit warning—apparently, stocks ’discount risks faster’ than ratings agencies can type them.

The kicker? This advice drops as Treasury yields wobble and crypto markets flirt with new highs. Priorities, people.

Morgan Stanley’s Take On Market Volatility And Investment Risks

Wilson recommends investors buy US stocks during dips caused by Friday’s credit rating cut, and he specifically mentioned that the reduced recession probability thanks to the US-China trade truce makes this an attractive opportunity.

Michael Wilson wrote in a note:

Credit Downgrade Impact

Moody’s credit downgrade was issued in response to America’s expanding budget deficit, which is showing little sign of improvement. This marks the final major rating agency to cut US debt rating, following similar actions by Fitch and also S&P in previous years. S&P 500 futures fell 1.2% Monday as market volatility increased and investment risks were reassessed by many institutional investors.

The benchmark US stock index has definitely trailed international peers in 2025 but recently recovered losses following the temporary trade agreement. This recovery presents new opportunities to buy US stocks despite lingering concerns about Moody’s credit shock.

Corporate Resilience

Corporate earnings remained surprisingly resilient despite trade tensions, and this suggests underlying strength in US stocks that might be overlooked. Recent profit upgrades signal potential equity gains even with temporary trade weakness, according to Wilson’s analysis.

Wilson explained in his note:

Market Outlook

Wilson now stands among just a few strategists favoring US stocks over international alternatives. Goldman Sachs’ David Kostin also expects the Magnificent Seven tech stocks to resume outperforming the broader market despite their recent underperformance amid market volatility.

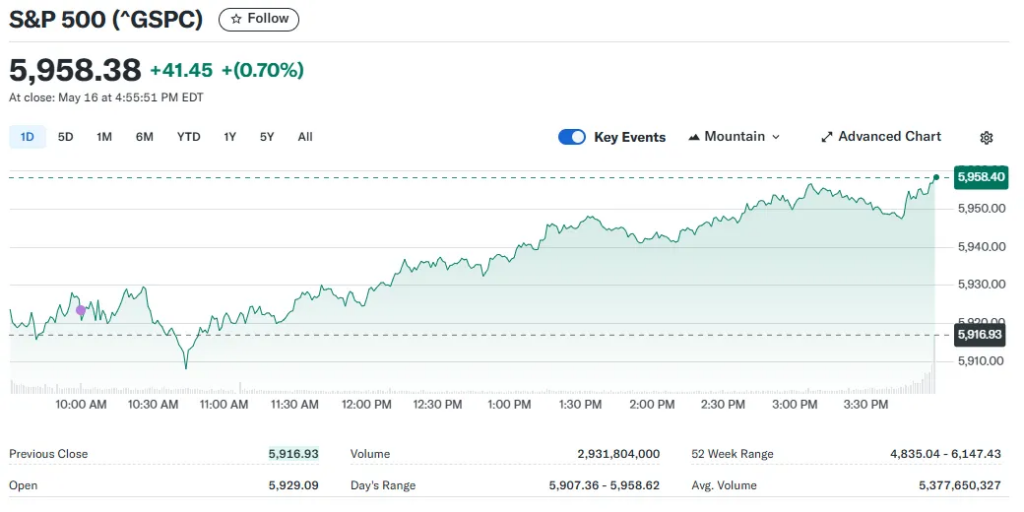

S&P 500 closed at 5,958.38 on May 16, gaining 0.70% despite Moody’s credit shock, demonstrating some impressive market resilience. The 10-year Treasury yield has stabilized at around 4.44%, slightly lower than the post-downgrade highs that initially triggered concerns.

Morgan Stanley’s recommendation to buy US stocks during periods of market volatility reflects confidence that reduced US-China trade tensions outweigh investment risks from the credit downgrade, and this is creating favorable conditions for investors despite regulatory uncertainty and other challenges in the current environment.