Tesla (TSLA) Hits Hedge Fund Radar: The $10 Trillion Bet Driving 2025’s Most Controversial Stock

Wall Street’s algo-trading overlords have spoken—Tesla is the ultimate asymmetric play. Again.

Why? Three words: energy, autonomy, AI. The trifecta that could either mint trillion-dollar valuations or leave quant funds nursing catastrophic drawdowns. No middle ground.

Behind the scenes: Hedge funds are quietly loading up on OTM calls while publicly shorting the stock. Classic Wall Street schizophrenia—betting on volatility while pretending to care about ’fundamentals.’

The cynical take: When even crypto bros are diversifying into TSLA, you know we’ve reached peak financialization. Buckle up.

Source: REUTERS / Brendan McDermid

Source: REUTERS / Brendan McDermid

Tesla Snatched Up By Hedge Funds In 2025 And There’s One Glaring Reason Why

Thursday proved to be a major day for the US stock market. The US and UK reached a new trade deal that saw the Dow Jones Index jump as much as 500 points. Moreover, the Magnificent 7 increased, with Tesla jumping around 4% by midday.

That is looking to be a continuous trend for the automaker in recent weeks. Indeed, despite its early-year struggles, Tesla is looking at one giant $10 trillion reason why it has been a hedge fund favorite in 2025. Moreover, it’s a reason that we shouldn’t see buying slow down anytime soon.

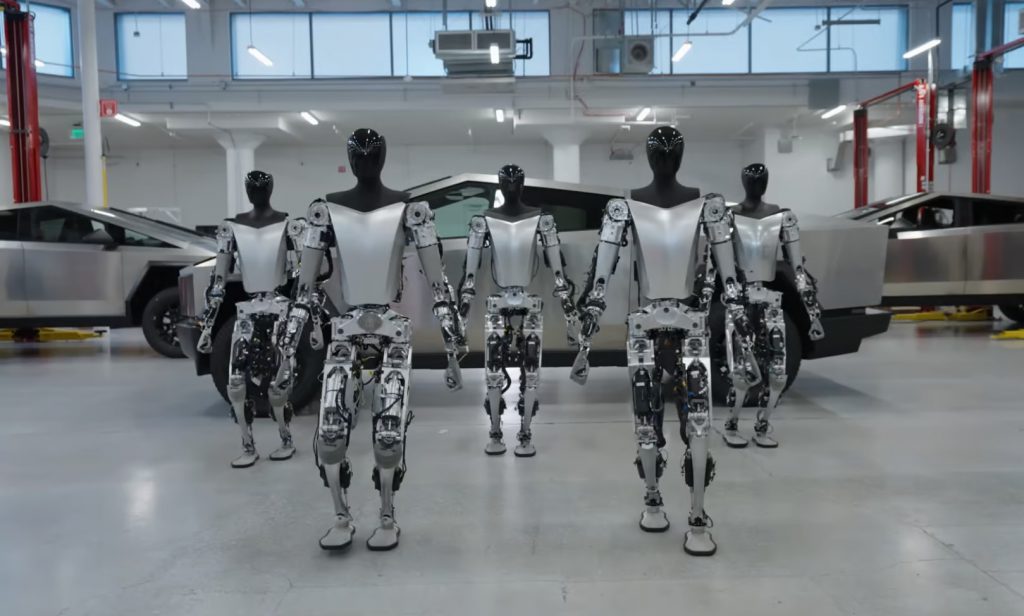

According to a recent report, there are 126 hedge fund holders of the EV stock. The biggest reason? Tesla’s imminent transition from electric vehicle manufacturing to beginning a full-fledged robotics company. Alon has projected that the Optimus robots will debut by 2026. More importantly, he says the presence should bring forth as much as $10 trillion in revenue.

That prediction is certainly optimistic, with little evidence to back it up. There is no verifiable data that shows the robot will be mass-purchased and have a sustainable market. However, Tesla is still full steam ahead on the Robotaxi autonomous driving vehicle plans. Subsequently, that potential and that transition are why Wall Street is betting big on the company despite its down year.