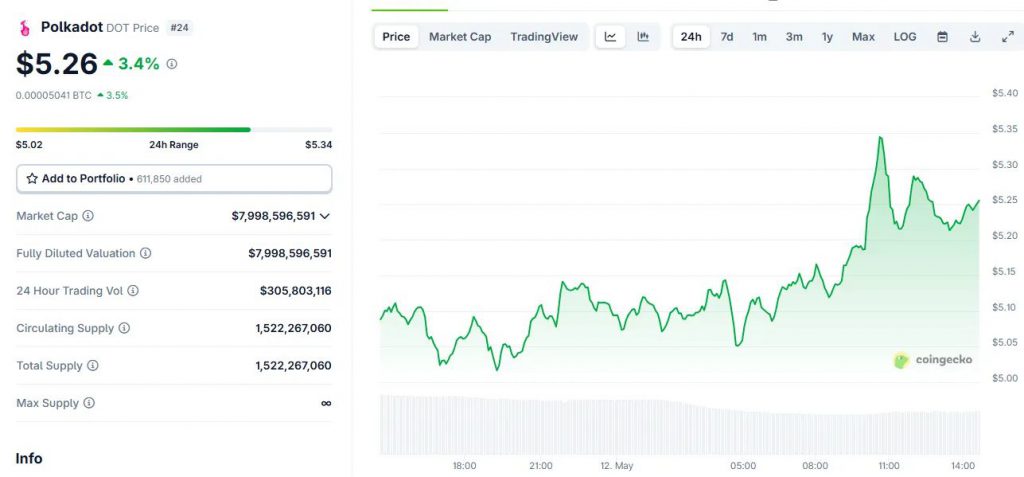

Polkadot’s Triple Bottom Signals 120% Rally—Traders Brace for Liftoff

Polkadot (DOT) just printed a textbook triple-bottom pattern—the kind that makes technical analysts reach for the champagne. Historical data suggests this formation precedes violent upside moves, with a 120% target in play if bulls hold key support.

Market psychology flipped bullish after DOT weathered last month’s ETF rejection bloodbath better than most alts. Now, liquidity is piling into cross-chain infrastructure plays—and Polkadot’s parachain auctions just got institutional wallets buzzing.

Cynics whisper about ’TA horoscopes,’ but the on-chain data doesn’t lie: whale accumulation wallets hit 18-month highs while retail traders were panic-selling the dip. Sometimes the market really does telegraph its punches.

Source: CoinGecko

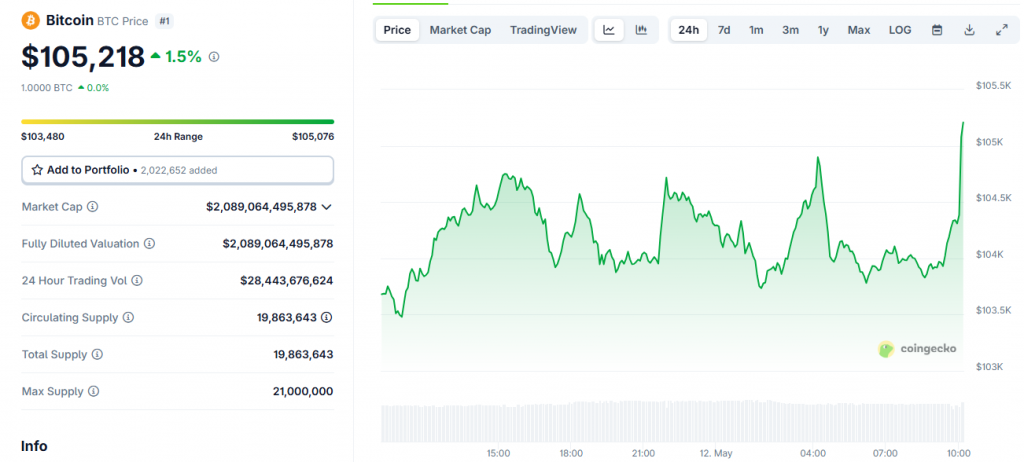

Source: CoinGecko

Boost Your Portfolio with Polkadot: Key Insights, Risks, & Rewards of DOT Token Investment

Triple Bottom Pattern Signals Major Rally Ahead

The DOT token price chart shows a clear triple bottom formation at $3.58, which is widely considered one of the strongest bullish indicators in technical analysis. Polkadot surge momentum has already pushed the price above the 50-day moving average and also past the key $4.765 resistance level from March.

This technical setup suggests that DOT is targeting the $11.60 resistance level, which the token has tested twice before in March and November last year. A move to this target WOULD represent a 120% gain from current prices, though a drop below $4 would invalidate this Polkadot surge thesis.

ETF Applications Drive Institutional Interest

The value proposition for investing in DOT tokens is enhanced by the planned ETF applications from important actors in the market. Both 21Shares and Grayscale Investments recently submitted applications to the SEC for spot Polkadot ETFs. Because Polkadot and ethereum both use proof-of-stake, the SEC is expected to review the application favorably.

Approval of a Polkadot ETF could lead to considerable institutional investment, mimicking the rise of over $40 billion into Bitcoin ETFs from January 2024. Institutional investment as a consequence of this approval would strengthen the potential for a Polkadot surge.

Polkadot 2.0 Enhances Network Performance

The ongoing Polkadot 2.0 upgrade provides fundamental support for a DOT token investment strategy. This three-part upgrade addresses previous limitations and positions Polkadot as a top layer-1 network.

Asynchronous backing, implemented earlier this year, has already cut block times from 12 to 6 seconds, effectively doubling transaction throughput. The agile coretime component now allows developers to purchase computational resources directly, bypassing the parachain auction process entirely.

The final phase, elastic scaling, has launched on Kusama ahead of main network implementation. This feature enables projects to add multiple cores to tasks and allocate resources on-demand during high-traffic periods, addressing previous scalability concerns and supporting the Polkadot surge potential.

Market Context Supports Bullish Outlook

The traditional “sell in May” strategy isn’t really playing out this year as most assets continue rising. Bitcoin has reached $105,000 while the total crypto market cap exceeds $3.3 trillion. Stock markets are also trending upward amid improving US-China trade relations.

Analysts predict bitcoin could eventually hit $200,000 as exchange supply decreases and demand increases. Historically, Bitcoin’s price appreciation eventually leads to capital flowing into alternatives like DOT token investment opportunities, furthering potential Polkadot surge conditions.

Investment Considerations

While technical and fundamental drivers indicate that there is a building surge for Polkadot, it is imperative that investors don’t falter with the market volatility dangers. The cryptocurrency market is notorious for sudden price jumps, and DOT suffers from this reputation also.

Security risks and regulatory ambiguities scenarios are still very relevant. Polkadot’s architecture defends against some problems, but larger risks in the ecosystem remain. Still, ETF-related initiatives should be seen as an expression of a growing level of mainstream recognition while regulatory moves can impact DOTs’ immediate price courses.

The particular upgrades for the Polkadot 2.0 address earlier scalability problems which got in the way of network performance during spikes in demand. These improvements strengthen the need for investment in DOT, particularly under the backdrop of increased relevance of cross-chain abilities in the developing blockchain universe.