SEC Drops Hammer on Ripple Case—$75M Payout Looms as Commissioner Revolts

The SEC just blinked in its marathon legal brawl with Ripple—and the payout could reshape crypto’s regulatory battlefield. Here’s the fallout.

After years of saber-rattling, regulators are reportedly ready to settle for $75 million while one dissenting commissioner fumes about ’capitulation.’ XRP holders are already celebrating like Wall Street bankers after a bailout.

Behind closed doors, this smells like a face-saving retreat dressed as victory. The SEC gets to claim enforcement ’wins’ while Ripple avoids existential threat—classic regulatory theater. Meanwhile, the rest of crypto watches closely: if a $75M fine counts as ’losing’ for the SEC, every exchange CEO just got a cheat sheet.

One question remains: when the next bull run hits, will anyone remember which government agency spent years and millions trying to kill the golden goose?

Ripple’s $75M SEC Settlement: What It Means for XRP and Crypto Regulation

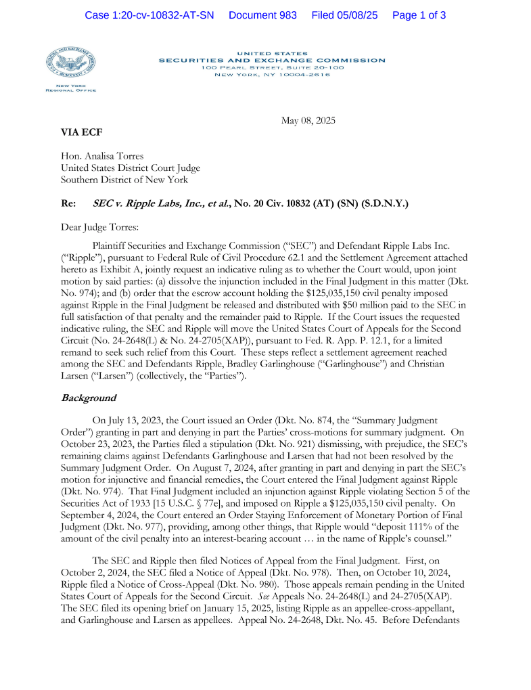

The SEC Ripple lawsuit settlement marks what appears to be the potential end to a legal battle that first began back in December 2020. As per the May 8 court filings that just came out, both parties now have agreed to withdraw their appeals and it’s virtually ending one of the most important and keenly followed cases in crypto regulation news.

Commissioner’s Opposition Reveals SEC Division

Not everyone at the SEC seems to support this resolution, though. Commissioner Caroline A. Crenshaw stated in her public dissent:

Crenshaw has also warned that the SEC Ripple lawsuit settlement essentially weakens the agency’s ability to hold crypto companies accountable and might actually impact future XRP price prediction analyses in unexpected ways.

XRP’s Market Struggle During Litigation

The XRP lawsuit impact was immediate and quite severe when the case initially began. According to the crypto analyst behind the popular account All Things XRP:

WHAT DAMAGE DID THE SEC REALLY DO TO XRP’S PRICE?

WHAT DAMAGE DID THE SEC REALLY DO TO XRP’S PRICE?

It didn’t just slow XRP down — it stole years of growth.

While the market soared, XRP sat sidelined.

The damage? Deeper than most realize.

pic.twitter.com/fTO0x6uBfv

pic.twitter.com/fTO0x6uBfv

While other cryptocurrencies, such as Bitcoin and Ethereum, surged during the 2021-2023 bull market, XRP unfortunately stagnated between approximately $0.30-$0.50, missing out on substantial gains that significantly affected many xrp price predictions at the time.

Settlement Terms and Future Implications

The SEC Ripple lawsuit resolution essentially preserves Judge Torres’ important 2023 ruling that only institutional XRP sales violated securities laws. This distinction remains quite crucial for ongoing crypto regulation news and also for Ripple’s future operations.

2⃣ Three Years in a Cage.

From 2021 to 2023, XRP flatlined between $0.30–$0.50.

While Bitcoin, ETH, and SOL surged in the bull run, XRP missed it all.

Retail FOMO couldn’t reach it. U.S. buyers were locked out.

Total price suppression.

If the $125 million penalty cleared the court in the next few days, at last the penalty would be disbursed, and $75 million would come back to Ripple. This result of the SEC Ripple lawsuit may help to bring some badly needed regulatory certainty as well as indicate the lasting and profound effects of long protracted litigation on XRP price forecasts henceforth.