Ethereum Bulls Charge: Is $3K the Next Stop?

ETH defies gravity—again—as traders pile into the rally. No ’if’s about this uptrend, just how high it goes.

Subheading: Technicals Scream Breakout

The charts don’t lie: Ethereum’s smashed resistance levels like a bull in a china shop. MACD cross? Check. Volume surge? Double-check. Only the SEC could kill this vibe now.

Subheading: Wall Street Whispers ’FOMO’

Hedge funds are quietly rotating out of overpriced AI stocks—straight into ETH futures. Nothing like latecomers juicing the rally further.

Closing Thought: $3K looks inevitable... until the next ’black swan’ bank collapse sends crypto into another existential crisis. Enjoy the ride while it lasts.

Source: CoinGecko

Source: CoinGecko

Cryptocurrency Market Makes Another Upward Push

The crypto market faced a slight correction yesterday. Bitcoin (BTC) briefly fell to the $101,000 level. The asset has since reclaimed $103,700. BTC’s resurgence may have led to a market-wide recovery.

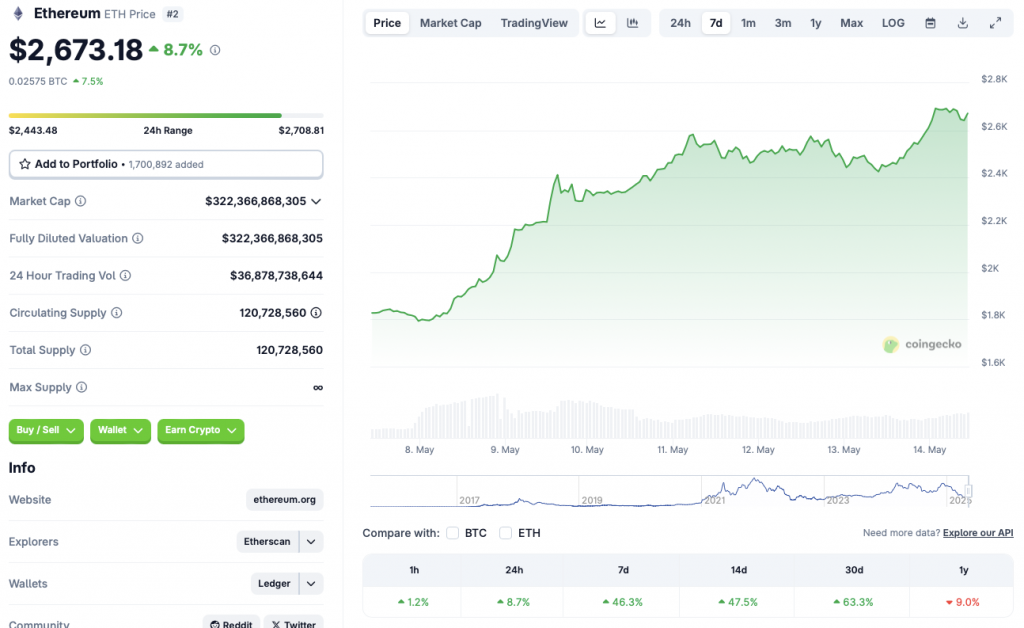

Ethereum’s (ETH) latest upward momentum is likely due to the network’s long-awaited Pectra upgrade. The Pectra upgrade was the most feature-packed update to date. The upgrade has likely led to a boost in ETH investor sentiment. The asset has outperformed even Bitcoin (BTC) over the last few days.

There is a possibility that ETH’s rally will continue over the coming days. The Federal Reserve may cut interest rates after its next meeting. The MOVE could lead to a surge in crypto investments.

Will Ethereum Reclaim $3000 This Week?

ETH’s price has to rally by 12.23% to hit the $3000 target. ETH has not traded above $3000 since early February of this year.

According to CoinCodex analysts, ethereum (ETH) may face a correction over the coming days. The platform anticipates the asset’s price to fall to $1462.98 on May 24. ETH’s price will dip by 45.27% if it falls to the $1462.98 mark.

There is also a possibility that Ethereum (ETH) will not face a correction. The asset could continue its upward momentum if BTC remains in the green zone. BTC hitting a new all-time high could lead to another market-wide rally.