Analyst Dan Ives Bets Big: AAPL to $210, MSFT to $400, PLTR to $18 in 12 Months

Wall Street’s favorite tech soothsayer Dan Ives just dropped a bombshell price target trio—Apple, Microsoft, and Palantir are all primed for double-digit rallies. Because apparently, even trillion-dollar megacaps need cheerleaders.

Apple’s $210 call implies 15% upside from current levels, while Microsoft’s $400 target suggests a 20% climb. But the real eyebrow-raiser? Palantir’s $18 projection—a 30% moonshot for the controversial data-mining firm.

Ives cites AI arms races and enterprise cloud spending as key catalysts. Never mind that Palantir’s government contracts still smell like Pentagon pork—when the hype train leaves the station, fundamentals become optional.

Tracking Apple, Microsoft & Palantir Stocks Amid Market Volatility and Nasdaq Trends

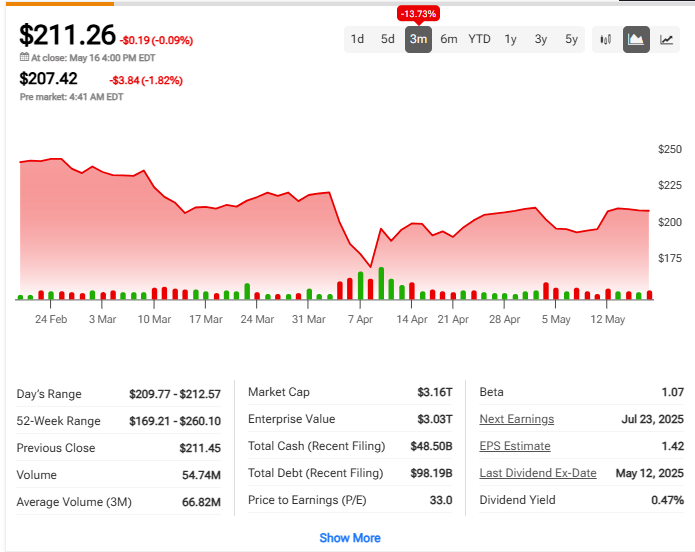

1. Apple’s Path to $210 – Bullish Case Emerges

The latest Apple stock price prediction from Wedbush’s Dan Ives actually suggests that AAPL could potentially reach around $210 within a year or so. While writing this, Bitcoin was worth over $200 which could suggest that those writing about it were unconcerned by the recent drops in the Nasdaq index.

Dan Ives stated:

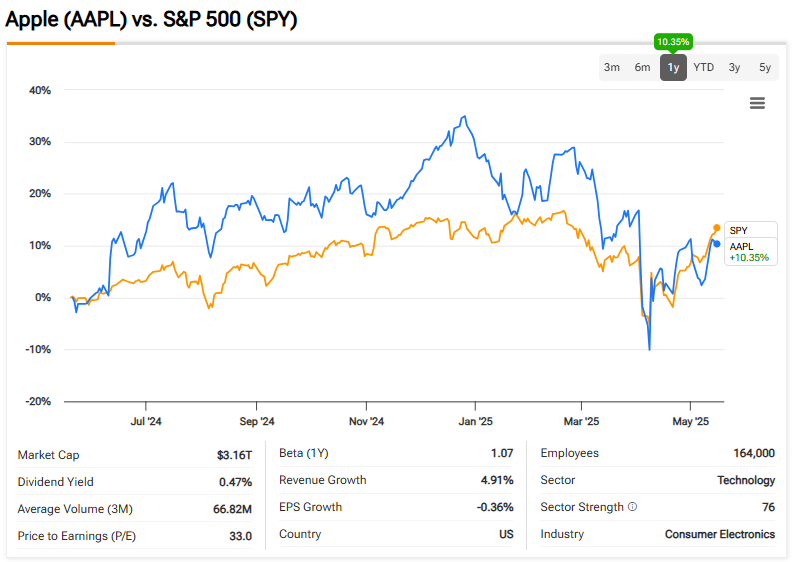

Wall Street generally seems to support this particular Apple stock price prediction with an average target of about $228.65, which is honestly surpassing even Ives’ forecast in some ways. AAPL continues to outperform the S&P 500 index despite NVDA essentially stealing many headlines in the tech sector lately.

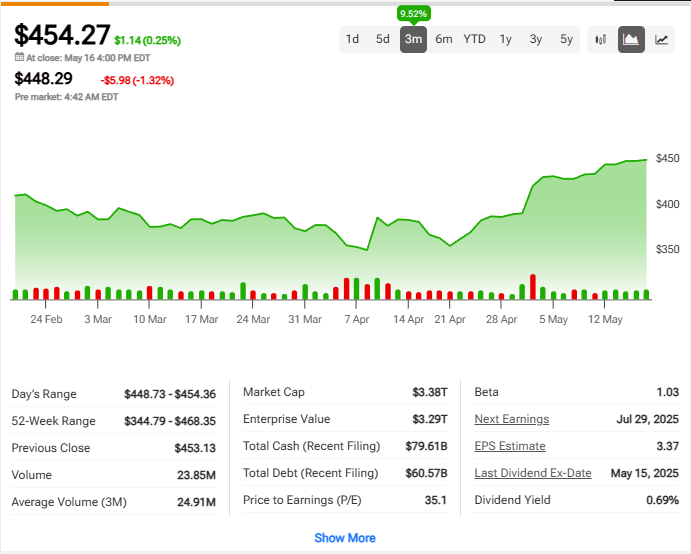

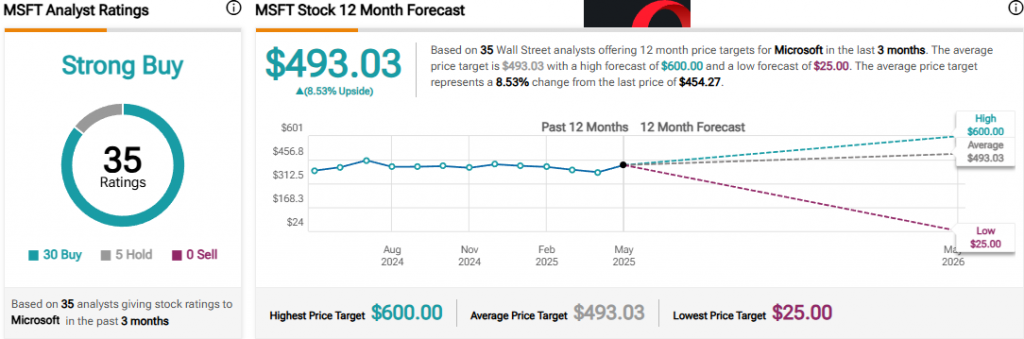

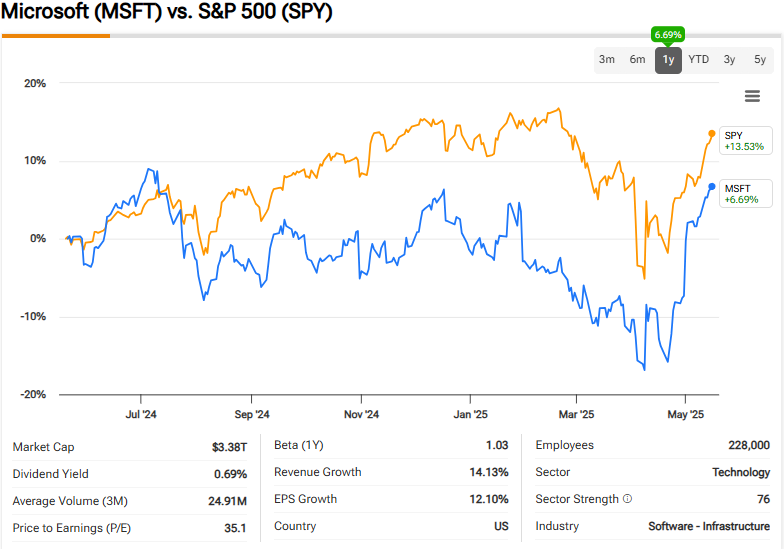

2. Microsoft’s $400 Target Amid AI Push

Microsoft‘s trajectory kind of mirrors the broader tech market volatility in recent months, yet MSFT currently holds somewhat stronger analyst sentiment than AAPL with approximately 35ratings from various experts.

While TSLA has definitely struggled with consistency this year, MSFT continues making steady progress toward Ives’ rather ambitious $400 target, mostly fueled by its ongoing AI advancement and also its impressive cloud expansion efforts.

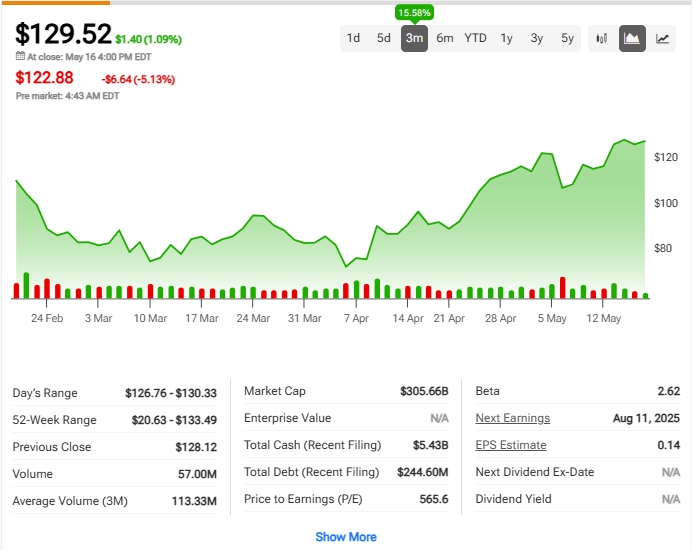

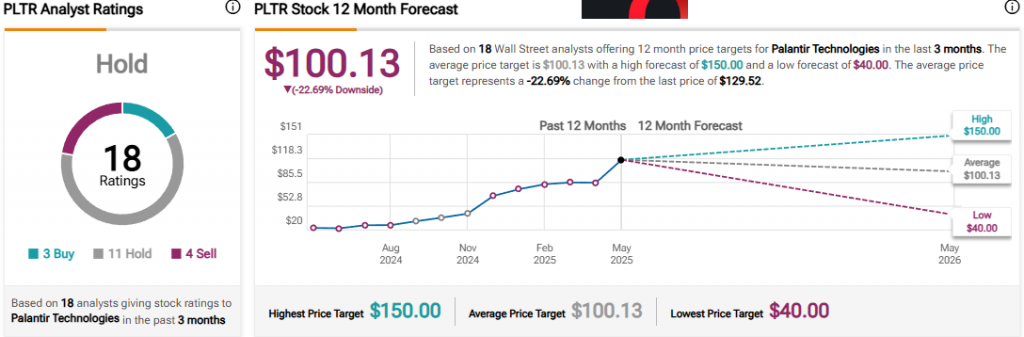

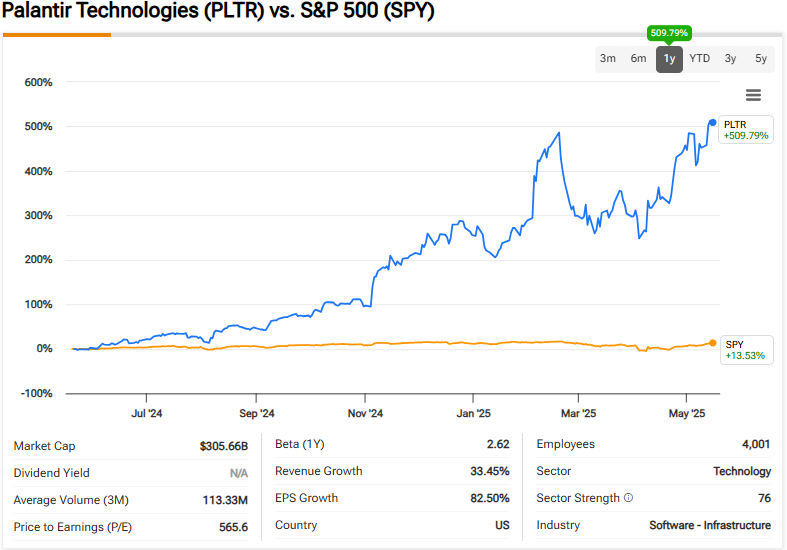

3. Palantir’s Controversial $18 Target

Palantir presents perhaps the most divisive Apple stock price prediction comparison right now, with PLTR showing really massive 509% yearly gains while most analysts still remain somewhat cautious about its future prospects.

Even though NVDA and TSLA have experienced volatile markets recently, Palantir’s recent performance could be one of the reasons Ives has given a somewhat higher target.

Models used to predict Apple stock prices consider the strength of the United States dollar, the local currency and the strong correlations being seen in Ripple and bitcoin markets these days.