Shiba Inu vs. Bitcoin: Which Memecoin Will Outperform in 2025?

Dogecoin’s spinoff takes another swing at the crypto heavyweight—can SHIB really flip BTC this cycle?

The case for Shiba Inu

Lower entry point, bigger pumps. Retail traders chasing the next 100x are piling into SHIB while Wall Street plays Bitcoin ETFs. Recent burns and Shibarium adoption add fuel to the hype train.

Bitcoin’s boring advantage

Institutional money flows don’t care about meme magic. With spot ETFs now trading and halving effects kicking in, BTC remains the safe-haven play—even if it lacks SHIB’s degenerate appeal.

Final verdict: SHIB might moon harder, but Bitcoin won’t rug you. Choose your fighter—just remember both are gambling in the world’s most volatile casino (disguised as finance).

Shiba Inu vs Bitcoin Current Market

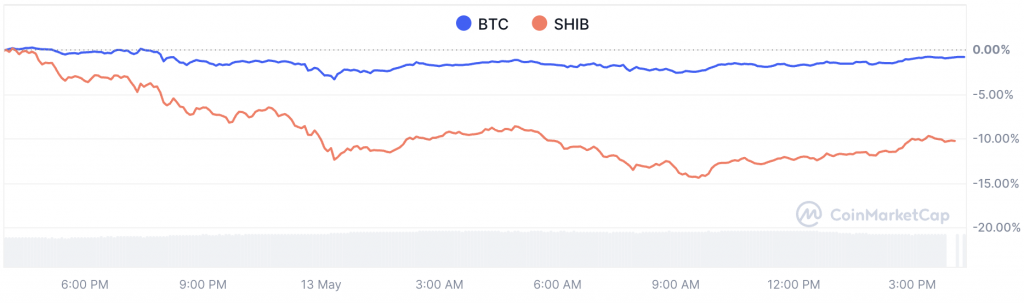

At the time of writing, SHIB was trading at $0.00001555. This comes after a 10.004% drop during the past 24 hours. It should be noted that SHIB enjoyed a notable rally throughout the last week as it rose by more than 25%.

Bitcoin’s daily drop was much smaller when compared to SHIB. The king coin saw a 0.88% decrease in its price during the past 24 hours. At the time of writing, BTC was priced at $103,485.26. The world’s largest cryptocurrency managed to rise to a high of $104,607.14, just earlier today.

2025 Price Prediction

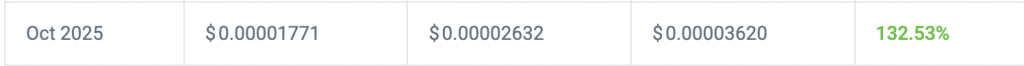

According to data from CoinCodex, the highest that shiba inu is expected to rise to in 2025 is $ 0.00003620. Through this, the meme coin will record a massive uptick of 133% from its current price level. Shiba Inu will achieve this peak during the month of October.

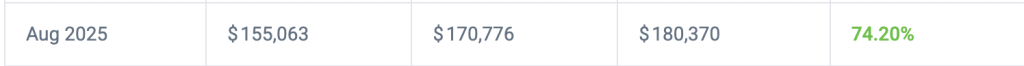

The same firm pointed out that Bitcoin will record a rise of 74% from its current value and surge to a high of $180,370. This is expected to occur in August of this year. This implies that, at least according to current projections, Shiba Inu might provide a return that is over double that of Bitcoin this year in terms of percentage increases.

Shiba Inus have a higher risk, even if they could yield bigger short-term rewards. Bitcoin might lead to more steady growth. Investor decisions should be based on their risk appetite.