Nvidia (NVDA) Dominates $68B Market With 120% Growth Potential—Wall Street Scrambles to Catch Up

Nvidia’s silicon supremacy isn’t just holding—it’s accelerating. The chipmaker now commands an iron grip on the $68 billion AI accelerator market, with analysts projecting a 120% upside as data centers hemorrhage cash to secure their H100s.

Behind the surge: A perfect storm of hyperscale demand and competitors tripping over their own node shrinks. While AMD plays catch-up and Intel rebrands its roadmap (again), Jensen Huang’s team keeps printing GPUs like the Fed prints money—except these actually hold value.

The real kicker? Every ’AI-powered’ earnings call from Fortune 500 CEOs this quarter just became an unofficial Nvidia infomercial. Maybe they should start paying licensing fees.

Source: Investopedia

Source: Investopedia

Nvidia Emerging as Potential Leader in New $68 Billion Market as Stock Could Surge

The US stock market retreated yet again Monday, as the Dow Jones reversed four days of gains to start the last week of April. That has once again hammered away at top tech stocks, with mega-cap companies struggling to gain any momentum so far in 2025.

That could be set to change, however, with one of the biggest firms on the planet. Indeed, Nvidia (NVDA) is set to be a leader in an emerging $68 billion market, as the stock has 120% upside emerging. Although the first three months have seen it struggle, there is one overlooked reality that could bring the share value back up.

Specifically, the company has been viewed as a top participant in the development of autonomous driving stocks. The market was worth more than $68 billion last year, according to Grand View Research. Moreover, the AI chipmaker is expected to play a key role in its continued growth.

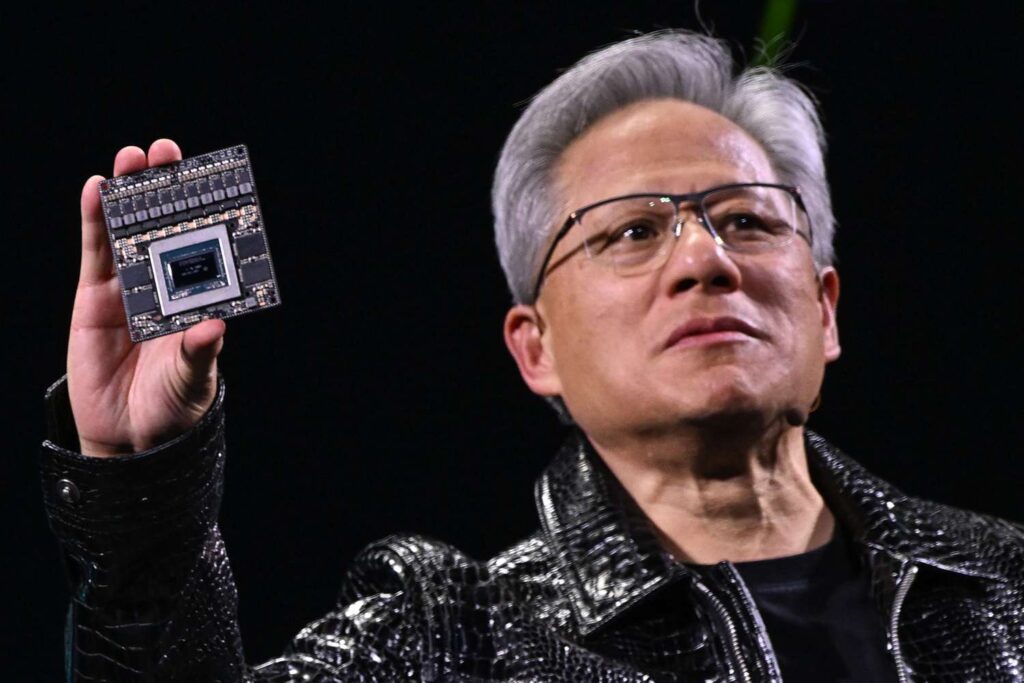

Nvidia has debuted its DRIVE platform, with a host of AV solutions coming to the forefront. This includes in-car AV hardware and different AI infrastructures. The semiconductor stock plays a fundamental role in all computer systems, including those critical to the arrival of self-driving cars.

This is why the stock has had a massive high-end projection forming. Although it fell more than 3% on Monday, that is expected to change. According to CNN data, NVDA has a $235 bull case projection, up 120% from its current position. Moreover, it boasts a media target of $160, representing 49% upside in that case.