Nvidia (NVDA) Surges Following Tariff Suspension and US Policy Shift: Can the Stock Reach $200?

Source: Investopedia

Source: Investopedia

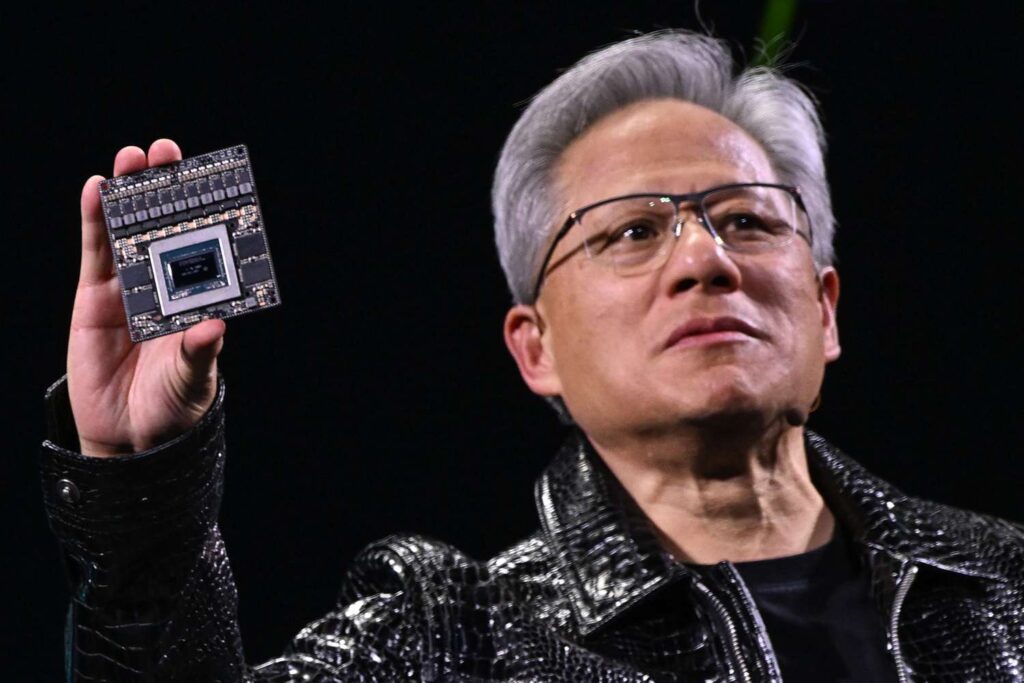

Nvidia Set to Shift US Production as Stock Eyes Return to 2024 Levels

Nvidia (NVDA) is a far cry from the 174% jump it made throughout last year in 2025. Indeed, the AI chipmaker is down more than 20% year to date. However, it had shown signs of life as we approached the midpoint of the year. Moreover, over the last five days, the stock is up almost 13%.

The question is, just where does the company go from here as far as its investment sentiment? With Nvidia benefiting from a recent US tariff pause and shifting its manufacturing toward the country, the stock may just be bound for $200.

US President Donald Trump recently announced that the semiconductor industry is set to benefit from a tariff exemption. Although the inconsistent economic policy is still a cause of concern, the reprieve is helpful. Moreover, they doubled down on the United States, announcing that they are eyeing a $500 billion investment over the next four years.

All of that sounds incredibly promising, but the stock is still beholden to a struggling market. Macroeconomic factors abound, and the economic fragility is undeniable. Still, shares have a media price target of $175, according to CNN data. Moreover, its heightened projection sits at $235, showcasing upside of more than 113%.

If the market can turn things around, Nvidia is a strong contender to outperform its median target. Moreover, if the US economy can find a way to strengthen, its recent announcement should boost the stock toward the $200 mark.