Nasdaq’s Dogecoin ETF Filing Ignites Wall Street Frenzy—Meme Coin Goes Mainstream

Wall Street’s latest pivot? Betting big on DOGE as Nasdaq drops a regulatory bombshell—filing paperwork for the first-ever Dogecoin ETF. Because nothing says ’mature asset class’ like a cryptocurrency that started as a joke.

Institutional players are now scrambling to position themselves around the meme coin, proving once again that finance will commodify literally anything—even internet culture. The ETF could launch as early as Q3 2025 if the SEC doesn’t torpedo it first.

Meanwhile, crypto traders are already front-running the news, sending DOGE volumes up 300% on offshore exchanges. Because when has chasing hype ever gone wrong?

Source: X

Source: X

Nasdaq’s Dogecoin ETF Could Redefine Wall Street Crypto Access

Multiple Dogecoin ETF Filings Under Review

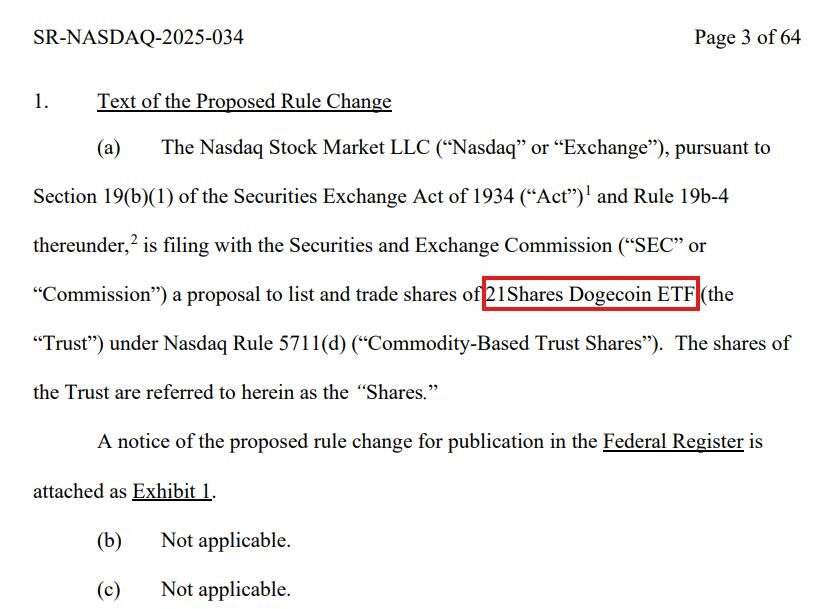

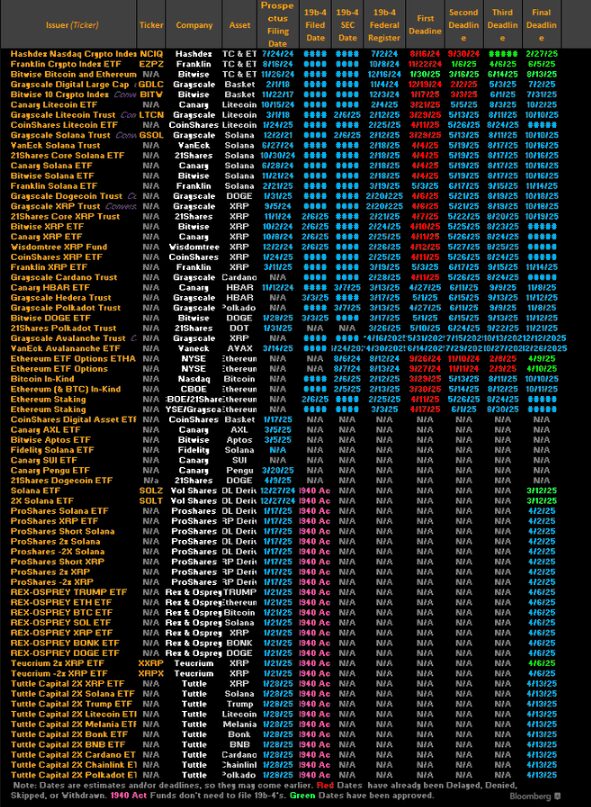

The financial institution Nasdaq filed its official 21Shares Dogecoin ETF listing application and then proceeded to join other financial institutions such as Bitwise and Grayscale in such applications. At present the SEC assesses more than 70 cryptocurrency ETF applications as Wall Street shows growing interest in digital assets and alternative investment trading.

Cointelegraph experts stated:

The NYSE Arca files an application for a Dogecoin ETF through Bitwise which will use Coinbase Custody for storing assets and Bank of New York Mellon for cash management. Serious institutional interest in future cryptocurrency market adoption becomes visible through these Dogecoin ETF partnerships.

DOGE’s Technical Foundation

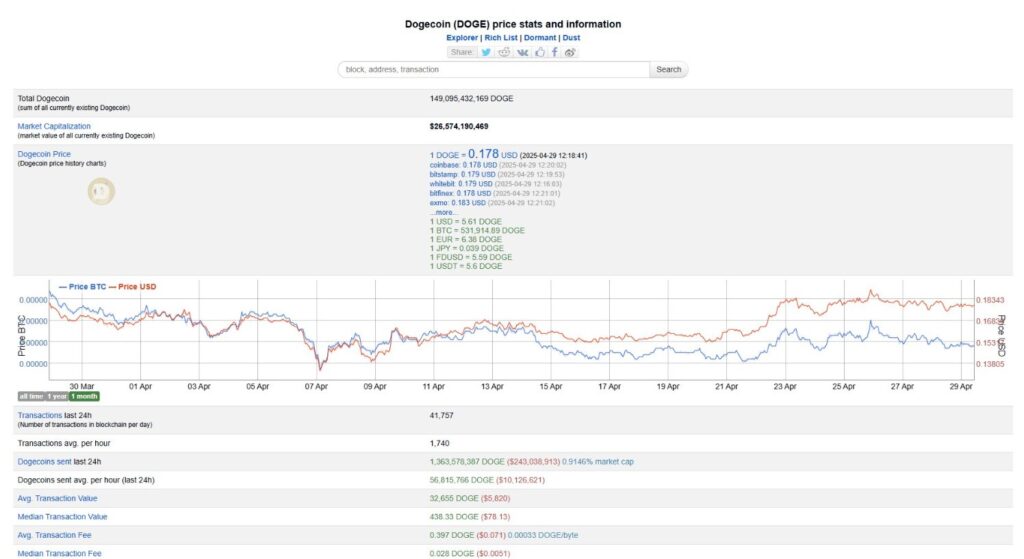

The Dogecoin network operates autonomously with its custom blockchain foundation which follows proof-of-work functionality like Bitcoin but has its distinctions. Dogecoin continues to operate with a $26 billion market value by processing more than 40,000 transactions each day at a current price point of $0.17.

Regulatory Considerations

While actively pursuing Dogecoin ETF listings, Nasdaq is also advocating for more consistent regulatory oversight. This balance between innovation and regulation addresses inherent Dogecoin investment risks while potentially expanding Wall Street crypto trading options for both retail and institutional investors alike.

In an April 25 letter, Nasdaq argued:

Market Impact Potential

Dogecoin ETF products under consideration will allow investors to participate in the market without owning cryptocurrencies directly thus spurring adoption across various investor groups. QED Protocol and Nexus use technical innovation to develop a layer-2 scaling solution for Dogecoin.

Cointelegraph noted in their recent analysis:

The Dogecoin ETF approval timeline remains somewhat uncertain as the SEC continues to balance investor protection concerns with market innovation in evaluating these Wall Street crypto trading vehicles throughout the review process.