The Dollar’s Decline: 7 Game-Changing Deals That Sideline USD

Global finance is quietly rewriting the rules—and the greenback’s getting ghosted. From BRICS oil trades to China’s digital yuan deals, here’s how power players are ditching dollar dominance.

1. Petro-Yuan Pact: Beijing and Riyadh cut USD out of $21B oil trades. Those petrodollar recycling days? Gone.

2. Gold-Backed Gas: Moscow-Delhi energy deals now settle in bullion—a middle finger to SWIFT sanctions.

3. Digital Silk Road: China’s CBDC clears African infrastructure payments while Washington sleeps on crypto regulation.

4. Euro-Yuan Axis: Airbus just booked a $17B order in offshore yuan. Frankfurt bankers didn’t see this twist coming.

5. Crypto Corridor: UAE-India remittances now flow through RippleNet, slashing correspondent banking fees by 60%.

6. Lithium Local Currency: Argentina and Chile test bilateral peso trades for battery metals—no USD conversion needed.

7. ASEAN Stablecoin: Southeast Asia’s new quasi-CBDC could displace $50B in dollar-denominated trade finance.

The writing’s on the blockchain: multipolar currency systems aren’t some dystopian fantasy—they’re today’s spreadsheet reality. Just don’t tell the IMF.

How Nations Use Yuan, Rubles, and Crypto to Bypass the Dollar

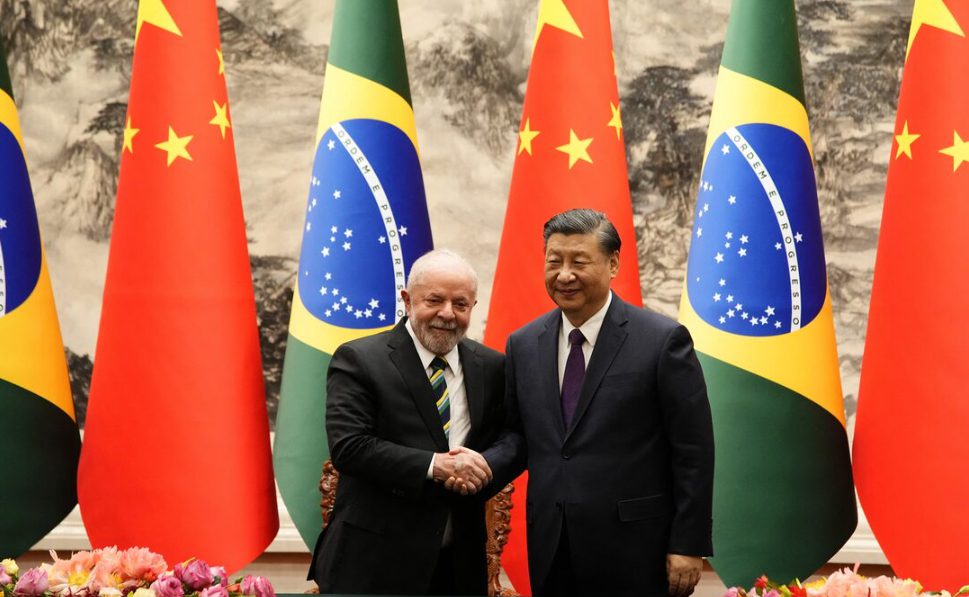

1. China-Brazil Currency Agreement

The de-dollarization partnership between China and Brazil allows for trade in yuan and real instead of US dollars. This agreement, which was finalized in March 2023, has strengthened economic cooperation and reduced dollar dependency for these two major economies.

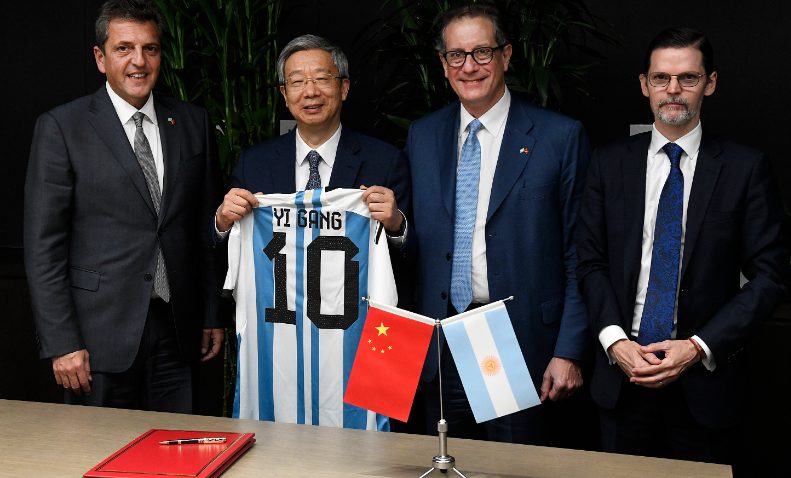

2. Argentina’s Yuan Payment System

Argentina has, for various reasons, implemented yuan payments for Chinese imports to preserve its dwindling dollar reserves. This de-dollarization strategy helps maintain essential trade while protecting foreign exchange holdings during economic challenges.

3. India-Russia Rupee-Ruble Mechanism

The rupee-ruble trade arrangement essentially allows India and Russia to bypass US dollar transactions entirely. This de-dollarization effort has proven quite crucial following Western sanctions against Russia.

4. Pakistan-China Oil Transactions

Pakistan announced plans to use yuan for Russian oil imports, creating a sort of three-way de-dollarization pathway outside traditional dollar systems. This approach helps address Pakistan’s balance of payment issues.

5. India-UAE Rupee Trading Initiative

India and the UAE are, at this point in time, discussing rupee-based non-oil commodity trading which represents a significant de-dollarization effort in the Middle East-South Asia corridor. This would cover textiles, pharmaceuticals, agricultural products, and other goods.

6. Iran-Russia Gold Cryptocurrency Development

Iran and Russia are exploring, right now, a gold-backed cryptocurrency to facilitate de-dollarization of bilateral trade. This combines traditional value stores with modern technology to create a sanctions-resistant payment system.

7. Southeast Asian Coordinated Efforts

The countries of Singapore along with Malaysia and Indonesia together with Thailand support de-dollarization efforts through frameworks established by ASEAN. The joint initiatives between these economies work to lower their exposure to U.S. economic policies along with dollar price uncertainties.

Various developments in de-dollarization demonstrate substantial global financial changes since nations pursue financial independence from the dollar and protect their economic sovereignty through currency agreements like yuan trade deals and rupee-ruble agreements and gold-backed cryptocurrency exploration.