Monero Defies Market Meltdown: Bullish Momentum Holds Strong - Will the Rally Endure?

While the broader crypto market bleeds red, Monero stands defiant—a privacy fortress weathering the storm. Its price chart tells a story of resilience, bucking the bearish trend that's hammering mainstream assets. What's fueling this stealthy outlier?

The Privacy Premium Proves Its Worth

Market crashes have a funny way of separating hype from utility. As investors scramble for cover, Monero's core value proposition—untraceable, fungible digital cash—shines brighter. It's not just another speculative token; it's a functional tool that bypasses surveillance, appealing to those who value financial sovereignty above all else. When trust in traditional systems erodes, trustless privacy becomes priceless.

Network Metrics Don't Lie

Look beyond the price. Active addresses hold steady, transaction volume remains robust, and the mining hash rate—a key security indicator—hasn't flinched. This isn't a dead-cat bounce; it's organic demand playing out in real-time. The network's fundamentals are shrugging off the panic selling engulfing less substantive projects.

The Regulatory Shadow Looms—And It's a Double-Edged Sword

Every new regulatory crackdown on transparent blockchains sends a subtle, bullish signal to privacy coins. Monero's technology, by design, resists the chain analysis that regulators and tax authorities rely on. This creates a persistent, underlying bid from a segment of the market that's permanently hedging against overreach—a cynical but realistic pillar of demand in our increasingly monitored financial world.

So, will it last? Momentum is a fickle friend in crypto, but utility is not. Monero's rally isn't built on memes or VC promises; it's built on code that delivers what it says it will. While the 'tourists' flee the market, the true believers in digital privacy are just getting started. The real question isn't if the rally will fade—it's whether the rest of the market will ever catch up to what Monero users have known for years.

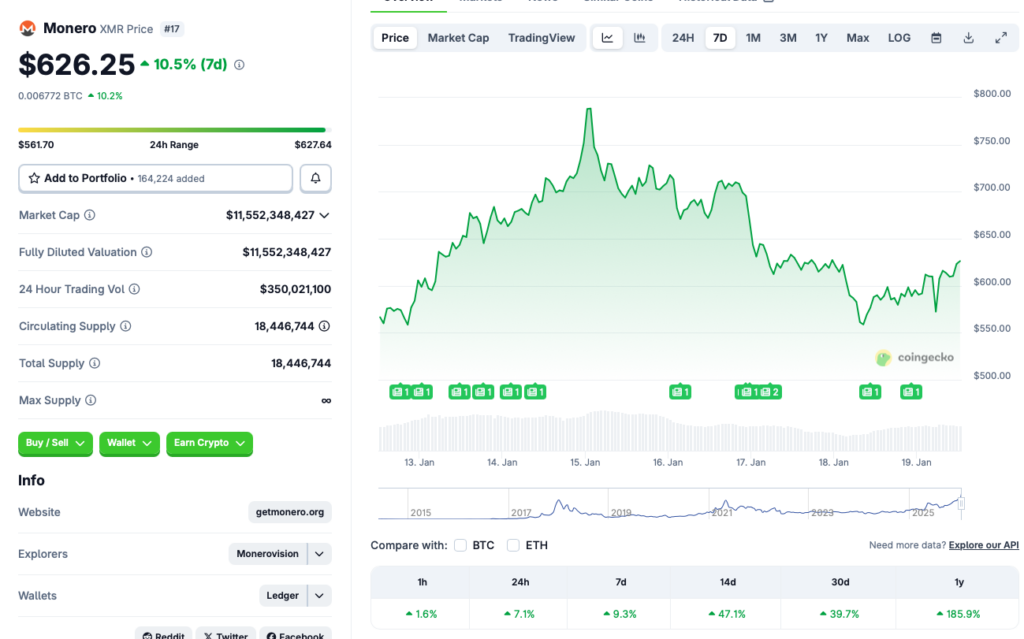

Source: CoinGecko

Source: CoinGecko

Will Monero’s Price Continue To Rally Despite The Market Crash?

Monero (XMR) turned bullish in late 2025 after a surge in demand for privacy-focused cryptocurrencies. Apart from Monero (XMR), ZCash (ZEC) also saw an upswing in late 2025. However, ZEC’s rally was short-lived, and the project faced a major slump after the core development team quit en masse due to internal conflicts. Investors likely quit their ZEC positions and moved their funds to XMR.

Monero (XMR) climbed to a new all-time high of $797.71 on Jan. 14 of this year. However, the asset’s price has dipped by 21.5% since its peak. XMR’s rally seems to have slowly cooled down over the last week. Given the ongoing market correction, Monero’s (XMR) rally could come to a halt over the coming days.

The crypto market is currently facing a steep price correction. Bitcoin (BTC) has fallen from $97,000 to $92,000, and other assets seem to be following its trajectory. Monero (XMR) could also suffer a similar fate. Today’s crypto market crash is likely due to ongoing geopolitical tensions between the US and Greenland. President Trump has expressed the desire for the US to acquire Greenland, citing national security concerns. However, other NATO countries have opposed this decision. France, Germany, and the UK have offered support to the Danish Kingdom to defend Greenland. President Trump announced additional tariffs on all countries supporting Greenland. The move may have led to a dip in investor sentiment.