Bitcoin Wipes Out All 2026 Gains: When Will the Real BTC Rally Finally Begin?

Bitcoin just erased every shred of progress it made in 2026. The question on every trader's screen isn't 'if' but 'when'—when does the genuine surge kick off?

The 2026 Wipeout: A Necessary Reset?

Markets don't move in straight lines—they purge. This year's gains vanishing acts less like a catastrophe and more like a system flush. It clears out the weak leverage, the overeager retail money, and resets the board for institutional players waiting on the sidelines with cleaner capital. Think of it as the market doing its own risk management, because frankly, some of those leveraged positions deserved to blow up.

Catalysts on the Horizon: More Than Just Hope

The rally trigger won't be a mystery. Watch for the convergence: regulatory clarity that finally moves past bureaucratic theater, institutional adoption that shifts from press releases to actual treasury allocations, and a macroeconomic pivot that makes hard assets attractive again. It's about the infrastructure maturing faster than the skeptics can publish their 'I told you so' reports. The pieces are being placed; the market is just waiting for the signal to execute.

The Psychology of the Bottom

True rallies aren't born from euphoria—they're forged in skepticism. When the last 'to the moon' tweet goes quiet and the conversation shifts from lambos to ledger mechanics, that's when you start looking up. The current pain shakes out the tourists. What's left is a hardened core of holders and builders, the exact foundation a sustainable bull run needs. Sentiment is a lagging indicator; price action leads.

Timing the Inevitable

Predicting the exact week is a fool's errand—reserved for charlatans and finance influencers selling courses. But the direction? That's locked in. Digital asset infrastructure is expanding while traditional finance grapples with legacy systems and committee meetings. The flow of capital is gravitational; it finds the path of least resistance and highest potential return. The wipeout isn't an end—it's an intermission. The next act begins when the market decides the discount is too steep to ignore, probably right after another major bank announces a 'blockchain task force' that goes nowhere. The real money moves quietly.

Bitcoin Wipes Out 2026 Gains

The start of 2026 has been tumultuous, to say the least. The markets have been under tight pressure, primarily due to the rising geopolitical uncertainties spurred by Donald Trump’s decision as US president to “buy” Greenland. At the same time, the markets are also anticipating interest rate cuts to continue adding pressure to the dollar, projecting a softer USD era to continue for a while. A blend of such activities has led the markets to go into a frenzy, with Bitcoin unable to score high in the process.

In addition to this, per the latest post by Walter Bloomberg on X, Bitcoin has ended up wiping out all the gains that the asset had acquired in 2026, leaving investors to question when Bitcoin will rally this year. Furthermore, Bloomberg was quick to add how nearly $490M flowed out of the US-listed Bitcoin ETFs, projecting the amount of frenzy that the markets are currently experiencing.

BITCOIN WIPES OUT 2026 GAINS

Bitcoin has erased all gains made since the start of 2026 as investors retreat from risk. After rising as much as 12% earlier, the cryptocurrency fell to around $87,000.

Nearly $490 million flowed out of U.S.-listed Bitcoin ETFs in one day,… pic.twitter.com/E2fUJBi5O6

The Bullish Forecast Remains High

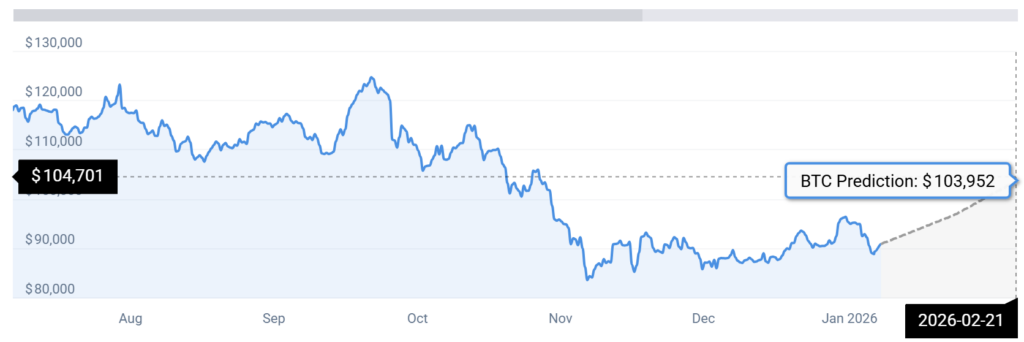

Per a recent forecast by CoinCodex, Bitcoin may rally soon, particularly peaking around February 2026, in its quest to hit the $102K price mark.