Gold Price Prediction For The Next 5 Years: The Digital Asset Perspective

Gold's five-year forecast lands as traditional finance scrambles for relevance.

The Safe-Haven Narrative Cracks

Central banks keep stacking bars, but the younger capital? It's flowing elsewhere. The 'digital gold' thesis for Bitcoin isn't just chatter—it's siphoning institutional interest and retail dollars that once automatically drifted toward bullion ETFs. Gold's millennia-long store-of-value monopoly faces its first real, programmable competitor.

Inflation Hedge or Legacy Asset?

When inflation prints hot, gold should soar. Yet its recent performance feels more like a sluggish reaction than a decisive hedge. Meanwhile, crypto assets, with their fixed supplies and global, 24/7 markets, are writing a new playbook for value preservation—one that doesn't involve vaults and assay certificates. The narrative is shifting under gold's feet.

The Real Competition Isn't Another Metal

Forget silver. The true battle is for the 'store of value' mindshare in a digitizing world. Gold's physicality becomes a burden—costly to secure, impossible to move swiftly. Digital assets bypass borders and close at 4 PM. They settle in minutes, not days. This isn't about replacing jewelry; it's about obsolescing a financial concept.

A Predictable, Diminished Climb

Expect gold to grind higher—central bank buying and geopolitical fear will see to that. But its growth trajectory looks anemic compared to the potential of the digital asset ecosystem. It's the difference between a steady bond coupon and a venture capital moonshot. The smart money is diversifying its 'hard asset' exposure beyond the periodic table.

Gold will likely hit new nominal highs, giving its proponents a reason to cheer. But in real terms—adjusted for the gravitational pull of decentralized finance and a generation that prefers private keys to safety deposit boxes—its luster is fading. The ultimate cynical jab? Gold's five-year prediction matters most to the funds that are already too late to the real asset revolution.

Gold Price Overhaul: Drivers Fueling Its Surge

Gold and silver have now become two of the most powerful assets to date. With crypto and stocks adopting a stable outlook, 2026 seems to be favoring the metals sector the most, with both the assets climbing high on the price radar at an extraordinary speed. Gold’s primary price support is currently the geopolitical mayhem and brawls, with the US-Greenland agenda heating up. That being said, the global banks’ gold buying spree is also ramping up gold’s demand, which again is assisting the asset in ranking up on the public radar.

China continues to stockpile gold behind the scenes:

China acquired +10 tonnes of gold in November, ~11 times more than officially reported by the central bank, according to Goldman Sachs estimates.

Similarly, in September, estimated purchases reached +15 tonnes, or 10 times… pic.twitter.com/CmC5eOvT33

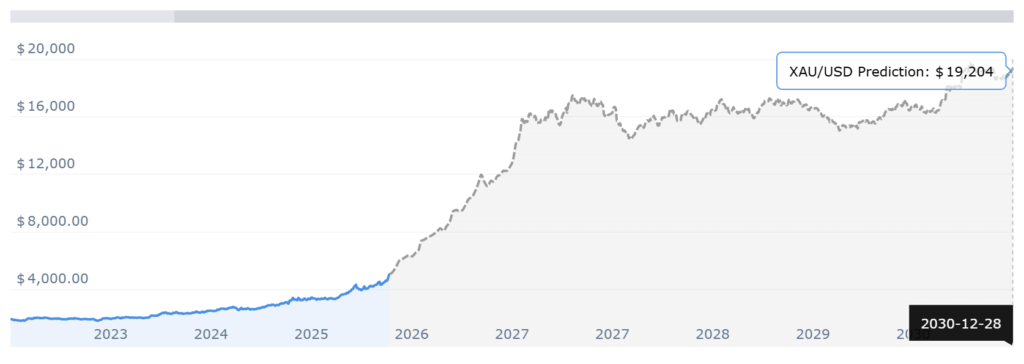

Gold Price Prediction for the Next 5 Years

According to CoinCodex gold stats, gold may hit a new price high of $19409 by the end of 2030.