Tesla (TSLA): Path to Millionaire Status or Wall Street’s Most Volatile Gamble?

The Question of Tesla: Why It has Become the Most Interesting Stock on Wall Street

There are few stocks in the position that Tesla (TSLA) is currently in. Shares of the company are down more than 33% year to date and have backslid amid the ongoing bear market. However, over the last six months, it is up more than 14% in a rather surprising turn considering the ongoing market volatility.

The question is, what do the long-term projections say? Specifically, is Tesla the next great millionaire maker, or is it simply the biggest risk on Wall Street today? Well, there are two outcomes that both have validity in their own right.

The Bullish Case

It’s not difficult to be bullish about Tesla, even despite its 2025 struggles. Indeed, Ark Invest has an ‘expected value’ price target of $2,600 for the stock by 2029. That is an incredibly bullish stance on the company but rooted in what could be real development for its technology offerings.

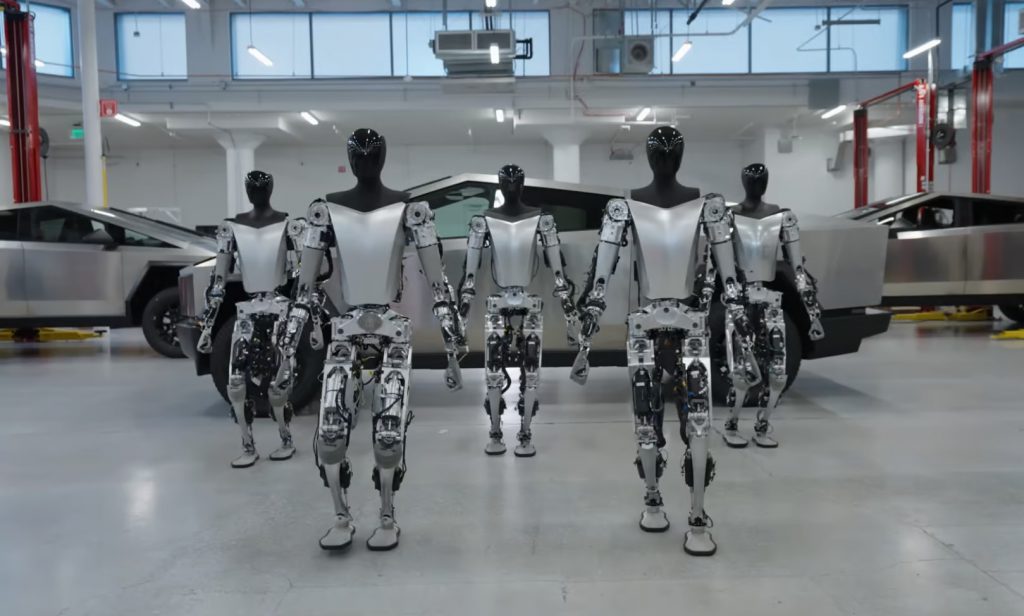

Many who expect big things for Tesla point to its game-changing project, the Robotaxi. For Ark, that product is worth 88% of the total company value. Indeed, that would mean that $2,288 per share of value comes from what it expects out of the autonomous driving project alone.

There are still a lot of questions regarding its arrival, but Musk has promised “unsupervised self-driving” as a paid service by June. Moreover, they project the cybercab to enter development in 2025. Despite concerns over its brand, these are lofty goals that could absolutely alter the trajectory of the stock.

The Bearish Case

However, there are still reasons to be concerned. Tesla has made a history of overpromising and underdelivering. Moreover, it is caught in a rather concerning situation of macroeconomic struggles and a NEAR brand crisis regarding its public perception.

The company could see its Robotaxi come to market but would have to navigate growing consumer protest that has dominated headlines in 2025. Moreover, the ongoing geopolitical concerns are still prevalent. Tariff turmoil has made the market increasingly uncertain.

Tesla is no different, even if it remains an EV leader as seen in its 44% market share in Q4 of 2024. The stock has reasons that are fair on both sides, with it overall hurting from perception and a history that is more talk than actual substance.

Is Tesla a Millionaire Maker?

The answer of whether Tesla (TSLA) is a millionaire Maker or Wall Street’s biggest risk is inconclusive at this point. However, it is undeniable to assume that, even with Ark Invest and similar firms bullishness, it is not suitable for the average retail investor considering the risk and high entry point.

According to CNN data, just 52% of analysts have a buy rating on the stock, compared to 21% calling to sell. Moreover, it has a high-end price projection of $1,000, showcasing its 295% upside. However, it also has a low-end projection of $120, down 52% from where it currently stands. The truth of the matter is that Tesla, even if it surges, stands as the market’s biggest stock risk.