AAPL Soars 24% as US-China Truce Papers Over Apple’s Risky China Dependence

Wall Street cheers the trade deal—ignoring the elephant in the room: Apple’s entire supply chain is still hostage to Beijing’s whims.

Tim Cook’s grin says it all. Another quarter, another geopolitical band-aid slapped on Apple’s single-point-of-failure strategy. But hey—when the music’s playing, why worry about chairs?

Will AAPL China Reliance Break Apple’s Momentum After Trade Boost?

Apple stock’s impressive performance currently hinges on its long-standing manufacturing relationship with China, which creates both strategic advantages and also potential vulnerabilities. Wedbush Securities analyst Dan Ives has identified clear winners from this deal:

Dan Ives stated:

Supply Chain Realities Impact Apple Stock

The trade agreement represents what many experts and analysts consider an ideal outcome for Apple stock investors. Any attempt at moving production alternatives would significantly affect Apple stock valuation in the coming months.

Dan Ives explained:

Tech Stocks Rally Boosted by Deal

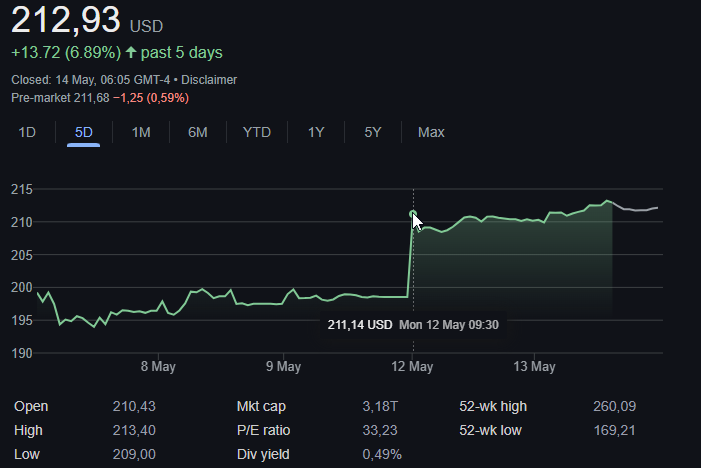

The agreement has, in recent days, fueled a broader tech stocks rally, with the NASDAQ 100 essentially erasing its year-to-date losses. The “magnificent seven” tech companies gained over $800 billion in market value, which really highlights how improved US-China relations positively impact Apple stock and the sector as a whole.

Dan Ives emphasized:

Political Negotiations and Apple Stock Outlook

The complex negotiations affecting Apple stock were characterized as strategic calculations by both nations, with significant and far-reaching economic implications for Apple stock holders and also the tech industry in general.

Dan Ives observed:

Apple stock continues to benefit from this temporary agreement, though investors are, at present, watching closely as further negotiations addressing intellectual property issues and also WTO concerns will be needed in the coming year.