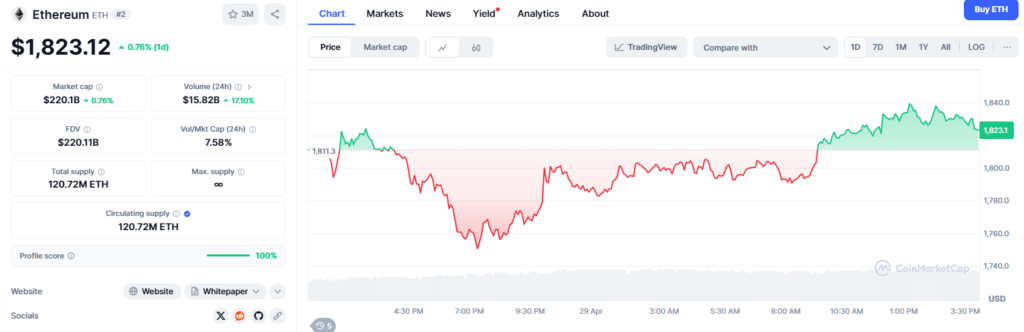

Ethereum Plummets 47% in 2025—Bargain Hunt or Dead Cat Bounce?

Ethereum’s brutal 2025 slump has crypto traders sweating. The second-largest blockchain isn’t just down—it’s showing zero network growth. Here’s why that matters.

Network activity flatlines while ETH bleeds out. Daily transactions? Stagnant. Active addresses? Going nowhere. Even DeFi’s poster child can’t defy gravity when adoption stalls.

But here’s the kicker: Wall Street’s suddenly interested. The same suits who called crypto a scam now whisper ’buying opportunity’ as retail gets liquidated. How convenient.

Bottom line: Ethereum’s tech still leads, but the price action screams ’show me the users.’ Until those metrics flip, this might just be a very expensive lesson in chasing knives.

Source: CoinMarketCap

Ethereum Price Drop Risks and market Uncertainty: Should You Invest Now?

Source: CoinMarketCap

Ethereum Price Drop Risks and market Uncertainty: Should You Invest Now?

Declining Active Wallets Signal Trouble

Recent data shows Ethereum’s active wallet addresses dropped to about 13.9 million in March, down 1.5 million from last year. This key metric suggests users are moving away from the network despite its well-established position.

Alex Carchidi, crypto analyst, was clear about the fact that:

At present competitors have stronger user involvement than NanoX. The cryptocurrency market capitalization for Solana reaches $78 billion despite its 68 million active wallets while Sui maintains 38 million active addresses but exists with $12 billion market value.

Competitors Gaining Ground

The Ethereum price has declined while its main competition consisting of Solana along with Cardano, Avalanche, and Sui actively expands its dominance in the market. The entire list of these competing cryptocurrencies now places among the top 20 cryptocurrencies and they surpassed ETH during this year.

Charles Hoskinson, Cardano founder and former Ethereum co-founder, raised concerns:

Leadership Uncertainty

A decrease in Ethereum prices occurs at the same time as internal management problems within the network occur. Listeners spread rumors that Vitalik Buterin would leave his leadership position at Ethereum during the early months of 2025 when the Ethereum Foundation underwent a complete restructuring process. ETH develops roadmap uncertainty as development teams openly clash about their priority needs.

Trump Administration Support

A few positive circumstances nevertheless remain active amid the current Ethereum price decline. Through the Digital Asset Stockpile program the Trump administration identified Ethereum as a CORE technology for American blockchain advancement. Ethereum stands as an investment for World Liberty Financial an institution which has ties to the Trump family members.

Market price levels would not receive any boost because there are no confirmed new Treasury purchases.

Investment Outlook

Ethereum oversees 120.72 million ETH in its current circulation at the same time as sustaining $16.71 billion in daily trade transactions. Trading has amplified after the price decline according to the 54.93% increase in daily volume figures. Currently, the market reveals moderate liquidity through its 7.58% ratio between trading volume and market capitalization.

Dominic Basulto, financial analyst, warned:

The Ethereum price drop analysis points to caution for investors. While its historical significance remains important, the combination of declining metrics, fierce competition, and leadership questions creates an uncertain investment case. The coming months will definitely determine if this 47% drop represents a buying opportunity or perhaps the beginning of a larger decline for ETH.