US Dollar Index Outlook: Is a 10% Plunge Imminent by Mid-2026?

The greenback's fortress shows cracks. After years of dominance, the US Dollar Index faces its most significant test yet—analysts whisper about a potential double-digit decline before summer hits.

Why the Dollar's Grip is Slipping

Global monetary policy divergence is finally catching up. While the Fed hesitates, other central banks are charging ahead with their own agendas, creating crosswinds that could capsize the dollar's long-running rally. It's a classic case of gravity—what goes up must eventually face a reality check.

The Technical Breakdown

Charts don't lie, and the current patterns suggest a structural shift. Key support levels that held for months are now being tested with alarming frequency. Technical analysts point to weakening momentum and bearish divergences that typically precede major moves. The 10% figure isn't pulled from thin air—it's the minimum retracement needed to reset overbought conditions that have built up since the last cycle.

What a Weaker Dollar Means for Everything Else

When the world's reserve currency stumbles, everything gets repriced. Commodities priced in dollars suddenly look cheaper to foreign buyers. Emerging market debts become slightly less suffocating. And yes, alternative stores of value—from gold to digital assets—start shining brighter in comparison. It's the financial equivalent of musical chairs, and someone's about to find the dollar's seat isn't as comfortable as they thought.

The Mid-Year Reckoning

By June, seasonal liquidity patterns combine with quarterly portfolio rebalancing, creating the perfect storm for currency moves. Institutional money managers, always chasing last quarter's winners (and creating next quarter's problems), may finally rotate out of their dollar-heavy positions. The timing aligns with when market patience for 'transitory' weakness runs out—and positions get cut, not adjusted.

The dollar's privilege isn't disappearing overnight, but its premium is shrinking. In a world where every central bank prints with abandon, being the cleanest shirt in the dirty laundry pile only gets you so much respect. A 10% correction wouldn't be a collapse—it would be the market finally charging an appropriate risk premium for the world's most borrowed-against currency.

10% Rate Cut to Shake the US Dollar’s Core?

State Street strategist Lee Ferridge has sounded a new alarm, the one that involves the US dollar undergoing a prolonged meltdown. According to Ferridge, the dollar is at a critical juncture and may drop to its lowest if the Fed rate cut scenario comes into play again. Ferridge thinks that if the Fed cuts rates aggressively this year, it may end up lowering the USD by nearly 10%. In general, the analyst shared how traders are expecting two rate cuts this year. However, a looming third-rate cut may also arrive this year if TRUMP continues to pressure the Fed to lower the rates sooner.

DOLLAR COULD DROP 10% IF FED CUTS MORE THAN EXPECTED

State Street strategist Lee Ferridge warns the dollar may fall 10% in 2026 if the Fed cuts rates more aggressively than markets anticipate under a new chair. Traders expect two cuts by year-end, but a third is possible amid…

This drop can be compared to its other currency competitors, particularly the euro, pound, yen, Canadian dollar, Swedish krona, and Swiss franc.

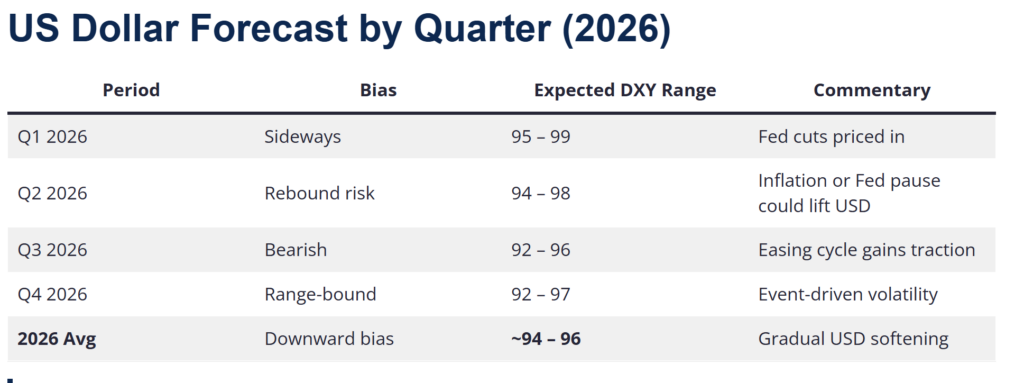

12-Month US Dollar Index Prediction

According to Cambridge Currencies USD stats, the US dollar may drop to nearly 94-98 by mid-2026. Moreover, the portal predicts the index to hit the 92-97 value range, driven by policy changes and geopolitical uncertainties.