Nvidia (NVDA) 2025: The AI Chipmaker’s Bid to Dethrone Big Tech—Again

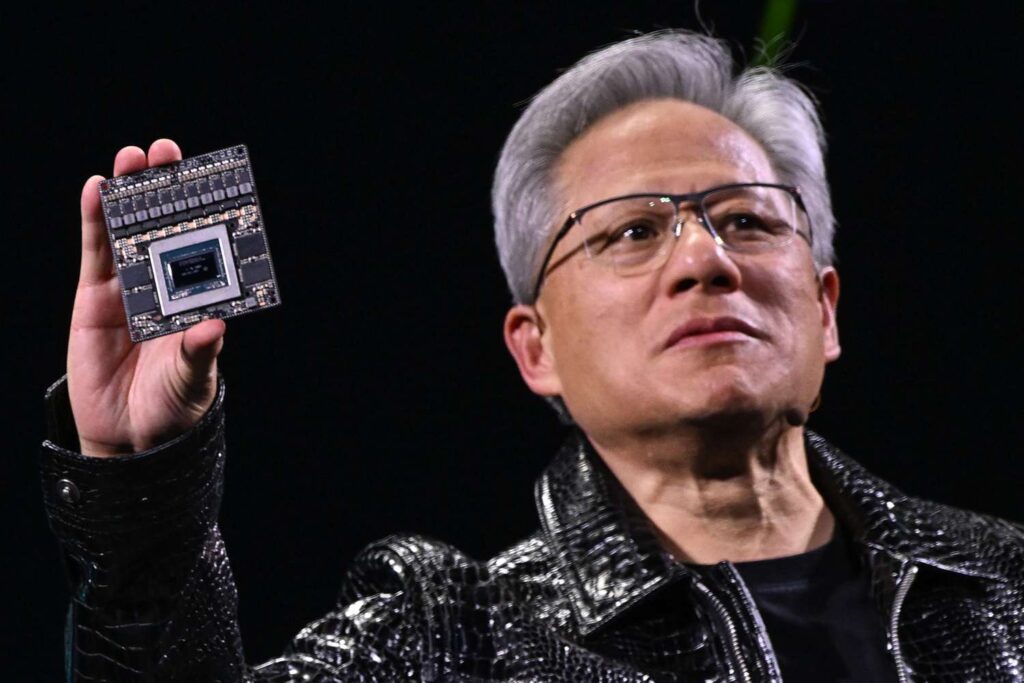

Nvidia’s stock—once the darling of Wall Street—is back in the ring. After a brutal 2024 correction, Jensen Huang’s empire is betting big on next-gen AI accelerators to reclaim its crown.

Can the GPU giant outmaneuver trillion-dollar rivals? Analysts whisper ’yes’—if it delivers on its Blackwell architecture promises. Meanwhile, hedge funds quietly rotate out of ’safe’ tech stocks... right on cue.

One thing’s certain: in the casino of chip stocks, NVDA remains the highest-stakes table. Just don’t ask your financial advisor about that 80x P/E ratio.

Source: Investopedia

Source: Investopedia

Can Nvidia Surpass Apple & Microsoft to Become the World’s Most Valuable Company Once Again?

Nvidia’s performance last year was the stuff of legend. It had increased by more than 174% and had firmly entrenched itself as the largest company by market cap. Moreover, it began to be featured in projections that would see it become the first company to reach a $4 trillion market value.

However, three months into the year, things are drastically different. The AI tech giant is now third behind both Apple (AAPL) and Microsoft (MSFT). Yet, there is still some reason to believe that Nvidia could eventually retake its position as the world’s most valuable at some point in 2025.

Throughout this year, Nvidia has dropped more than 15%, tripling the declines of the S&P 500. Additionally, it has lost $1 trillion in market cap. Interestingly, it is not alone in that, as nearly every Magnificent 7 stock is falling. Those plummeting values are also more connected to macroeconomic realities than anything that Nvidia has done.

That is where the belief in its turnaround begins. Indeed, NVDA will remain at the heart of AI development; that is unlikely to change. Subsequently, as companies unveiled earnings reports throughout April, it was clear that spending on the technology would continue.

Alphabet (GOOGL) announced $75 billion toward capital expenditures. Moreover, Microsoft and Meta Platforms (META) doubled down in a similar way. The potential ceiling for Nvidia as a company with a value above $4 trillion will persist so long as demand and intention to grow in the AI sector continue with some of the most profitable and prominent companies on the planet.