Buffett Ditches $6B in Bank of America as De-Dollarization Goes Mainstream—But Clings to Apple

Warren Buffett’s Berkshire Hathaway just made a seismic shift—dumping $6 billion in BAC shares while doubling down on AAPL. Is this the Oracle of Omaha betting against the dollar’s dominance?

De-dollarization isn’t some fringe theory anymore. When the world’s most famous value investor starts rotating out of traditional banking exposure, even Wall Street’s old guard pays attention. Yet his Apple stake remains untouched—suggesting Big Tech might be the new ’too big to fail.’

Funny how the same institutions warning about crypto volatility are now sweating over their own reserve currency. Maybe next they’ll start calling Bitcoin ’risky’ while their balance sheets hemorrhage T-bills.

Berkshire Hathaway Sells Bank of America, Citigroup Amid Dollar Risk

Berkshire Hathaway has, in recent months, significantly reduced its exposure to major banking institutions due to de-dollarization trends that could potentially impact the traditional banking sector. Bank of America (BAC) and Citigroup (C) have experienced the largest selloffs, which marks a notable and somewhat unexpected shift in Buffett’s investment approach.

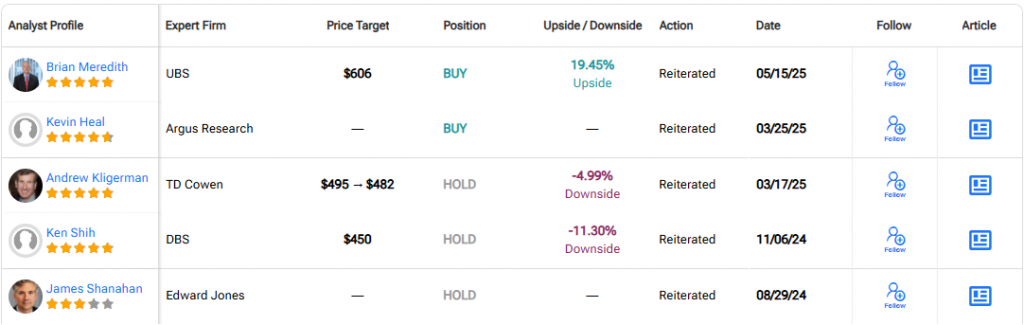

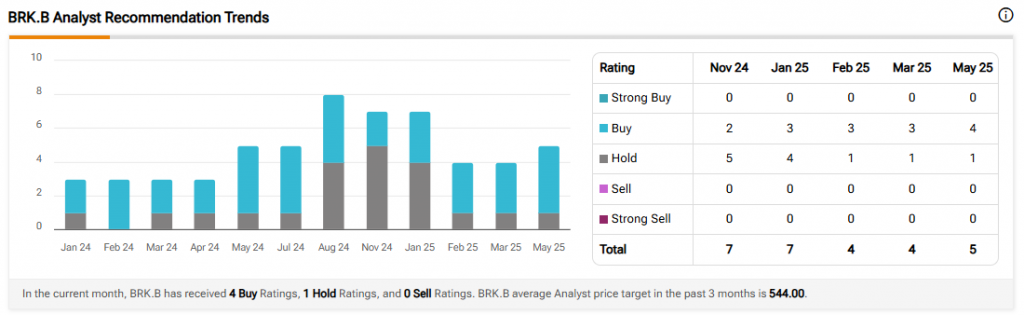

Despite the banking sector selloff and various market fluctuations, BRK.B still maintains arating among analysts with an average price target of $544.00.

UBS analyst Brian Meredith stated:

Apple Holdings Remain Steady Despite De-dollarization Concerns

While Berkshire Hathaway has been offloading bank stocks in the past few months, its position in Apple remains largely unchanged. This particular decision indicates Buffett’s continued confidence in the tech giant’s ability to withstand currency fluctuations in a de-dollarizing global economy.

Analyst Sentiment Improves Despite Dollar Risks

Analyst sentiment for Berkshire Hathaway has somewhat improved recently with 4ratings and just 1 “Hold” rating as of May 2025. The generally positive outlook suggests that many market experts seem to approve of Buffett’s strategic repositioning away from banking stocks due to ongoing de-dollarization risks.

Kevin Heal from Argus Research noted:

Constellation Brands Investment Increases as Dollar Hedge

Berkshire Hathaway has, interestingly enough, increased its stake in Constellation Brands (STZ), apparently seeking consumer staples with pricing power that may provide better insulation from de-dollarization effects than traditional banking investments would.

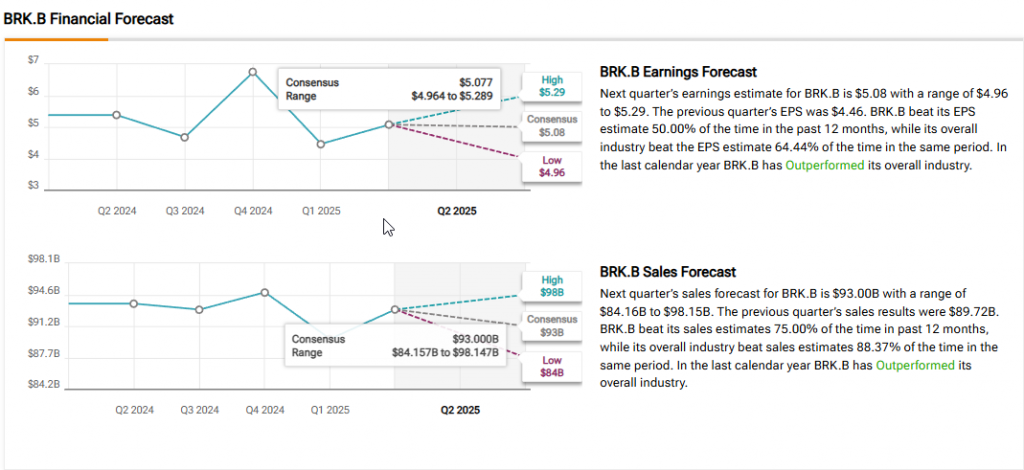

Berkshire’s financial outlook still remains relatively strong despite its strategic repositioning to counter United States dollar risks. The company is currently expected to generate earnings of approximately $5.08 per share next quarter, with projected sales of around $93 billion or so.

The global trend toward de-dollarization has certainly accelerated in recent times, prompting strategic portfolio adjustments from investors like Buffett and others. Berkshire Hathaway’s moves away from Bank of America and toward Apple and also Constellation Brands reveal a careful and calculated approach to navigating the shifting monetary landscape that has been exacerbated by persistent de-dollarization concerns.