Hedge Funds Go Rogue: Goldman Sachs Reports Unprecedented Bank Stock Gamble

Wall Street’s wolves are flipping the script—Goldman data reveals hedge funds making their biggest bank stock plays since 2008. Are they seeing something the rest of the Street missed? Or just chasing liquidity like tourists at a crypto pump-and-dump?

The move comes as traditional finance continues its awkward dance with digital assets—proving once again that when the big money moves, it’s never for the reasons they put in the press release.

Source: Watcher Guru with Reuters Data

Source: Watcher Guru with Reuters Data

What Hedge Funds’ Shift Means for Banks and Markets

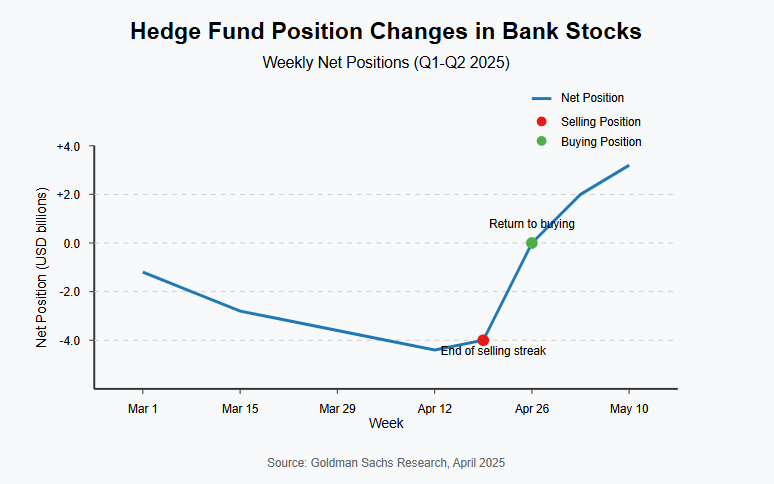

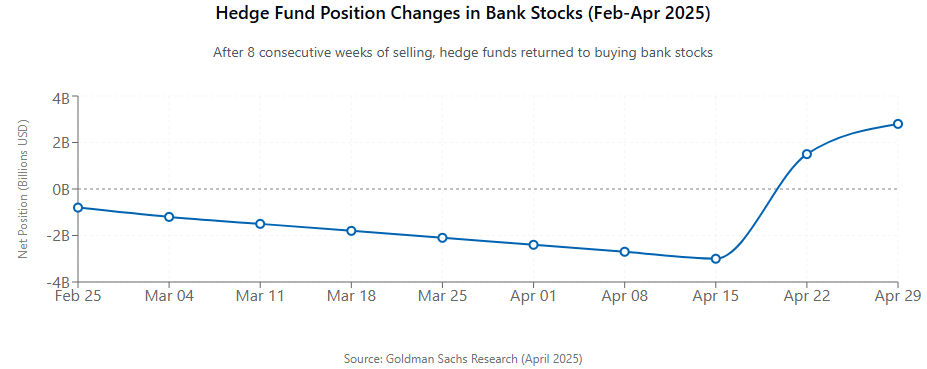

The sudden hedge funds stock move comes as markets process first-quarter earnings reports from major U.S. banking institutions. Goldman Sachs revealed this shift in a note released last Friday, which was later seen by Reuters.

Goldman Sachs stated:

Record Trading Performance Attracts Investment

Major banks achieved spectacular success in their trading units during the latest period. During the market boom of the early year JPMorgan Chase and Morgan Stanley generated their highest revenue while Wells Fargo collected more fees from clients. The encouraging financial outcomes seem to drive hedge fund investments into banking institutions in recent times.

Long Positions Dominate Bank Shares Strategy

The Goldman Sachs analysis shows hedge funds have taken mostly long positions on financial stocks for five of the last seven weeks. This type of buying has outpaced hedge fund trades resulting from exiting short bets, demonstrating genuine confidence in bank shares amid ongoing market volatility.

Performance Gains Follow Strategic Shift

The recent hedge funds stock move is already showing positive results. According to the Goldman Sachs note:

While capital markets firms and banks dominated last week’s purchases, financial services firms that facilitate trading were the most bought financial stock category this year, highlighting the nuanced approach hedge fund strategies are taking in the current market.