Buffett Bets $73M on Sleeper Tech Stock—Wall Street Yawns

The Oracle of Omaha just placed a $73 million vote of confidence in a tech play the market’s ignoring. No flashy AI claims, no metaverse hype—just classic Buffett value hunting in a sector drunk on overvaluation.

Why this stock? It’s got the trifecta: strong cash flow, recession-resistant revenue, and a management team that actually ships products. Meanwhile, Silicon Valley’s favorite ’disruptors’ keep burning cash on blockchain pet projects.

One hedge fund analyst quipped: ’Buffett could buy a fax machine company and the Street would call it Web3 infrastructure.’ The old man’s playing chess while tech bros lose at checkers.

How Berkshire’s S&P 500 Stock Pick Reveals a Smart Tech Strategy

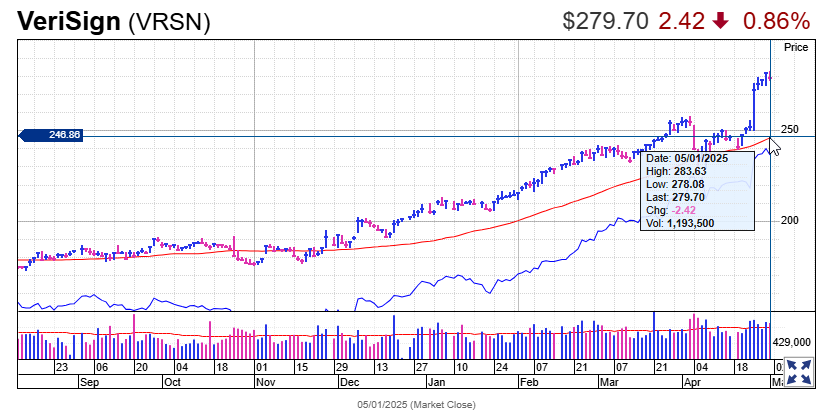

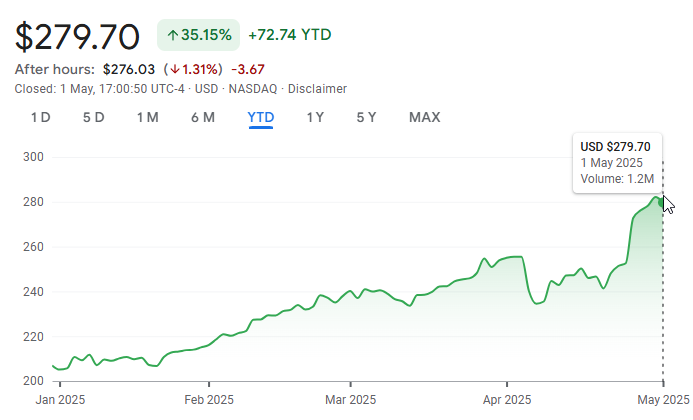

Buffett’s increased interest in VeriSign sort of highlights a strategic shift in his stock market strategy. The regulatory filings, which came out not too long ago, revealed that Berkshire Hathaway purchased about 377,736 shares for approximately $73.95 million over six trading sessions ending December 24.

According to Fortune:

VeriSign’s Market Position

VeriSign stock has actually gained some pretty good momentum despite previously underperforming the S&P 500 index. This Warren Buffett investment choice, when you think about it, makes a lot of sense when examining the company’s strong fundamentals. The company, which was basically a top domain registry during the late 1990s internet boom, has created a stable business model that apparently caught Buffett’s attention.

Billy Duberstein of The Motley Fool stated:

Buffett’s Growing Tech Position

This Warren Buffett investment marks, like, a significant development in Berkshire Hathaway’s portfolio strategy. Buffett began buying VeriSign in Q1 2024 and has now, at the time of writing, amassed around 13.2 million shares, representing a nearly 14% stake in the company, which actually makes Berkshire the largest shareholder.

Adam Patti, CEO of VistaShares, said:

Analyst Outlook on this S&P 500 Stock

The undervalued tech stock has, in recent months, garnered some pretty positive analyst sentiment. Citi analysts have projected strong performance for VeriSign in 2025:

The Warren Buffett Investment Signal

Buffett’s substantial investment in VeriSign sends, like, a really strong signal about this undervalued tech stock from the S&P 500. With Berkshire Hathaway’s cash reserves exceeding $300 billion right now, every Warren Buffett investment decision is closely watched by investors and analysts alike. The domain registry business provides the stability and competitive advantage that aligns with Berkshire’s long-term stock market strategy.