Petrodollar Under Siege: 5 Major Oil Players Ditch USD for Yuan Settlements

The dollar’s dominance takes another hit as five oil giants pivot to yuan-denominated deals—because nothing says ’geopolitical shift’ like crude priced in redback.

Black Gold, Red Currency

From Russia to the Middle East, producers are cutting settlement times and bypassing US sanctions by embracing China’s currency. The petrodollar system isn’t dead yet, but it’s coughing up blood.

Wall Street’s Worst Nightmare

Traders scrambling to hedge yuan exposure while DC policymakers pretend this is just a ’temporary adjustment.’ Meanwhile, Bitcoin maximalists smirk—told you fiat was fragile.

The financial world’s playing musical chairs, and the Fed just lost another seat. Place your bets: who blinks first—SWIFT or the BRICS+ CBDC alliance?

China’s Influence Grows as Oil Giants Switch from USD to Yuan

1. Sinopec Leads Yuan-Based Energy Trade

The Chinese refiner Sinopec stands as the biggest oil refinery in China and leads the way for yuan payment deals. Sinopec established the important milestone of Saudi Aramco in creating a $4 billion yuan-denominated joint venture during April 2025 while accelerating worldwide de-dollarization initiatives.

According to Reuters:

2. Saudi Aramco Expands Yuan-Based Projects

Saudi Aramco, which is currently the world’s largest oil exporter, has also been expanding yuan-based refining and petrochemical projects in China. And although it’s not fully settled in yuan just yet, Aramco’s growing partnership with Chinese firms certainly signals a strategic shift toward de-dollarization in oil trade.

Dean Mikkelsen, Editor of Oil & Gas Middle East, stated:

3. Gazprom – Russian Energy Companies Pivot to Yuan

Gazprom, Russia’s major state-owned energy company, has really accelerated yuan settlements due to Western sanctions. And in 2025, Gazprom continues to ramp up pipeline gas and LNG to China via yuan trade agreements, which is another clear indicator of the de-dollarization trend.

Wu Dahui, deputy dean of Tsinghua University’s Russian Institute was clear about the fact that:

4. PetroChina & CNOOC – Chinese Oil Companies Are Leaders In Digital Yuan Adoption

PetroChina actually completed China’s first crude oil trade in digital yuan back in 2023, while CNOOC also executed the first LNG deal settled in yuan with TotalEnergies in that same year. These developments, along with other similar initiatives, represent critical steps in the ongoing de-dollarization process.

E. Yongjian, vice general manager of Bank of Communications’ research department, had this to say:

Challenges Remain Despite Progress

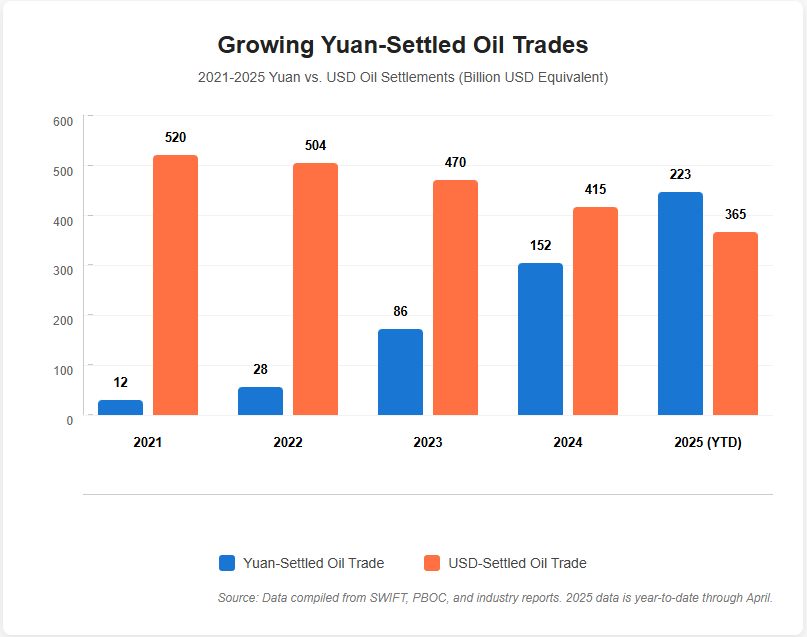

Despite all the recent advances in de-dollarization, there are still some significant obstacles that persist. At the moment, the yuan currently accounts for only about 5.3% of SWIFT trade finance settlements, compared to the dollar’s dominant 84%.

Qu Fengjie, researcher at China’s National Development and Reform Commission, suggested:

The de-dollarization trend among these five oil giants really highlights China’s growing influence in global energy markets and also reflects broader shifts in international finance as more and more countries are now seeking alternatives to dollar dependency.