BRICS Gold Holdings Set to Eclipse U.S. Treasury Reserves at Current Trajectory

Gold is staging a geopolitical comeback. The BRICS alliance—Brazil, Russia, India, China, and South Africa—is accumulating bullion at a pace that threatens to rewrite the global reserve playbook.

The Great Diversification

For decades, U.S. Treasury bonds were the undisputed safe haven. Central banks parked trillions, anchoring the dollar's dominance. That's changing. A strategic pivot toward tangible assets is underway, with gold at its core. The move isn't just about hedging inflation—it's about building a financial architecture less susceptible to Western monetary policy and sanctions.

Velocity vs. Volume

The story isn't just in the total ounces held, but in the acquisition speed. While established reserves like Fort Knox remain massive, the growth curve tells a different tale. BRICS nations are adding to their stockpiles methodically, quarter after quarter, turning gold into a strategic tool rather than a ceremonial relic.

A New Anchor for a Multipolar World

This isn't merely a trade. It's a long-term recalibration. As these economies deepen ties and explore alternatives to dollar-denominated trade, physical gold provides a neutral, apolitical foundation. It bypasses the SWIFT network, ignores interest rate decisions from the Fed, and sits quietly in vaults—a silent challenge to fiat hegemony.

The trend signals a profound shift in trust. When the ultimate 'risk-off' asset migrates from digital IOUs from one government to physical metal held by others, the message is clear. The financial elite are preparing for a different future—one where gold's timeless lure outshines the promise of a Treasury coupon, which, let's be honest, is just a fancy IOU from the world's most indebted nation.

Tracking Gold Reserves Trend Amid Treasury Sell-Off And De-Dollarization

The Numbers Behind the Shift

China currently holds approximately $775 billion in US Treasuries and 2,298 tonnes of gold worth around $150 billion at recent prices. India holds $190 billion in treasuries and 880 tonnes of gold, valued at roughly $57 billion. Brazil holds $180 billion in treasuries and 172 tonnes of gold, which comes to about $11 billion. Combined, these three nations hold roughly $1.15 trillion in treasury securities versus $430-450 billion in gold—a gap of approximately $400 billion that both movements are closing from both sides at the same time.

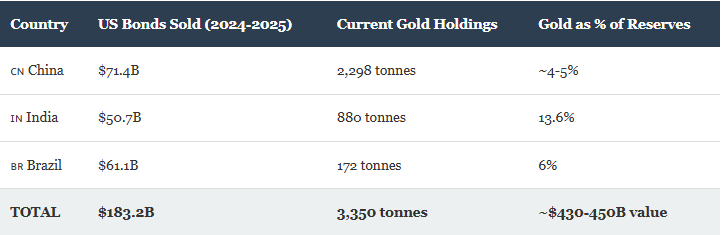

China led the BRICS treasuries sell-off by dumping $71.4 billion over the 12-month period, according to The Daily Hodl. India cut $50.7 billion, marking a 21% reduction and its first decline in four years, as reported by OpIndia. Brazil offloaded $61.1 billion in what Binance described as one of the most significant moves in its recent history. At the time of writing, aggressive gold purchases are matching these reductions and reshaping BRICS gold treasury holdings.

Meera Chandan, co-head of Global FX Strategy at JPMorgan, stated:

Gold Accumulation Accelerates

Brazil’s Central Bank added 43 tonnes over three months, bringing total reserves to 172 tonnes, the World Gold Council reported. This represents an aggressive sprint in central bank gold accumulation that hadn’t been seen from Brazil since 2021. China’s People’s Bank added 1 tonne in November 2025, continuing steady accumulation patterns that have characterized its approach for years now. India’s Reserve Bank has been on a particularly aggressive gold purchase spree, with holdings reaching 880.18 metric tonnes—up from 557 tonnes in 2015, representing a 58% increase.

Frank Giustra, Canadian mining investor and philanthropist, warned at the Precious Metals Summit:

Multiple factors are driving the strategic shift in BRICS gold treasury holdings, including concerns about dollar weaponization following the 2022 seizure of Russian assets and ongoing geopolitical tensions. Between 2020 and 2024, central banks of BRICS member states purchased more than 50% of global gold, according to Ahead of the Herd, systematically reducing their reliance on dollar-denominated assets.

The Math Points to Overtake

At $180 billion annual treasury reductions and 250 tonnes of gold purchases per year, conservative projections show the value of BRICS gold treasury holdings in gold surpassing treasuries by late 2027 or early 2028. If gold hits Morgan Stanley’s forecast of $5,800 per ounce by Q4 2026—which several analysts consider likely—the timeline compresses even further. The gold reserves trend accelerates the crossover, while the treasury holdings shift from both sides simultaneously closes the gap faster than many had expected just a year ago.

The BRICS de-dollarization impact extends beyond just these three nations. Considering all five original BRICS nations together—adding Russia’s 2,336 tonnes and South Africa’s 125 tonnes—the bloc holds approximately 5,811 tonnes of gold worth $750-800 billion. This represents roughly 20-21% of global central bank gold reserves, according to FastBull, and the percentage is growing. The trajectory of BRICS gold treasury holdings suggests a systematic strategy rather than opportunistic purchases.

What Analysts Are Saying

Giustra also stated regarding the broader financial transformation:

ING analysts have cautioned that “,” as reported by Yellow. The firm described this as an “” in recent analysis, suggesting that the shift in BRICS gold treasury holdings is structural rather than cyclical. Market participants expect India to “,” according to Indonesia Finance Market, which WOULD further accelerate central bank gold accumulation trends.

At the current pace, the question isn’t whether BRICS gold treasury holdings will overtake treasury holdings in value, but when—and the answer appears to be sooner than most analysts had anticipated.