WFE Chief Declares Swiss CBDC Pilot a Watershed Moment—Now Watch the Tokenization Stampede Begin

Switzerland’s wholesale CBDC success sparks institutional FOMO as asset managers scramble to digitize everything from bonds to fine art. "We’re witnessing the birth of a trillion-dollar tokenized economy," crows the World Federation of Exchanges chair—while TradFi dinosaurs still can’t decide if blockchain is a threat or a spreadsheet.

Key drivers: The Swiss National Bank’s Helvetia Phase III settlement system processed $5B in daily transactions with sub-second finality. Private banks now testing programmable features for repo markets.

Bottom line: When the gnomes of Zurich move, Wall Street follows—even if they’re dragging their patent-leather loafers through the metaverse.

How Swiss CBDC Pilot Results Are Accelerating the Global Tokenization Race

Switzerland’s SIX Digital Exchange (SDX) has actually demonstrated CBDC tokenization benefits that are now, at the time of writing, influencing global markets. The Swiss model provides some valuable lessons for addressing market volatility and settlement efficiency in the digital asset space.

Richard Metcalfe, Head of Regulatory Affairs at the World Federation of Exchanges, stated that:

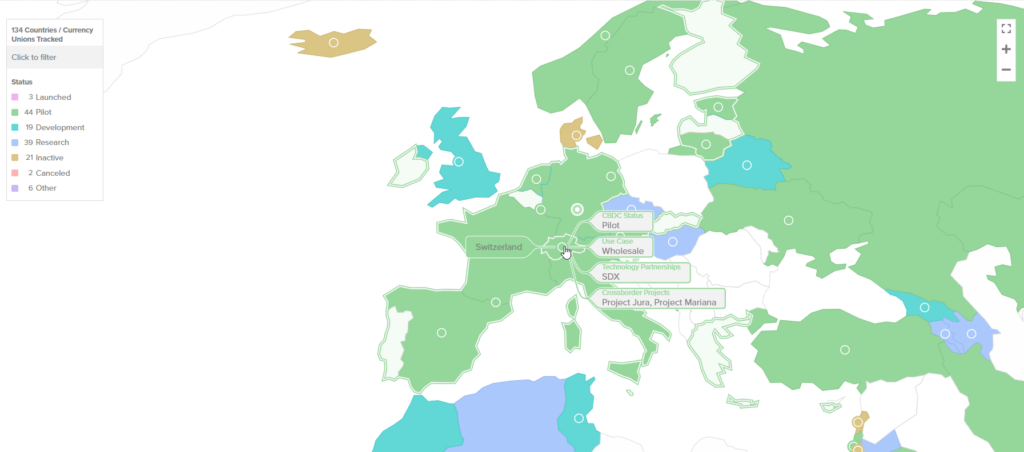

Global CBDC Momentum

The Swiss CBDC tokenization pilot has actually triggered similar initiatives globally in recent months. The EU has, for instance, announced plans for wholesale CBDC following positive Eurosystem trials. Fnality operates within UK borders building central bank-backed digital currency alongside Brazil and Hong Kong and the United Arab Emirates which develop CBDC tokenization systems.

For SDX, CBDC tokenization trials resulted in about six bond issuances during a six-month period, though adoption remains somewhat gradual with only one additional issuance since mid-2024.

Problems With CBDC Tokenization

The process of CBDC tokenization encounters several obstacles that stem from DLT performance constraints and difficulties in integrating legacy systems. For long-term success of CBDC tokenization the WFE paper emphasizes the requirement for enhanced interoperable systems and better regulatory standards.

The World Federation of Exchanges, representing more than 250 market infrastructure providers, notes that CBDC could fundamentally transform settlement systems while possibly reducing counterparty risks for various market participants.

The current adoption of CBDC tokens demonstrates advancement by converting experimental technological testing facilities into operational service platforms. The Swiss implementation demonstrates how security measures in CBDC tokenization protect both regulatory standards and foster economic sector monetary cooperation.