JP Morgan Sounds Alarm: The US Dollar’s Reign Is Crumbling—Here’s Why

The greenback’s days as the undisputed global reserve currency are numbered—and even Wall Street’s giants can’t ignore the warning signs.

De-Dollarization accelerates as BRICS nations and crypto carve escape routes from USD dominance. Meanwhile, Treasury printers keep humming like a Ponzi scheme on autopilot.

Key triggers: Sanctions overuse backfires as countries ditch dollar settlements, while Bitcoin becomes the go-to hedge against fiat debasement. No wonder JPM’s analysts are sweating.

The verdict? The dollar’s 40% overvaluation won’t last. Smart money’s already rotating into hard assets and decentralized alternatives. Just don’t tell the Fed.

Source: Watcher Guru

Source: Watcher Guru

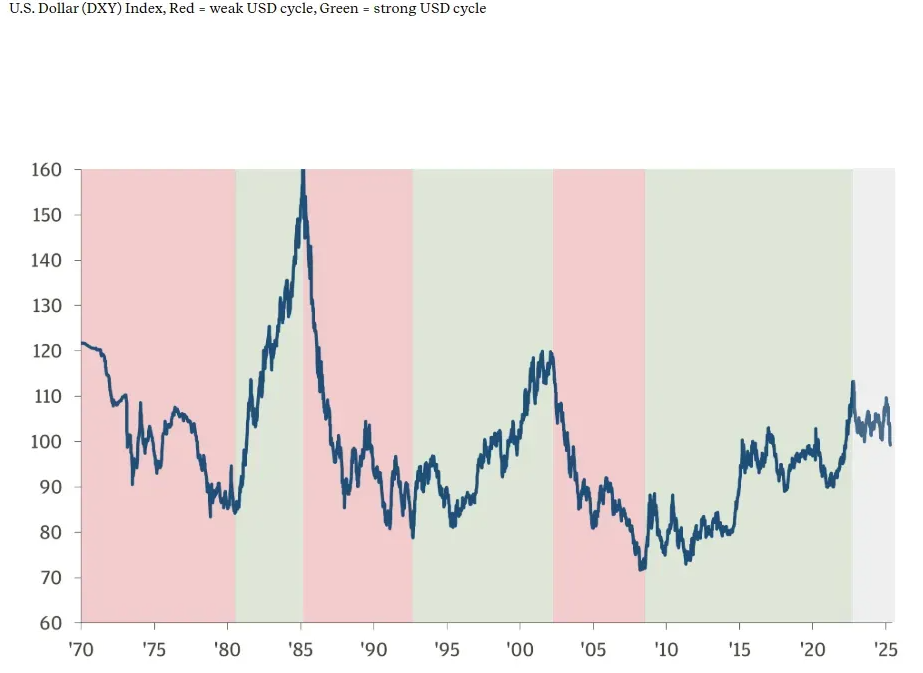

Dollar Reset Underway

JP Morgan’s latest forecast indicates that the US dollar’s longstanding overvaluation is finally unwinding, with a potential 10-20% decline against major currencies such as the euro and Japanese yen. This significant de-dollarization movement coincides with foreign investors dramatically reducing their US stock inflows, and at the time of writing, recent weeks have actually registered some of the largest outflows on record.

Sanctions Driving Reserve Diversification

Weaponized sanctions have, without a doubt, accelerated the global de-dollarization process as nations reconsider their exposure to dollar assets. The freezing of Russia’s reserves back in 2022 and also the threats against Colombia’s dollar assets have seriously damaged the US dollar’s reputation as neutral ground in the global financial system.

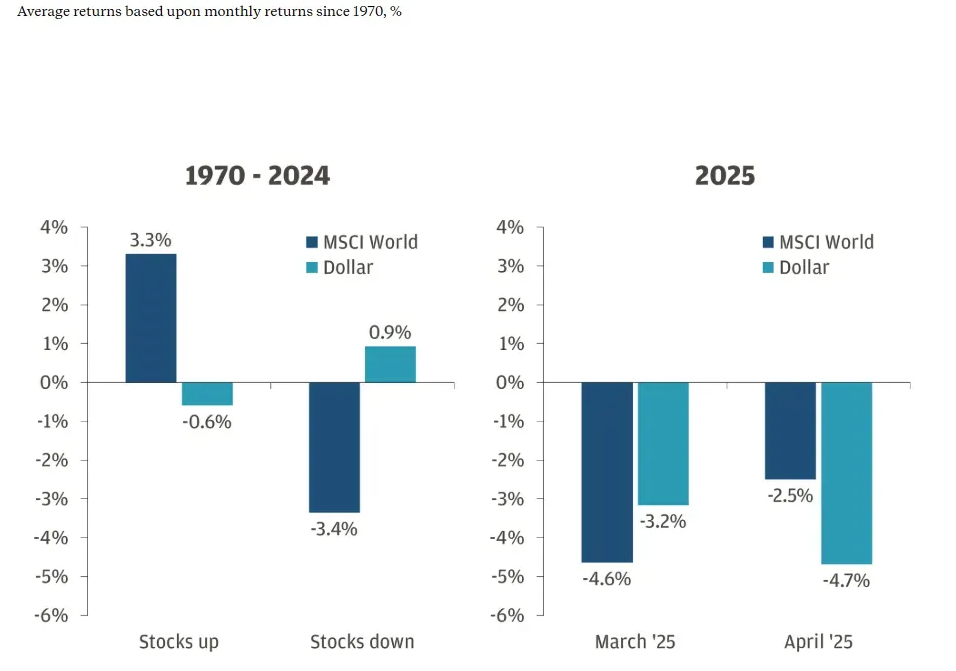

Dollar Losing Safe Haven Status

JP Morgan’s comprehensive research highlights an unexpected breakdown in the dollar’s “confidence premium” during 2025. The global reserve currency has repeatedly declined alongside US stocks and bonds—an unusual pattern that historically occurred only about 6% of the time for US assets compared to around 30% for emerging markets like Brazil and others.

Economic Pressures Mount

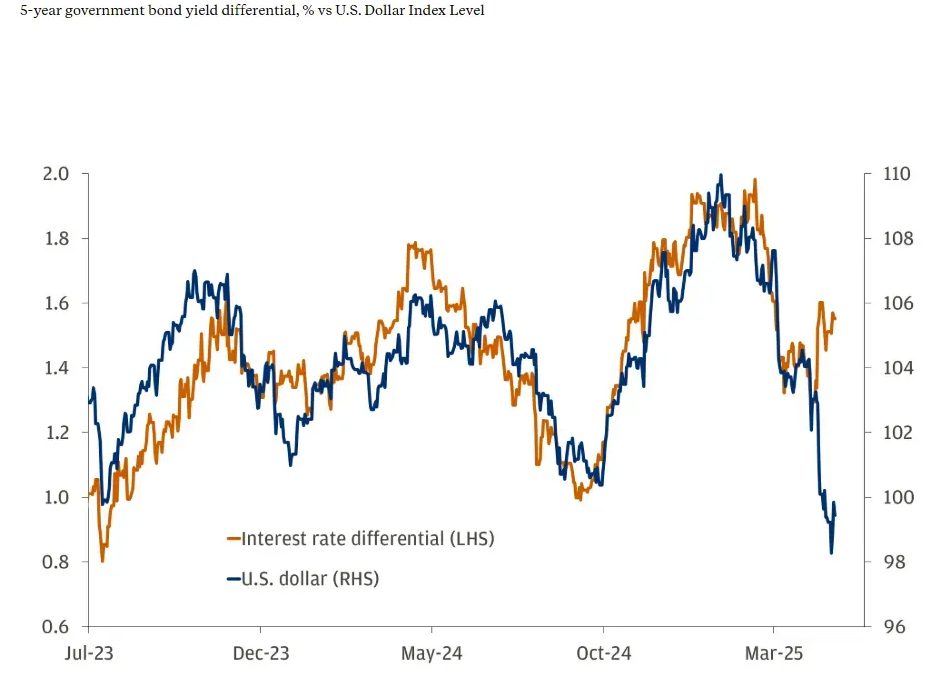

Tariffs are expected to hit the US economy harder than global counterparts, with recession probability forecasts rising from approximately 20% to a concerning 45%. Meanwhile, the Federal Reserve’s pivot toward rate cuts is narrowing yield differentials that previously supported dollar strength, further contributing to de-dollarization concerns expressed in JP Morgan’s analysis.

Investment Implications

With around $26 trillion in foreign-owned US assets, even relatively small portfolio shifts can create significant and unpredictable market movements. While US assets remain valuable, their analysis of de-dollarization suggests investors should consider geographic diversification as an important strategy.

JP Morgan states:

JP Morgan further notes:

As weaponized sanctions and policy uncertainty continue undermining the US dollar’s global reserve currency status, the multi-decade era of dollar exceptionalism appears to be entering a new phase defined by accelerating de-dollarization trends that JP Morgan and other financial institutions are now closely monitoring.