XRP’s Make-or-Break Moment: Where Will the Price Land After SEC Settlement Dust Settles?

Mid-May 2025 isn’t just another month for Ripple—it’s judgment day. The SEC’s long-awaited settlement details are finally public, and the market’s either about to reward XRP’s compliance or punish its legacy as a ’regulated rebel.’

Bull case: Institutional inflows surge as legal clarity unlocks dormant liquidity. Bear case: The ’sell the news’ crowd cashes out, leaving retail bagholders muttering about ’just one more lawsuit.’

Meanwhile, Wall Street’s old guard will either pretend they never called crypto a scam—or double down while quietly rebalancing their portfolios. Classic.

Source: CoinCodex

Source: CoinCodex

XRP Price Forecast: What Ripple’s SEC Settlement Means for Market Volatility and Security Risks

Official Settlement Confirmation

Ripple has officially confirmed in its Q1 2025 XRP Markets Report that the long-running SEC lawsuit has finally concluded. This settlement effectively ends a legal battle that began way back in December 2020 and removes a significant regulatory uncertainty that had influenced XRP price prediction models for years and years.

In Ripple‘s official announcement on their X account, they stated:

The start of 2025 saw major momentum for Ripple, XRP, and the broader crypto industry.

The Q1 2025 XRP Markets Report is here: https://t.co/CWpeEQW6XT

Highlights include: SEC and Ripple reached an agreement to end the lawsuit

SEC and Ripple reached an agreement to end the lawsuit Hidden Road acquired for $1.25B to scale XRPL…

Hidden Road acquired for $1.25B to scale XRPL…

Short-Term Bearish Outlook

The positive regulatory developments for XRP do not predict a reduction in its future prices but point toward a possible steep price decrease. Technical indicators show XRP is likely to reduce its value by 20.73% to position at $1.66 during early June.

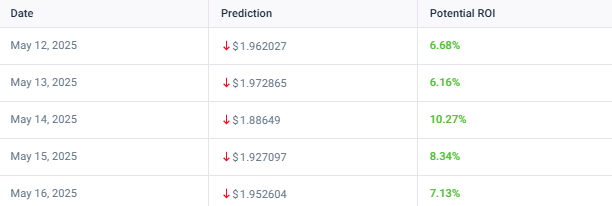

Investors are concerned by a bearish sentiment in the XRP market during an overall market greed condition highlighted by a Fear & Greed Index at 59. XRP’s price predictions for mid-May demonstrate ongoing weakness through a potential movement to $1.88 on May 14 which would yield a 10.46% return on investment for those holding short positions. Traders must monitor XRP’s price prediction volatility because of its market instability.

Technical Resistance Factors

Market analyst Dr. Cat’s Ichimoku Cloud analysis of the XRP/BTC pair reveals several significant resistance levels affecting the XRP price prediction outlook. The 3-month chart shows the Kijun Sen acting as major resistance, while a large bearish TK gap indicates some negative momentum.

In his analysis, Dr. Cat stated:

$XRP / $BTC

As you see, if the price attacks my 5200 target by June, the chance for a rejection (whether first or a final one) is around 90%.

The reason is that the price must fight three obstacles at the same time: The quarterly Kijun Sen, bearish TK cross with decent gap… pic.twitter.com/AteoPtQBJ2

Long-Term XRP Price Prediction Scenarios

The long-term XRP price prediction presents two rather different paths. If XRP breaks out too soon (May-June), it could stall around $4.50-$6. However, consolidation through 2025 with a Q4 breakout could push XRP to $12-$30, depending on Bitcoin’s performance and other market factors.

Market Volatility and Security Implications

The SEC settlement clarified some regulatory points yet it failed to reduce the volatility that currently hovers at 5.29%. The XRP price prediction models need to include ongoing security risks coupled with market unpredictability because green days have reached only 37% throughout the previous month.

The $1.25 billion deal that Ripple made to acquire Hidden Road could enhance the institutional interest in XRPL which will possibly shape future XRP market trend projections. The strategic acquisition seeks to expand operations for the XRP Ledger and the new RLUSD stablecoin.

XRP price prediction will undergo diverse influences from technical resistance levels combined with Bitcoin’s performance along with market sentiment through mid-May 2025 as well as post-Mid-May 2025 timeframes.