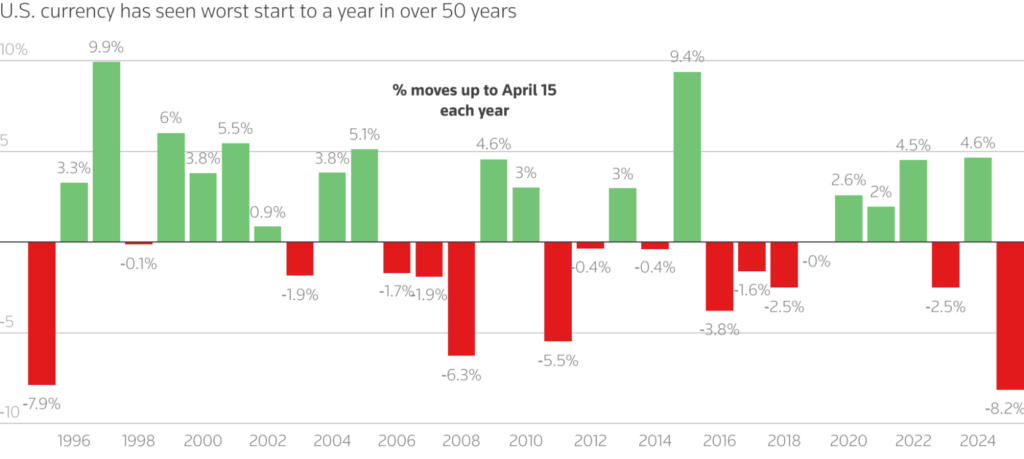

Goldman Sachs Predicts 10% Decline in U.S. Dollar Value by April 2026 Amid Global De-Dollarization Trend

In a recent analysis, Goldman Sachs has projected a significant 10% depreciation in the U.S. dollar’s value by April 2026, citing the accelerating global shift away from dollar dominance. This de-dollarization movement, driven by geopolitical realignments and the rise of alternative reserve currencies, could reshape international trade and finance. The report highlights how central banks diversifying reserves and bilateral trade agreements bypassing the dollar are contributing to this structural decline. Market participants are advised to monitor currency hedging strategies and portfolio allocations in light of this forecasted dollar weakness over the next two years.

US Dollar Weakness: Key Drivers, Forecasts & Impacts on Global Markets

Tariffs and Currency Impact

US tariffs’ impact on the dollar is becoming increasingly evident as trade policies continue to shift. Goldman Sachs highlights how these changes are currently eroding both consumer and business confidence in multiple ways.

Michael Cahill, Goldman Sachs senior currency strategist, stated:

The U.S. dollar drop Goldman Sachs predicts is linked to the changing nature of tariffs at this time. With broad tariffs affecting multiple countries, the dynamics are shifting dramatically in recent weeks.

Cahill writes:

Global Currency Shifts

Global currency fluctuations are being influenced by changing perceptions of U.S. governance and institutions. For almost a decade, the U.S. dollar benefited from significant capital flows into U.S. assets from developed market economies such as the euro area, Japan, and also Norway. This positioning is now expected to reverse in the coming period.

Signs of this reversal are already emerging. Consumer boycotts of U.S. goods have been observed, and reduced tourism flowing to the U.S. has been noted, with foreign arrivals to major U.S. airports falling following recent tariff announcements.

International Response to Dollar Weakness

The USD weakness forecast has prompted various responses from international financial institutions and governments. Foreign officials have taken several actions to attempt to reduce their reliance on the dollar, contributing to the U.S. currency’s declining share of foreign exchange reserves over the last decade.

Cahill notes:

Critical Import Challenges

The Goldman Sachs report highlights how critical imports, which are quite difficult to substitute, present additional challenges. With increased foreign pricing power, U.S. terms of trade may need to adjust via higher import costs, causing the dollar to depreciate rather than foreign currencies.

Cahill describes this situation as:

The U.S. dollar drop Goldman Sachs predicts appears increasingly likely to materialize as stronger-than-expected foreign spending plans combine with weaker U.S. asset performance. This has already led to some brief but active rotation out of U.S. assets and increased interest in hedging U.S. dollar exposure. The USD weakness forecast points to significant implications for global markets and also investors worldwide in the coming year.