Pentagon’s $150B Cash Cannon Loads Up—Here Are the 5 Defense Stocks Primed to Profit

Lockheed, Raytheon, and Northrop Grumman stocks are already climbing—because nothing juices share prices like Congress rubber-stamping blank checks for missiles.

Warfare goes digital: These contractors now pour R&D into AI targeting systems and cyberweapons. Forget trenches—tomorrow’s battles will be fought in code.

Ethics optional: ’Defense’ stocks always outperform during geopolitical tension. Whether that’s savvy investing or profiting from conflict depends on your moral flexibility.

Bonus cynicism: Wall Street analysts suddenly care about ’national security’ right when those sweet, sweet government contracts hit earnings reports.

Top Military Spending Picks in Aerospace and Defense for 2025

1. Lockheed Martin (LMT) – Missile Defense Giant

Lockheed Martin stands as a top defense stock that is currently benefiting from the $25 billion missile defense allocation. The company’s stock at the time of writing trades at $476.29, and has shown a healthy 6.62% gain recently.

2. Northrop Grumman (NOC) – Nuclear Modernization

The $13 billion nuclear deterrence funding provides Northrop Grumman with opportunities to boost their B-21 Raider bomber program by using $4.5 billion specifically designated for speedier development. Due to its positions within classified space programs and military technology development Northrop Grumman exists as a defense stock trading at $483.31 per share.

Major General Teodor Incicas, Chief of the General Directorate for Armaments within Romanian Ministry of National Defence, stated:

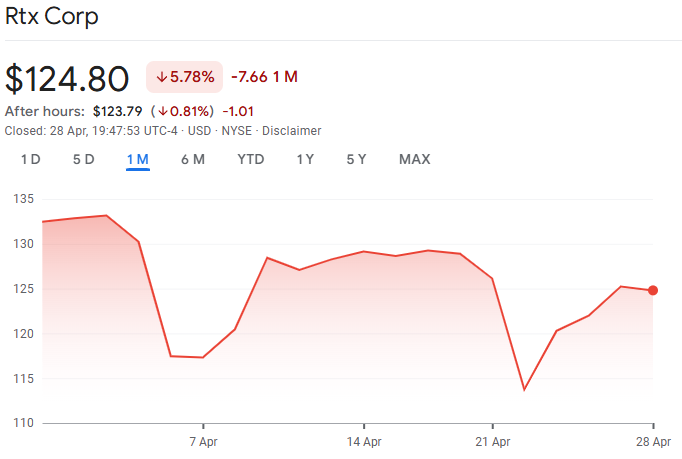

3. RTX Corporation (RTX) – Missile Systems

RTX Corporation aligns perfectly with the $21 billion that has been allocated for ammunition production. Currently trading at around $124.80, this defense stock is pretty well-positioned for contracts in cruise missiles and also air-to-air missiles development in the NEAR future.

4. General Dynamics (GD) – Naval Systems Leader

General Dynamics will likely benefit from approximately $34 billion for shipbuilding, including an additional $4.6 billion that supports a Virginia-class nuclear submarine. This defense stock trades at about $271.94 with some strong growth potential in naval and ground systems.

5. L3Harris Technologies (LHX) – Innovation Leader

L3Harris stands to gain from around $14 billion allocated to “innovative” weapons systems. This defense stock focuses on communication systems and electronic warfare, which are key areas in aerospace and defense companies’ future growth strategies.

With the US military budget increasing significantly in recent months, some sustained growth through 2029 positions defense stocks advantageously. Companies aligned with the Pentagon’s prioritized spending areas will likely represent the best defense investments, especially aerospace and defense companies that focus on next-generation capabilities and such.

The military spending 2025 outlook remains pretty strong right now, with defense stocks benefiting from continued global tensions and various modernization efforts. Investors seeking the best defense investments should probably focus on these top aerospace and defense companies with established Pentagon relationships and proven track records.