Paypal (PYPL) & Microsoft (MSFT): The 12-Month Stock Analysis That’s Actually Worth Your Time

Forget the noise. Two tech titans just delivered a masterclass in navigating market chaos—and the lessons are brutal.

The PayPal Pivot: From Payments to... Survival?

PYPL spent the last year rewriting its own playbook. The digital payments pioneer got a harsh reminder that past dominance guarantees nothing. While crypto volatility scared off legacy finance, PayPal doubled down on blockchain integration—quietly building rails while others debated the risk. A cynical move? Maybe. But in a sector where 'innovation' often means slapping a buzzword on an old product, it's a rare glimpse of actual adaptation.

Microsoft's Cloud Conquest: The Engine That Won't Quit

MSFT didn't just weather the storm; it built a better umbrella. While competitors trimmed sails, its cloud and enterprise segments became relentless growth engines. The play wasn't about flashy consumer gadgets—it was about embedding itself deeper into the global business stack. A boring strategy? Tell that to their balance sheet. It turns out solving mundane, trillion-dollar problems is still a fantastic business model.

The Takeaway: Execution Over Hype

Here's the finance jab you came for: In a market obsessed with quarterly theatrics, both companies highlighted the unsexy truth. Sustainable growth comes from infrastructure, not headlines. PayPal's grind towards utility and Microsoft's quiet domination remind us that the most powerful trends aren't always the loudest. They're the ones already running the world.

PayPal (PYPL) and Microsoft (MSFT) Stock News and Narratives

PayPal (PYPL) and Microsoft (MSFT) stocks are witnessing a downward trend as of late. Speaking about PayPal, the recent exit of the firm’s CEO has ended up casting a LAYER of doubt over its future. Investors are particularly wary of PYPL CEO Alex Chriss’s exit from the firm, with its share plunging as low as 20%, dampening the 2026 PYPL stock forecast. The firm has selected HP’s Enrique Lore as its new president and CEO.

In addition to this, Microsoft’s recent earnings report has also raised a new question for the company to combat. The fact that Microsoft’s shares are down 10% despite delivering a Stellar earnings report speaks volumes about the changing investor expectations. The firm is projecting a bearish stance, as investors were earlier expecting a high delivery output from MSFT’s cloud computing service Azure, which reported earnings near 39% as compared to 40% in the fiscal first quarter.

Projection For 2026 for Both the Stocks

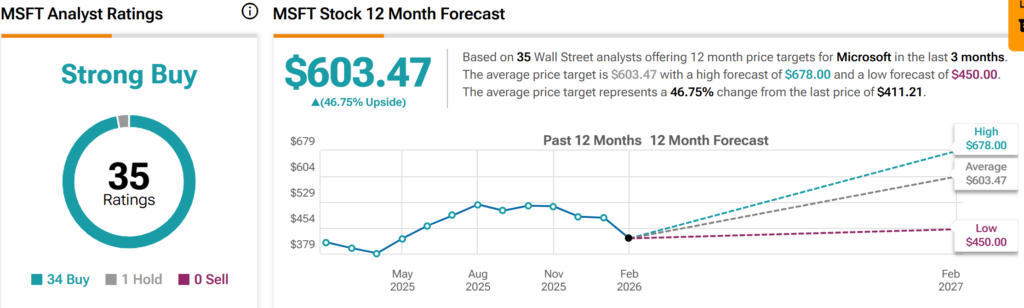

Per TipRanks, PYPL stock is currently eyeing a high of $90, which it can achieve in the next 12 months, provided the new CEO-elect could help drive the firm in the right direction.

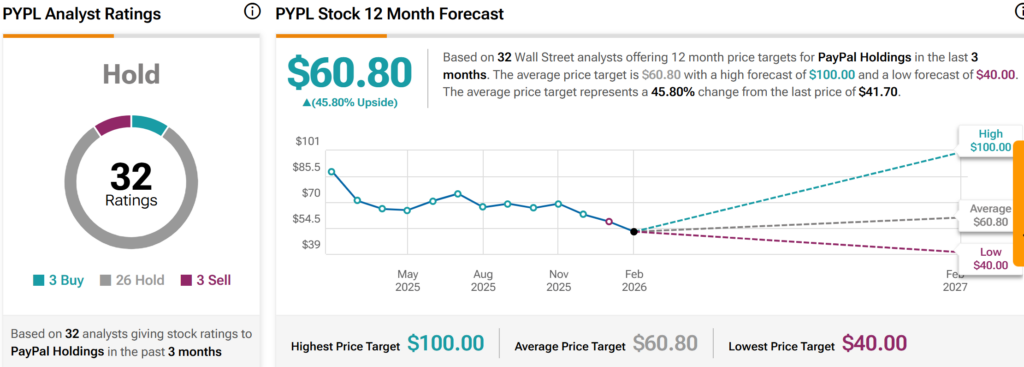

TipRanks later shared an analysis for Microsoft (MSFT) stock, claiming how this stock is eyeing a high worth of $678 in the next 12 months.