SEC’s Ethereum ETF Stalling Costs Investors $61M—Grayscale Sounds Alarm

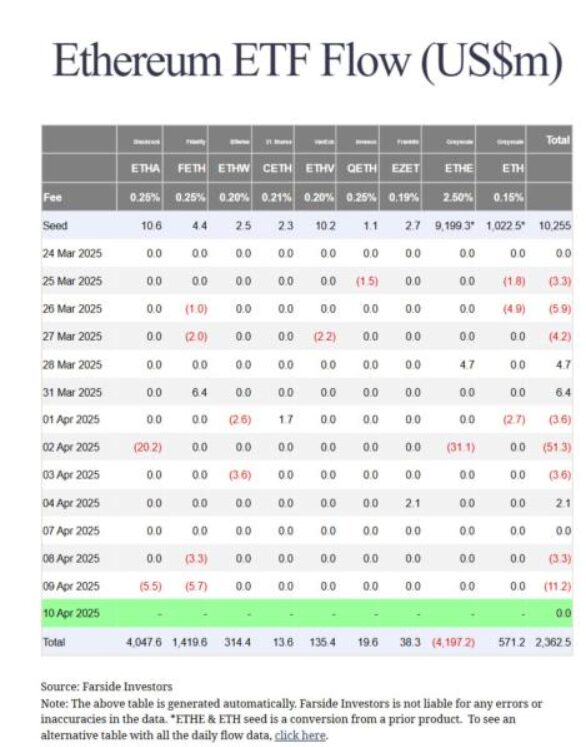

Regulatory foot-dragging strikes again: Grayscale calculates a $61 million opportunity cost for Ethereum investors as the SEC delays staking-enabled ETFs. Wall Street’s ’measured approach’ looks more like a wealth incinerator for crypto natives.

While traditional finance gatekeepers debate ’investor protection,’ decentralized protocols quietly siphon yield—and talent—from legacy systems. The irony? These delays may accelerate the very innovation the SEC fears.

Source: SEC

Source: SEC

Grayscale Pushes SEC for Ethereum ETF Approval as $61M Lost in Staking Rewards

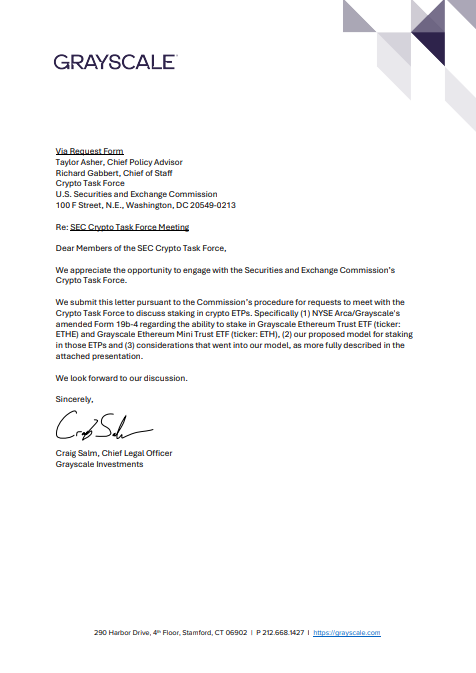

On April 21, representatives from Grayscale met with the SEC’s Crypto Task Force to advocate for Ethereum ETF staking capabilities. The company is currently seeking amendments to Form 19b-4 filings for both the Grayscale Ethereum Trust ETF and also the Ethereum Mini Trust ETF.

Craig Salm, chief legal officer at Grayscale Investments, said:

The financial impact of these restrictions was clearly outlined in Grayscale’s memorandum:

Network Security Benefits

Ethereum ETF staking would benefit both the network and also investors. Grayscale has also emphasized this dual advantage in their presentation to the SEC:

International Precedent

At the time of writing, the SEC Ethereum decision lags behind global markets, where Ethereum ETF staking is already permitted in various jurisdictions. Grayscale noted this disparity in their documentation:

Grayscale has also affirmed their operational readiness with this statement:

Future Outlook

The Grayscale Ethereum ETF situation demonstrates how regulatory forces conflict with emerging crypto developments. The potential outcome of the SEC’s decision about this proposal will determine Ethereum price fluctuations. Thehasil will determine essential factors that influence traditional investor access to Ethereum ETF staking possibilities and set new directions for cryptocurrency investment vehicles in the American market.