BlackRock Goes All-In: $1.5B Bitcoin Buying Spree Since May 1

Wall Street’s quiet period is over—BlackRock just dropped $1.5 billion into Bitcoin in six days. The world’s largest asset manager is loading up on crypto while traditional markets nap.

Why now? Three theories:

1. Institutional FOMO: After missing 2024’s 300% rally, BlackRock’s playing catch-up before the halving hype cycle kicks in.

2. Political cover: With the SEC’s lawsuit graveyard overflowing, even cautious allocators are diving in.

3. The ultimate hedge: Because nothing says ’I distrust central banks’ like converting 0.3% of AUM into digital scarcity.

Bonus cynicism: Watch how fast their ’prudent risk management’ memo gets rewritten when BTC dips 15%.

Source: Farside Investors

Source: Farside Investors

Bitcoin Faces Correction Despite BlackRock’s Big Purchases

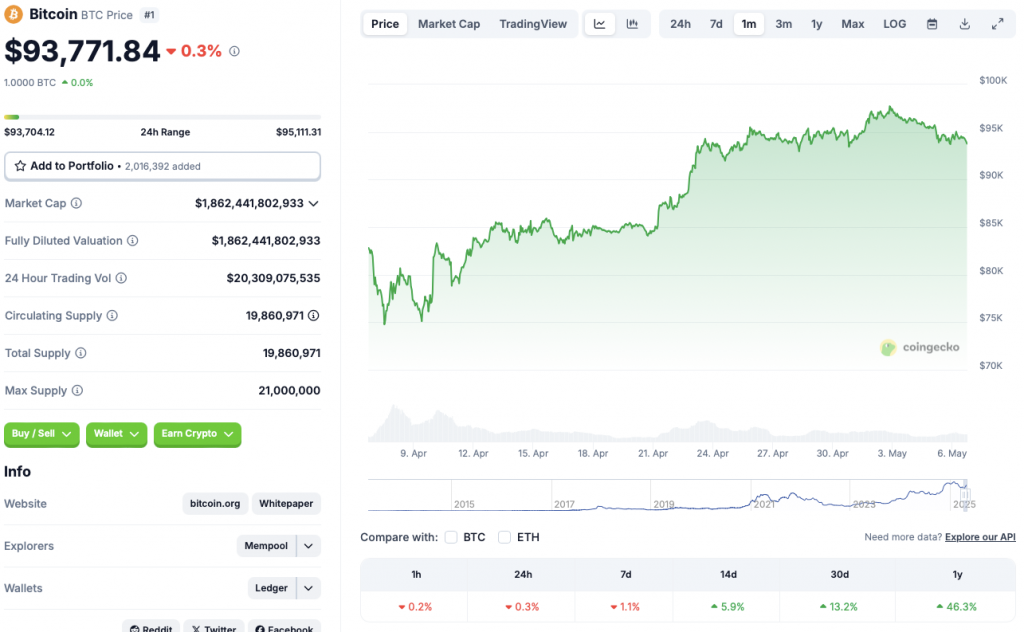

BlackRock’s big BTC purchases align with the asset’s recent climb to the $97,000 mark. The asset is facing substantial resistance at $97,000. While the rally was welcomed, BTC has faced a slight price correction today. BTC has fallen to the $93,000 mark, down 0.3% in the daily charts and 1.1% over the previous week. Despite the dip, BTC has rallied 5.9% in the 14-day charts, 13.2% over the previous month, and 46.3% since May 2024.

The recent market resurgence was likely due to an increase in institutional investments. Retail investors have likely not participated much in the rally.

Bitcoin’s latest dip could be due to Florida withdrawing two of its crypto reserve bills. The move came as a setback to crypto advocates and investors.

Will The Asset Rally Soon?

There is a chance that the Federal Reserve will drop interest rates soon. Inflation in the US has cooled more than anticipated. President Trump has also pushed for interest rate cuts. A rate cut could lead to a surge in risky investments. Bitcoin (BTC) and the larger crypto market may benefit from such a development.

A spike in retail investors could also push BTC past the $97,000 mark. The original crypto could reclaim $100,000 if it breaks its current resistance level. Breaching $100,000 could push BTC to a new all-time high. The asset is currently down by 13.7% from its peak of $108,786.