Corporate Bitcoin Hoarders Now Outnumber Retail Investors – 2025 Report

Wall Street’s crypto land grab hits tipping point as institutional holdings surpass retail for the first time.

• The big eat the small: Public companies now control 53% of circulating supply—up from 12% in 2021.

• Treasuries over traders: MicroStrategy alone holds 3% of all Bitcoin, while retail wallets shrink by 18% YTD.

• Self-custody exodus: Exchange balances hit 5-year lows as ’not your keys’ crowd gets priced out.

Funny how these same corporations that mocked crypto ’nerds’ in 2022 now pay $5M+ for conference speaking slots. The ultimate FOMO play—just don’t call it a speculative bubble when BlackRock does it.

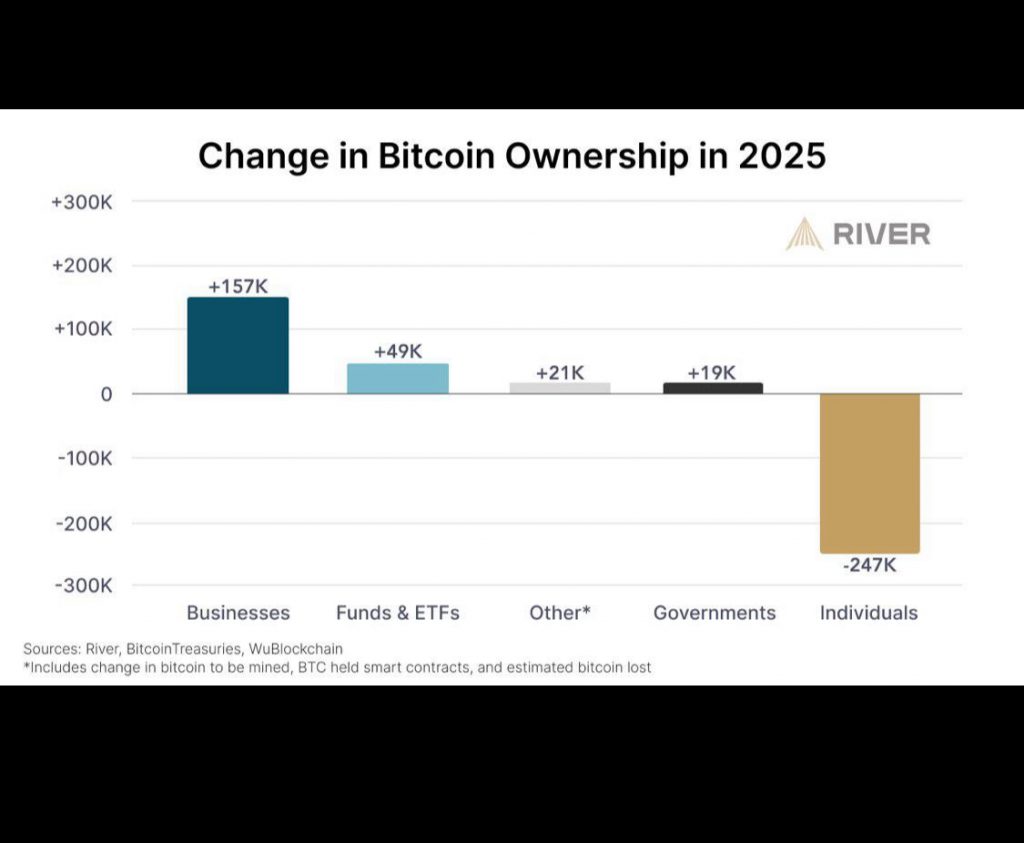

Individuals Take A Backseat and Make Way For Businesses

According to a study by River, BTC has witnessed a notable rise in businesses owning the king coin. This number has increased by more than 157K so far in 2025. Other areas include funds and exchange-traded funds (ETFs), others, as well as governments. Meanwhile, the number of individual ownership of Bitcoin owners has declined massively. River’s report reveals a 247K downfall in the same.

While several expressed frustration, a few others pointed out how people could have sold their bitcoin to invest in BTC ETFs. River further confirmed that investors account for a majority of the overall ownership of the asset. The firm pointed out how individuals make up for 69.4% of the overall BTC supply. Easing all the fear of investors, the report further read,

““

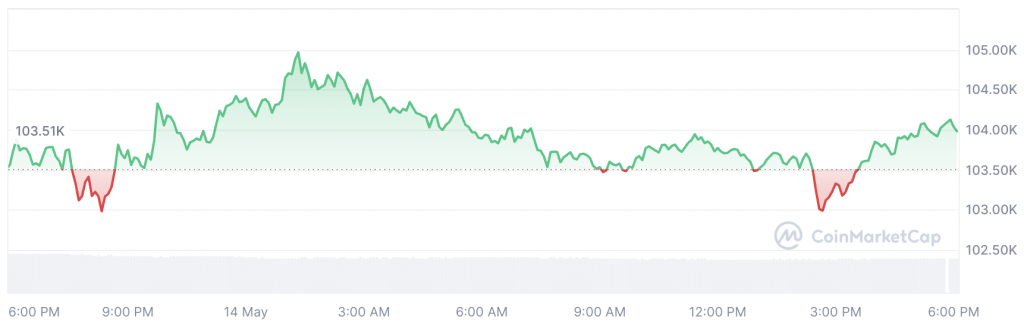

Bitcoin’s Current Price

Over the past week, the world’s largest cryptocurrency has managed to rise by nearly 8%. At the time of writing, Bitcoin was trading at $104,010.10. Just earlier yesterday, the asset surged to a high of $105,747.45.