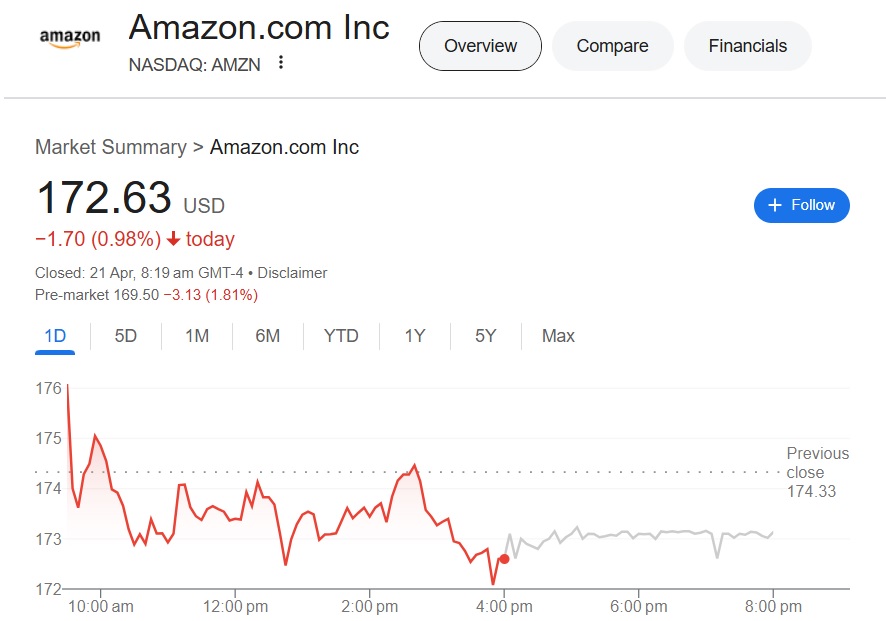

Amazon’s Stock Rating Lowered: Analysts Reveal Lowest Projected Price for AMZN Shares

As of April 21, 2025, financial analysts have revised their outlook on Amazon (AMZN), issuing a downgrade amid shifting market conditions. The updated assessment includes a detailed projection of the stock’s potential floor price, reflecting heightened scrutiny of the company’s valuation metrics. This adjustment comes as investors evaluate Amazon’s growth trajectory against broader economic headwinds, with technical indicators suggesting possible support levels. Market participants are advised to monitor volume trends and institutional activity around these key price points for confirmation of the new baseline valuation.

Source: Google

Source: Google

Raymond James Downgrades Amazon Stock: See AMZN Target

Leading wealth management firm Raymond James analyst Josh Beck recently downgraded Amazon stock’s prospects to Outperform from Strong Buy. The analyst previously wrote that AMZN could reach a high of $275 but has cut back on the prediction by a wide margin.

According to the latest price prediction, Amazon stock could reach $195 after being downgraded from $275. That’s a steep decline for AMZN’s prospects as the stock has entered bearish territory. The global trade wars and tariffs have ignited a paradigm shift in the markets with uncertainties paving the way. While the 90-day tariff pause has cooled the markets, the threat of a decline looms large.

The global markets are in a sticky situation where things could begin to go downhill from July. If Trump does not scrap the tariffs on 185 countries, leading stocks could tumble in the charts. Amazon is the frontrunner in exchanging goods from businesses to consumers and the tariffs directly affect its stock.

AMZN could have difficult times if the tariffs are not scrapped by Trump after the 90-day pause in July. The broader markets could enter a bearish phase leading to price dips and overall stagnation of wealth. Investments from both retail and institutional funds could decline during the upcoming crash eroding investors’ confidence in the markets.