JP Morgan Goes All-In on Cettire—Wall Street Whale Swallows 5% Stake

Another day, another institutional bet on digital commerce—this time with JP Morgan playing the role of bullish whale. The banking giant’s stake in Cettire just breached the 5% threshold, a move that screams ’we like the stock’ louder than a meme trader with leverage.

Why it matters: When traditional finance heavyweights start nibbling (or in this case, gorging) on e-commerce plays, it’s either a genius pivot or a desperate yield hunt. Spoiler: Their analysts probably just discovered ’online shopping’ exists.

The kicker: This isn’t your grandpa’s value investment. That 5% stake? Pure FOMO fuel for hedge funds still trying to short crypto. Welcome to 2025—where even bankers chase retail trends.

Source: TipRanks

Source: TipRanks

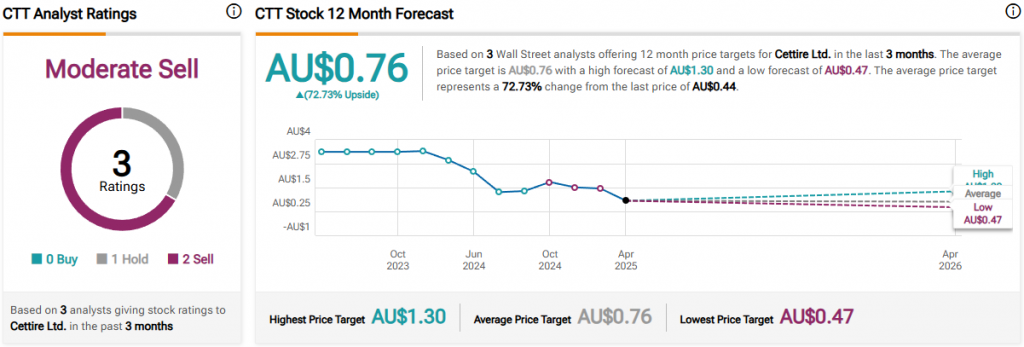

Currently, it is challenging to predict the behaviour of CTT’s stock since distinct analysts offer different recommendations with an average price target of $0.33, which is 72.73% higher than the current price of $0.19. The publicity has had some effects, as it established a high of $0.56 right now, and the low estimate is at a value of $0.20.

Why JP Morgan’s Cettire Investment Matters for Investors and the Market

Institutional Confidence Amid Market Uncertainty

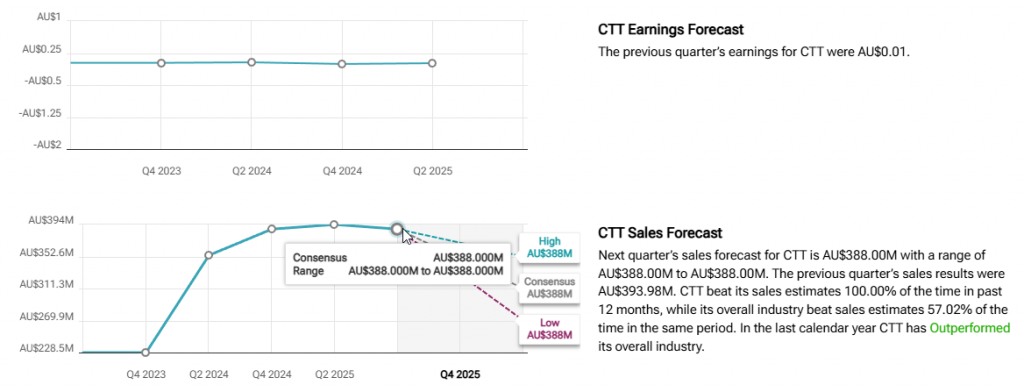

Cettire has been earning above the latest and greatest sales estimates for the past few consecutive quarters and the next quarter sales is also estimated to be $166.9 million, which is slightly below the Q4 value of about $169.4 million yet its YoY has been on a rising trend.

Diverging Views on Valuation

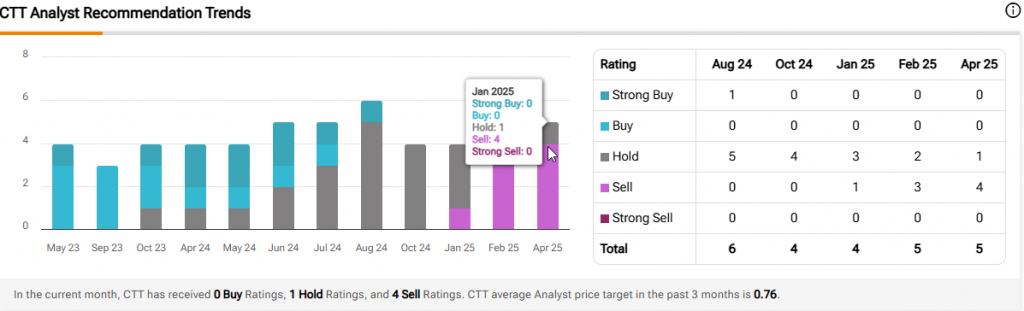

However, three stray cover analysts – one recommending CTT as a Hold while the other two tender a Sell – seem to emanate from JP Morgan’s confident stance regarding the company fundamentals. The difference between the low price target of $0.20 and the high price target of $0.56 also probably indicates the high level of uncertainty in the company’s future valuation of Cettire.

Potential Stabilizing Effect

JP Morgan’s 5.29% stake could help reduce volatility in CTT’s trading pattern. The stock has seen dramatic swings over the past year between $0.20 and $0.56. Institutional ownership often brings more stability and may attract further interest from long-term investors.

Future Growth Prospects

Nevertheless, the increased attention to the company’s activities means that Cettire has to maintain the revenues higher than sales expectations and operate under close scrutiny by institutions. They recorded a downtime valuing at $0.19, reaching the even median value of $0.33 will be good news for today’s shareholders.