Yuan Defies 145% Tariffs—Accelerating the Great Dollar Unravel by 2025

Trade wars? No problem. China’s currency just laughed off punitive tariffs that would crater most economies—and Wall Street’s sweating the implications.

The resilience playbook: Beijing’s yuan-centric trade networks and digital currency pilot programs are quietly building a dollar-proof financial ecosystem. When the Fed hikes rates again, expect more nations to hedge with yuan reserves.

The cynical take: Nothing unites geopolitical rivals faster than a shared desire to escape Washington’s financial surveillance—and its printing presses.

How China’s PBoC Strategy Against Trump’s Tariffs Strengthens Global De-Dollarization Momentum

Yuan Stability Maintained Despite Tariff Pressure

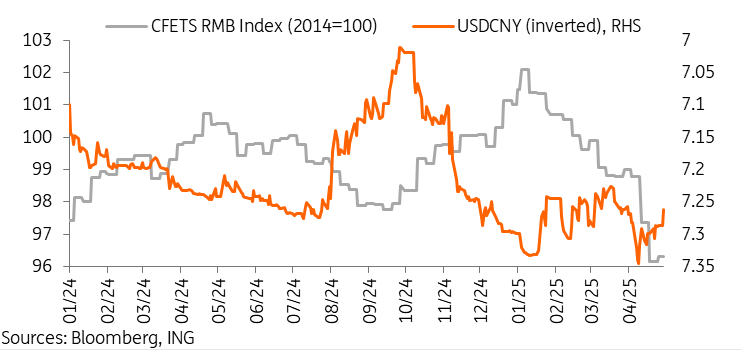

The Chinese yuan faced some pretty intense pressure after Trump’s unexpected tariff announcement. Despite briefly reaching around 7.35 against the dollar, the currency has basically returned to pre-tariff levels of about 7.26, which demonstrates China’s ongoing commitment to currency stability even during these rather tense trade disputes. This stability is also considered by many analysts to be a key factor in current de-dollarization efforts.

Lynn Song, Chief Economist for Greater China at ING, stated:

PBoC Defies Market Expectations

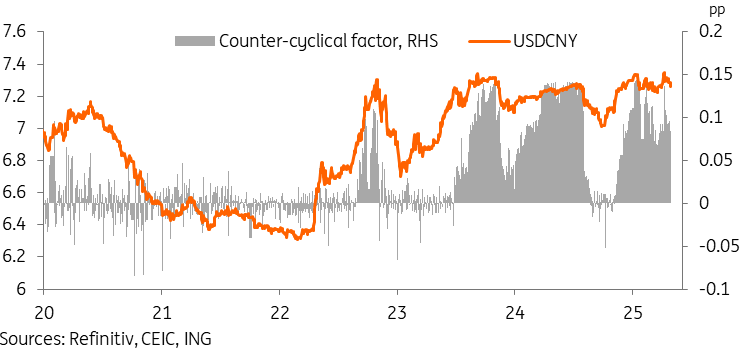

Many analysts and market watchers kind of expected China to perhaps devalue its currency to help offset these tariffs, but the PBoC has instead prioritized stability above all else. This approach to de-dollarization seems to focus on maintaining domestic purchasing power while also supporting the broader RMB internationalization goals that China has been pursuing for some time now.

Different From Previous Currency Tensions

The ING currency analysis also points out several key differences that basically explain why the current de-dollarization situation is actually quite different from previous trade wars:

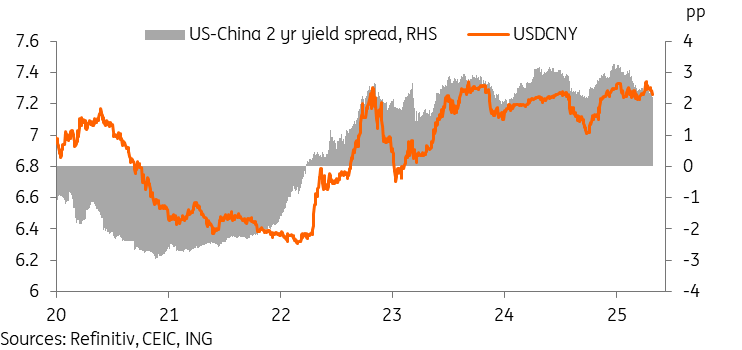

Yuan Strength Supported By Yield Trends

At the moment, the PBoC monetary strategy appears to benefit from the narrowing US-China yield spreads, which helps support yuan stability and seems to reinforce ongoing de-dollarization efforts. The experts at ING are actually forecasting further spread narrowing as the monetary policies continue to diverge.

ING analysts reported:

For now, ING maintains its USD/CNY forecast band of around 7.00-7.40, with some potential for a stronger yuan if tensions happen to ease somewhat. China’s successful defense against these extreme tariff pressures is essentially marking an important milestone in the global de-dollarization process, and in many ways strengthening the yuan’s position as an alternative to traditional dollar dominance in international markets.