XRP Futures Go Live May 19 – Where Will Prices Land by Month’s End?

Crypto traders brace for impact as XRP futures hit the market this week. The timing couldn’t be more dramatic—just days before the monthly close, when every hedge fund’s ’proprietary algorithm’ suddenly develops performance anxiety.

Price predictions flood in: Will the derivatives launch trigger a liquidity squeeze or a speculative frenzy? Analysts are split between ’measured growth’ and ’volatility bomb’ scenarios.

One thing’s certain: The usual suspects—whales, market makers, and that one anonymous Twitter account with a laser-eyed profile pic—are already positioning for maximum advantage. Welcome to the casino.

XRP May 2025 Forecast, Futures Launch Impact, And Ripple Market Outlook

CME Futures Launch Impact on XRP Price

The Chicago Mercantile Exchange (CME) Group has confirmed XRP futures launch on May 19, placing XRP alongside Bitcoin and ethereum in terms of institutional derivatives offerings.

CME Group was clear about the fact that:

Mark your calendars and get ready to expand your crypto portfolio with XRP futures starting May 19.

Mark your calendars and get ready to expand your crypto portfolio with XRP futures starting May 19.

Trade your market view with confidence with CFTC-regulated XRP futures, available in larger- and micro-sized contracts. https://t.co/QKapp7sxi6 pic.twitter.com/Xnys8py1Du

https://t.co/QKapp7sxi6 pic.twitter.com/Xnys8py1Du

This launch follows CME’s introduction of XRP pricing indices in July 2023, setting the groundwork for broader institutional adoption. The xrp price prediction for May end must consider this significant market development.

Price Trajectory Through Late May

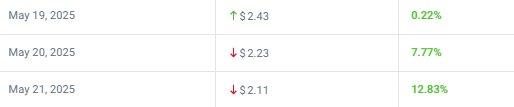

Market data indicates a consistent downward price movement following the futures launch:

XRP is expected to MOVE from $2.35 on May 18 to $2.43 on launch day before beginning its decline. By May 22, the price is projected to fall below $2.

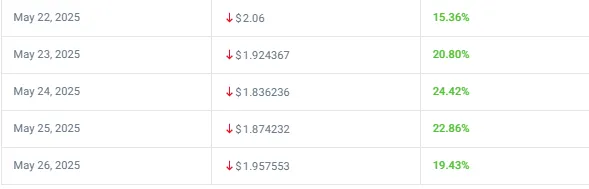

By May 31, the XRP price prediction for May end settles at approximately $1.89. The most substantial percentage drops occur between May 21-24, with daily declines exceeding 10%.

Market Implications and Trading Volume

Trading volumes have gone up as prices start to decrease. Stabilization of percentage changes between 17% and 22% during May 27-31 suggests nothing more than that the market is adjusting after its initial uncertainty.

The introduction of XRP futures indicates that big investors are accepting the token and also creates new market challenges for it. The XRP price for May is a reflection of how derivatives can quickly affect the prices of cryptocurrencies. After all, XRP has managed to rebound after earlier crashes, which proves it is tough.

With the price dropping below $3 this year, the token has created certain points of support that could prevent large declines once the futures launch’s volatility ends. Recent announcements show that the futures open interest for XRP has soared by $1 billion due to strong anticipation for ETF approval this summer, showing influential players remain interested despite the recent drop in prices.