Ultrashort Bond Funds Defy Volatility—Two Packs Crushing 6.2% Yields While Traders Sweat

Wall Street’s ’safe haven’ play gets a crypto-era twist as ultrashort bond funds quietly outperform. These two portfolios are dodging market chaos—and delivering yields that’d make your savings account weep.

How? By exploiting rate hikes faster than a DeFi yield farmer. Meanwhile, hedge funds still can’t decide if we’re in a recession or a bull market.

Pro tip: When the VIX spikes, follow the money—not the CNBC panic anchors.

Why These Ultrashort Bond Funds Outperform In Rising Rate Environments

Ultrashort bond funds tend to thrive when rates rise because their short duration profiles can actually minimize interest rate risk. The best short-term bond funds can, in fact, quickly reinvest at higher yields, and this creates a significant advantage for investors.

The chart above shows how the ultrashort bond funds have been giving about 14.56% returns versus virtually 5.94% across the broader bond index, which indeed speaks to their effectiveness during rate hikes and market swings.

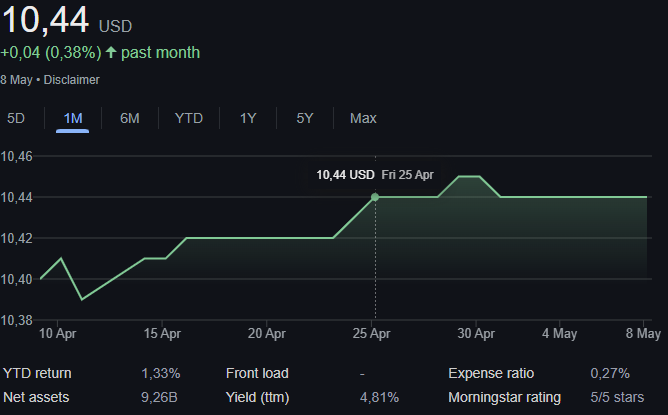

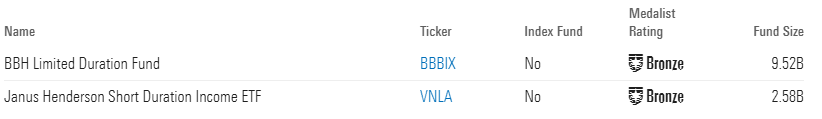

1. BBH Limited Duration Fund (BBBIX): Consistent Top Performer

BBH Limited Duration Fund (with approximately $9.52B in assets) stands among the top ultrashort bond funds with a rather impressive 6.21% one-year return, placing it in the 5th percentile of its category.

BBH’s portfolio management team stated:

2. Janus Henderson Short Duration Income ETF (VNLA): Flexible Approach

The Janus Henderson Short Duration Income ETF (around $2.58B in size) represents another top ultrashort bond fund, and it has been delivering about 6.25% over one year. VNLA adapts rather quickly to changing conditions, which makes it quite ideal for navigating bond funds amid rate hikes.

Janus Henderson’s investment team explained:

High yield bond funds like these offer somewhat practical alternatives for investors who are trying to balance their income needs with volatility concerns. Their low duration bond funds structure basically provides meaningful yield without too much excessive interest rate exposure.

For those who are seeking the best short-term bond funds in today’s rather complex environment, ultrashort bond funds such as BBBIX and VNLA merit consideration for their proven ability to deliver competitive returns while also managing downside risk in these uncertain times.