MicroStrategy Doubles Down: Drops $1.34B on 13,390 Bitcoin—Because Cash is for Cowards

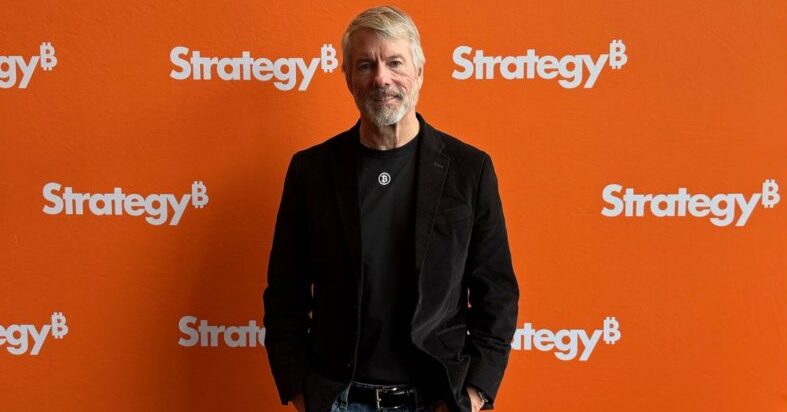

Michael Saylor’s crypto juggernaut just vacuumed up another 13,390 BTC—because why diversify when you can hypercharge a single bet? The move pushes MicroStrategy’s total stash north of 200,000 BTC, worth roughly $13B at current prices. Wall Street analysts weep into their spreadsheets.

Meanwhile, Treasury yields twiddle their thumbs at 4%. Saylor’s playbook? Buy the dip, ignore the noise, and let the suits keep arguing about ’risk-adjusted returns.’ The company funded this round with convertible notes—because nothing says conviction like debt-fueled accumulation.

Fun fact: This $1.34B purchase averages $100k per coin. Either a masterstroke or the most expensive HODL experiment in history—depending on which hedge fund manager you ask. Spoiler: The ones shorting BTC aren’t laughing anymore.

How Institutional Crypto Buying Is Shaping Bitcoin Strategy Today

This latest Michael Saylor bitcoin purchase was, as a matter of fact, executed at an average price of approximately $99,856 per bitcoin, which is considerably higher than their overall average acquisition price. Despite some ongoing market volatility concerns, MicroStrategy’s Bitcoin investment strategy remains, at the time of writing, aggressive and unwavering, and shows no signs of slowing down anytime soon.

The tech firm now holds, quite impressively, a staggering 568,840 BTC in total, having acquired them for about $39.41 billion at an average price of $69,287 per bitcoin. This persistent accumulation of bitcoins, under the guidance of Michael Saylor’s purchase strategy, which has been ongoing for several years now, reflects the growing institutional crypto buying trends and also the generally positive crypto market sentiment that we’re seeing in 2025.

MicroStrategy bitcoin holdings have grown substantially since the company first began converting its treasury reserves to Bitcoin back in 2020. The firm’s Bitcoin investment strategy, largely attributed to Michael Saylor’s purchase decisions, has essentially transformed it from a conventional enterprise software company into a de facto Bitcoin proxy for traditional investors, and many market observers are watching this development with great interest.

This latest acquisition by Michael Saylor bitcoin purchase strategy demonstrates, once again, his continued confidence in cryptocurrency as both a treasury reserve asset and an inflation hedge. As institutional crypto buying gains momentum right now in the market, MicroStrategy’s bold approach continues to influence broader crypto market sentiment among corporate treasuries worldwide, and many are wondering who might follow this path next.