China’s Digital Yuan Cuts SWIFT Out of the Loop: 7-Second Payments Disrupt Global Banking

Move over, SWIFT—China’s digital yuan just rewired cross-border finance. Transactions now clear in 7 seconds flat, leaving legacy banking rails choking on dust.

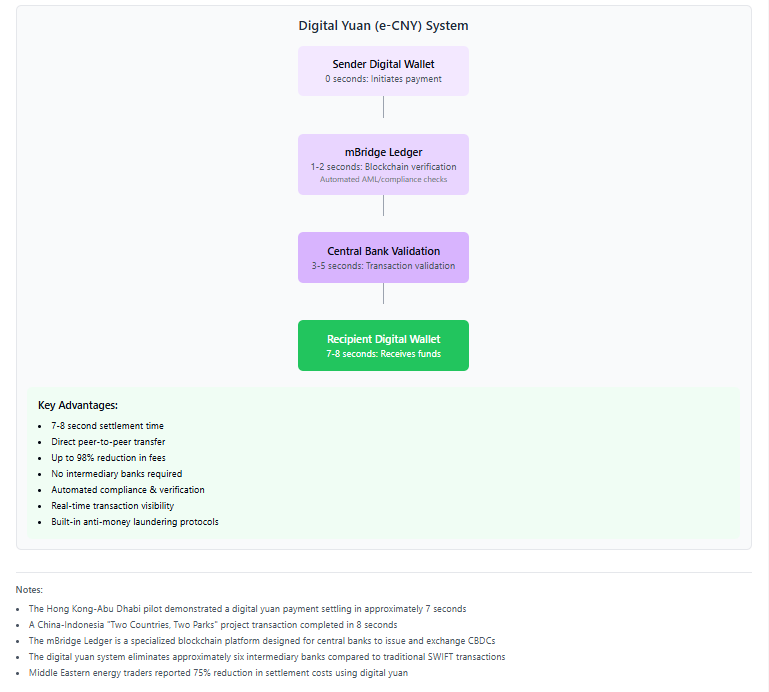

How it works: The e-CNY’s blockchain backbone bypasses correspondent banks entirely. No more waiting days for settlements—just direct, atomic transfers between wallets. Beijing’s playing chess while Wall Street struggles with checkers.

The fallout: Expect resistance from institutions clinging to fee-heavy FX corridors. But when 1.4 billion people can send value faster than a Venmo request, adaptation isn’t optional—it’s survival.

Bonus jab: Somewhere in London, a forex trader just spilled his third espresso realizing his spread markup got automated into obsolescence.

How China’s CBDC, Blockchain, And SWIFT Race Reshape Finance

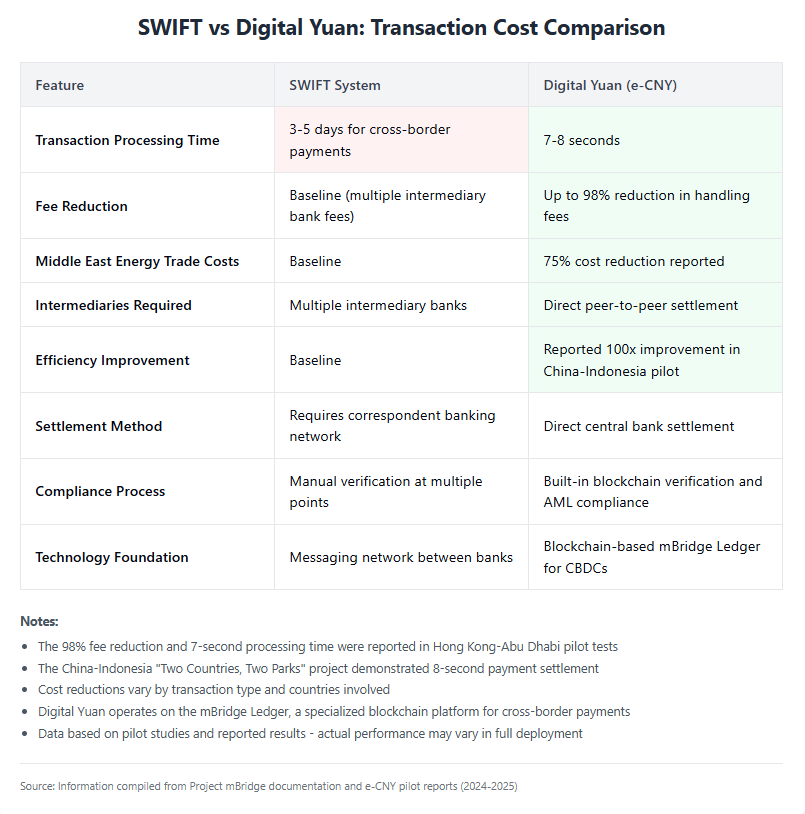

The digital Chinese digital yuan, which is also sometimes referred to as e-CNY, currently offers significantly faster and, frankly, much cheaper cross-border transactions than the traditional methods we’ve been using for decades. While SWIFT transfers typically take several days and also involve somewhat unpredictable fees, the Chinese digital yuan can actually complete transactions in just seconds at a fraction of the cost, which is pretty impressive.

Proshare, an African research firm, stated:

SWIFT’s Growing Challenges

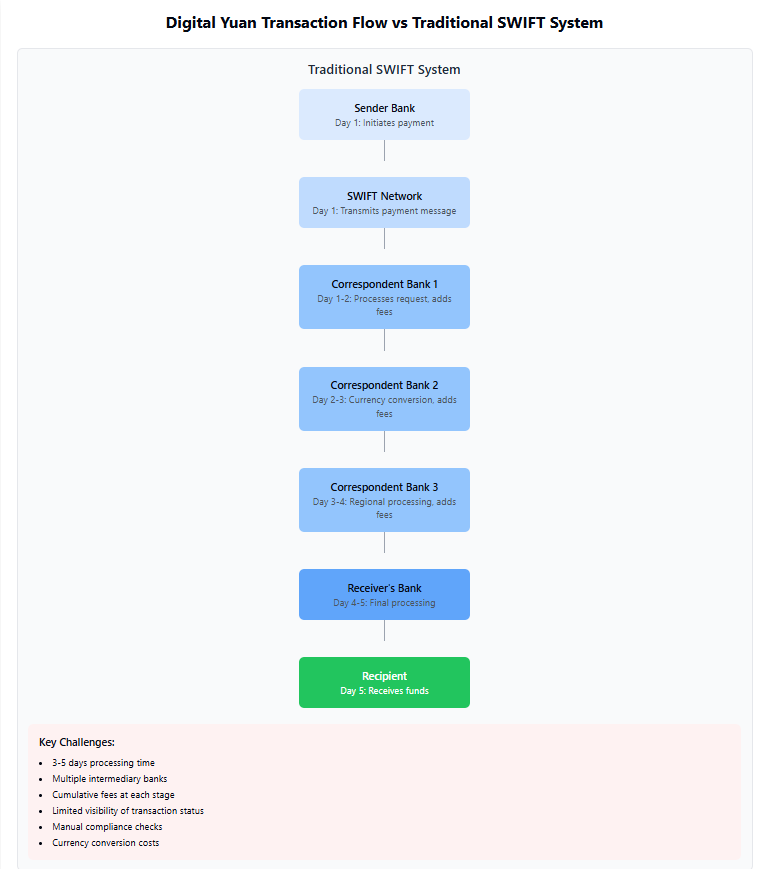

The SWIFT network, while trusted by over 10,000 financial institutions globally for many years now, faces some significant limitations that are becoming more apparent. Transactions generally require several days to process and, in addition, involve multiple intermediary banks that each charge their own fees, making final costs somewhat unpredictable and often higher than expected. The Chinese digital yuan addresses these pain points directly with its innovative blockchain-based approach.

Digital RMB’s Expanding Influence

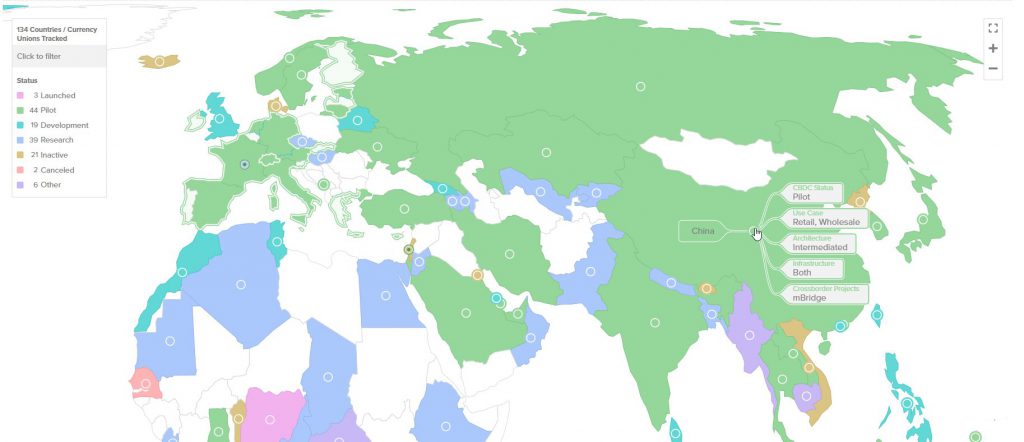

The Chinese digital yuan is, right now, gaining quite a bit of traction internationally through various initiatives such as Project mBridge and other similar programs. This collaborative effort aims to solve fundamental problems in cross-border payments using CBDC technology and also blockchain finance innovations that have been developing over recent years.

Michele Marius from ICT/Tech noted:

With compatibility reportedly found in approximately 87% of countries worldwide, the Chinese digital yuan represents a significant and growing shift in CBDC adoption and cross-border payment capabilities that many analysts are watching closely.

This technological revolution seems to validate regional efforts like Caribbean’s CaribCoin and also Africa’s PAPSS to establish independent payment rails. As blockchain finance continues to develop and CBDC adoption increases across various markets, the Chinese digital yuan stands, at this moment, at the forefront of a fundamental transformation in how money moves across borders.