Goldman Sachs Analyst Drops Bombshell: The US Dollar’s BRICS-Led Reckoning Is Coming

Wall Street’s favorite crystal ball gazer—Goldman Sachs—just hinted at the dollar’s shaky future. BRICS nations aren’t playing by the old rules anymore, and the greenback might pay the price.

De-dollarization isn’t a conspiracy theory—it’s a spreadsheet reality. When emerging markets start hoarding gold and trading in yuan, even the Fed starts sweating.

The irony? The same banks that built the dollar’s empire are now mapping its decline. Talk about hedging your bets.

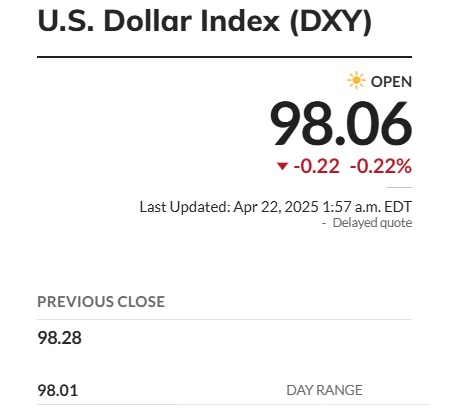

Source: MarketWatch

Source: MarketWatch

BRICS: Goldman Sachs on The US Dollar’s Future: ‘Weakness Is Here To Stay,’ Says Analyst

Kamakshya Trivedi, Head of Global FX at Goldman Sachs said that the US dollar’s weakness is here to stay. Trivedi explained that the geopolitical winds have changed as emerging economies are now looking at their own benefits similar to how the US does on foreign policies. The Goldman Sachs analyst remains bearish on the US dollar as BRICS and other countries are diversifying their reserves.

said the analyst. He added,However, the Goldman Sachs analyst explained that the local currencies of BRICS countries do not pose a threat to the US dollar. Read here to know the eight currencies that outperformed the USD this year.

He stressed that the euro and Japanese yen could rise as the greenback declines in the charts.While BRICS currencies might not pull the US dollar down, the euro and yen could, said the Goldman Sachs analyst.