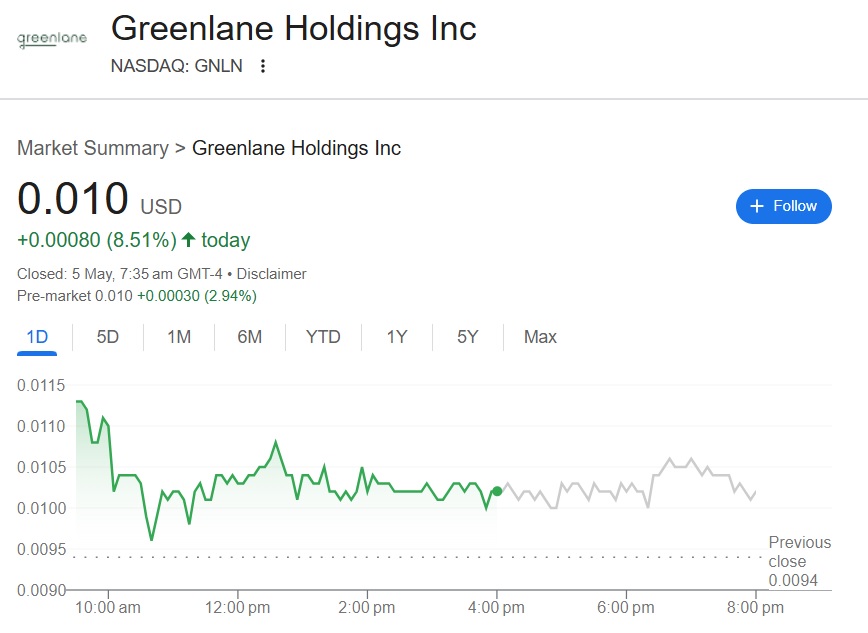

Greenlane Holdings—Nasdaq’s Penny Stock Darling—Spikes 9% in Single Session

Another day, another micro-cap rollercoaster. Greenlane Holdings—the Nasdaq-listed penny stock trading at a whopping $0.01—just ripped 9% in 24 hours. Who needs fundamentals when you’ve got meme-tier volatility?

The Pump Without the Substance

No news, no earnings catalyst—just the kind of speculative frenzy that’d make a hedge fund manager clutch their pearls. Retail traders clearly still love playing with fire.

Penny Stocks: The Casino Where Everyone Loses (Except Brokers)

Let’s be real: these moves aren’t investments. They’re lottery tickets—with fees. But hey, at least someone’s making money on the spreads.

Source: Google

Source: Google

Investors who took an entry position in the penny stock Greenlane Holdings early this month reaped the profits. An investment of $1,000 turned into $1,085 in just two trading sessions in GNLN. The US stock market is seeing an upward trajectory lately as Dow Jones climbed more than 560 points on Friday.

Should You Invest in Penny Stock Greenlane Holdings (GNLN)?

Though penny stock Greenlane Holdings spiked 8.5% in a day, it’s NEAR its 52-week low after experiencing a steep decline. GNLN has plummeted 99% year-to-date erasing investor’s money in just five months. The stock entered 2025 trading at a high of $1.71 but saw a continuous crash to the $0.01 level.

Therefore, an investment of $1,000 made early this year in Nasdaq penny stock Greenlane Holdings could have turned to $10 now. This is the stock that everyone needs to remain cautious about as it’s a risky asset to accumulate. The upward trend is limited with only a few price spurts but the downward trajectory is unlimited.

However, a recent analysis on Investing projected that penny stock Greenlane Holdings could recover from here.read the forecast through the InvestingPro AI algorithm.

Nonetheless, Watcher Guru does not support the thesis of taking an entry position in penny stock Greenlane Holdings. It is advised to do thorough research before taking an entry position in GNLN and trade at your own risk.