Tech Titans Clash: Amazon (AMZN) vs. Meta (META) - The 12-Month Stock Showdown

Two tech behemoths enter the ring. Only one leaves with investors' favor. Over the past year, Amazon and Meta have charted wildly different paths through market turbulence, regulatory headwinds, and the relentless pressure to innovate. This isn't just a stock story—it's a battle for the future of digital dominance.

The E-Commerce Engine vs. The Metaverse Gambit

While one giant doubled down on core logistics and cloud supremacy, the other bet the farm on a virtual reality future that still has analysts scratching their heads. Their financials tell the tale of two strategies: one grounded in tangible, quarterly delivery, the other soaring on the speculative fumes of a next-gen internet. The divergence is stark, and the stakes? Only shareholder value and sector leadership.

Market Sentiment: A Study in Contrasts

Wall Street's love affair is fickle. Sentiment has swung from euphoric to cautious and back again, often on the whims of Fed statements and inflation data that have about as much predictability as a crypto meme coin. The numbers—the real ones from earnings calls, not the hype—have forced a brutal reassessment of what 'growth' actually means in a capital-expensive world.

The Final Tally: Speculation vs. Execution

One year later, the scoreboard illuminates a classic finance parable. It's the age-old clash between the visionary dream that promises tomorrow's riches and the gritty executor minting cash today. In a market suddenly allergic to fairy tales, the winner might just be the company that remembers profits are more than just a theoretical concept for the next roadmap. After all, on Wall Street, a bird in the hand is worth two in the metaverse.

Amazon (AMZN) Stock Analysis

Amazon stock is currently experiencing a bearish outlook, as the company’s fourth-quarter earnings report projected a staggering $200B AI spending segment. The firm shared how it expects the firm’s capital expenditures to continue surging as it heavily pivots towards data centers and infrastructure to cater to its rising AI demand.

CEO Andy Jassy said in a statement.

The announcement was met with a mix of strikingly bearish reviews, with investors skeptical about the firm’s plan to spend $200B to embrace the AI revolution. The company’s stock tumbled down post the announcement, falling 10% in the process.

BREAKING: Amazon stock, $AMZN, falls -10% after reporting Q4 2025 earnings.

It's now down -15% on the day including its regular hours move. pic.twitter.com/pkzYdSS9No

Meta Stock Analysis

In addition to Amazon, Meta stock, on the other hand, is also under investors’ watchful radar; additionally, as a result of the rising AI mechanism, the company plans to bolster its spending toward infrastructural support. The firm is planning to boost its AI spending, ready to spend nearly $135B on AI infrastructure.

Meta and Amazon stocks are both under pressure at present, with the firm’s heavy leaning towards AI causing distress among its investors.

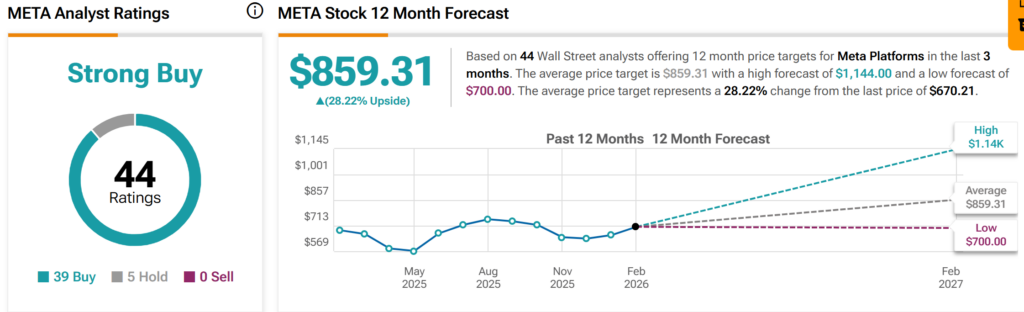

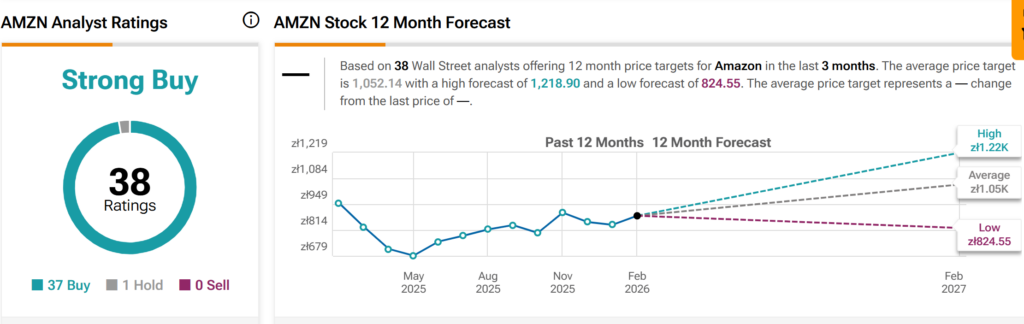

12-Month Forecast for Amazon (AMZN) and Meta (META)

According to TipRanks Amazon (AMZN) stock stats, the firm, if successful in redirecting its AI narratives, could make its stock surge to hit $340 in the next 12 months.

Additionally, for the Meta (META) stock, TipRanks stats suggest that the firm’s shares may surge to as much as $1.14K.