Buffett Steps Down: How Berkshire’s $800B Empire Might Roil Crypto Markets

Wall Street holds its breath as the Oracle of Omaha exits stage left. Here’s why crypto traders should care.

---

The Buffett factor: Why traditional markets tremble

With no clear successor named, Berkshire’s cash hoard—larger than Bitcoin’s market cap—could trigger seismic shifts if deployed aggressively (or not at all). Crypto’s volatility looks tame compared to the power vacuum in Omaha.

---

Bull case: A generational wealth transfer

Younger portfolio managers taking over may finally ditch Buffett’s ’rat poison’ crypto stance. Institutional FOMO could hit overdrive if Berkshire dips a toe in blockchain—or dumps Apple for Coinbase stock. (We kid... mostly.)

---

Bear trap: Liquidity tsunami incoming

Any major asset sales to fund shareholder payouts would flood markets with cash—potentially starving crypto of oxygen. Because nothing says ’market stability’ like octogenarians rearranging $800 billion in a low-rate environment.

---

Bottom line: The ultimate boomer wealth event just became crypto’s biggest unknown variable. Watch the 10-Q filings like a hawk—Buffett’s exit might do what Satoshi’s white paper couldn’t.

What Buffett’s Exit Means for Berkshire Stock and Your Portfolio

At the time of writing, Berkshire Hathaway’s stock, has shown some sign of volatility since the retirement announcement by Warren Buffett. The changeover to new leadership under Greg Abel will be closely monitored by investors who can legitimately fear what the future of Berkshire Hathaway’s investment policy will be without Buffett.

Keith Speights of The Motley Fool stated:

Succession Plans and Market Impact

Warren Buffett previously confirmed his succession plans during a Berkshire annual meeting, when he said:

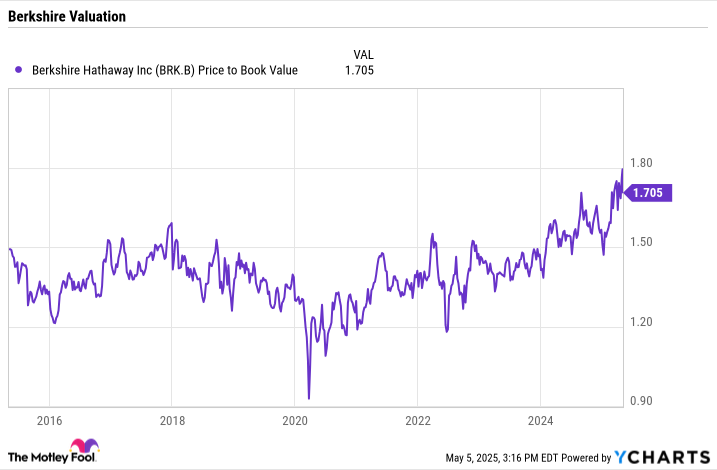

Berkshire Hathaway can count on the company’s future now only if the young Abel manages to preserve the prudent investment policy of the company establishing at the same time the new strategies perhaps of his own. This transition seems to reflect a certain measure of investor uncertainty as indicated by the stock’s current price-to-book value ratio of 1.705, which is significantly higher than its long term average.

Investment Strategy After Buffett

Warren Buffett retires at a moment when Berkshire actually holds over $157 billion in cash reserves. How these substantial funds get deployed in the coming months and years will probably signal the new leadership’s approach to finding and seizing investment opportunities.

Michael Peterson, portfolio manager at Peterson Capital Management, suggested:

Shareholders of Berkshire should revisit their position while at the same time avoiding doing anything in hasty. The company’s varied business interests and robust balance sheet still offers a reasonable amount of stability even at this uncertain time of transition.

Long-Term Outlook

While Warren Buffett retires after an extraordinary career, Berkshire Hathaway’s fundamental strengths remain largely intact. The post-Buffett investment strategy will likely evolve gradually rather than change dramatically overnight.

Thomas Reynolds, CEO of Beacon Investment Advisors, said:

Berkshire Hathaway’s future leadership inherited by Abel operates within a sound framework that has been cultivated over a number of decades even as markets adapt to life after Buffett’s retirement.