Bitcoin’s Power Law Points to $200K by Q4 2025—But $155K Hinges on This One Factor

Bitcoin’s price trajectory is following a power law model—again. If history holds, BTC could hit $200K by late 2025. But there’s a catch: the $155K mid-range target depends entirely on institutional inflows staying steady. No pressure, Wall Street.

The math doesn’t lie. Past cycles show Bitcoin’s price adheres to a logarithmic growth curve, with deviations eventually snapping back to the mean. This time? The model’s upper band aligns with $200K, while the conservative estimate lands at $155K. Guess which one requires ETF whales to keep stacking sats.

Here’s the kicker: power laws work until they don’t. Ask any quant who got rekt in 2022. But with halving-induced scarcity and BlackRock’s blessing, this rally might just have the legs—unless traditional finance screws it up, as usual.

Bitcoin Price Prediction For 2025: Will BTC Hit $150K or Reach $200K?

Power Law Shows Path to $200K

The power law predicts $200K Bitcoin target based on network growth that follows Metcalfe’s Law, which is pretty interesting when you look at the historical data. Right now, 21st Capital co-founder Sina has pointed out that Bitcoin has, in fact, reclaimed its power-law price level, and this could mean something for future growth.

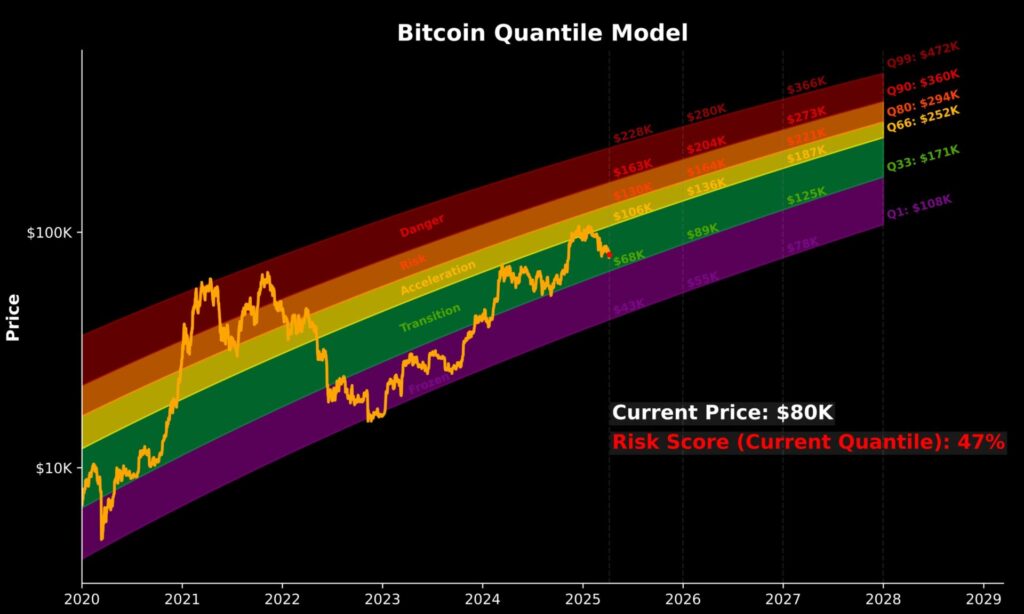

Based on Sina‘s Bitcoin Quantile Model, reclaiming the power-law price keeps BTC on track to hit a price target of $130,000 and $163,000 before the end of 2025.

Bitcoin sits currently in what’s called the “Transition” range where accumulation typically happens before eventually entering the “Acceleration” zone. This Bitcoin price prediction for 2025 really depends on maintaining momentum through, well, Q3 and beyond.

$91,400 Support Critical for $155K Target

On-chain analyst Ali Martinez has actually identified one very specific condition for Bitcoin’s potential rise to $155,400—and that’s maintaining support above the $91,400 level, which seems to be critical for the next phase.

Martinez noted:

This BTC price forecast essentially uses the Pi Cycle Top Indicator, which basically tracks moving averages to predict market peaks. The power law predicts $200K Bitcoin only if this critical support level manages to hold through the inevitable market volatility we’re likely to see.

Four-Year Cycle Points to Q4 Surge

Anonymous analyst apsk32 offers perhaps the most bullish prediction based on power curve time contours across four-year cycles, and their analysis suggests a strong Q4.

apsk32 stated:

This Bitcoin price prediction for 2025 builds on historical patterns that have typically shown strong Q3 and especially Q4 performance in previous cycles.

Exchange Outflows Signal Bullish Sentiment

Over 40,000 BTC actually left exchanges in just one week—and this is typically a signal that often precedes price increases as the supply available for sale goes down on the open market.

Ali Martinez reported:

More than 40,000 #Bitcoin $BTC have been withdrawn from exchanges over the past week! pic.twitter.com/Gytd1ZFWEV

— Ali (@ali_charts) April 26, 2025This reduced supply, combined with Bitcoin’s technical strength at an RSI of around 68.65, seems to support the BTC price forecast models that are targeting that $150K-$200K range that everyone’s talking about.

With Bitcoin currently trading above key moving averages and power law models remaining intact, crypto market trends are suggesting that the $200,000 target remains quite plausible as long as those critical support levels can hold through 2025. The power law predicts $200K Bitcoin by Q4 2025—and nearly all models are, at this point, pointing toward unprecedented price discovery if current market conditions manage to persist.