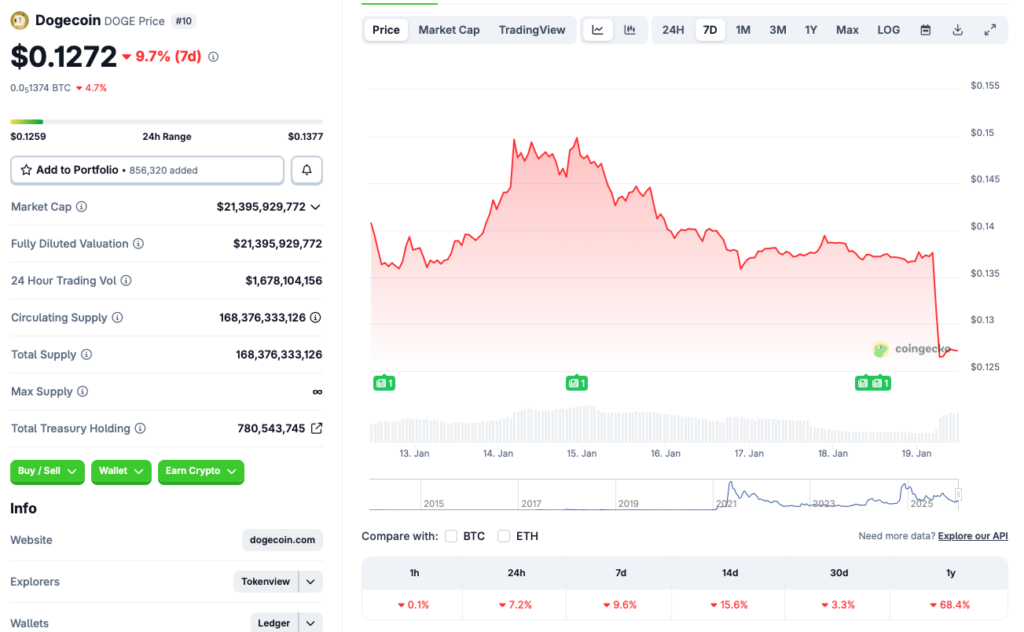

Dogecoin Plunges 9% This Week: Is This The Ultimate Buying Opportunity?

Dogecoin just got mauled by the bears. A brutal 9% weekly nosedive has the meme-coin community holding its breath and checking its portfolios. Again.

Decoding The Dip

That 9% figure isn't just a random stat—it's a flashing neon sign in the crypto casino. It signals a classic market shakeout, where weak hands panic-sell and seasoned players start scouting for entry points. The question on everyone's screen: is this a temporary correction or the start of something uglier?

Timing The Meme Market

Buying the dip sounds brilliant in theory—like buying a luxury sports car after a 50% off sale. In practice, it's about gauging momentum versus mania. Dogecoin's value has always danced to a different tune than your average asset, fueled as much by social media trends as by technical charts. A dip here could be a prime accumulation zone... or just the first step down a steeper staircase.

The Professional's Dilemma

For every crypto purist who scoffs at 'joke' money, there's a trader who's made a serious fortune on it. Adding DOGE to a portfolio is a calculated risk on viral sentiment itself. It's betting that the internet's favorite shiba inu still has bite, and that its community can once again defy sober financial logic—the kind of logic that, let's be honest, hasn't exactly covered itself in glory lately either.

So, buy the dip? It's less of an investment question and more of a gut check. Are you buying a discounted asset, or are you simply paying for a ticket to the next rollercoaster ride? In crypto, sometimes they're the same thing.

Source: CoinGecko

Source: CoinGecko

Why Did Dogecoin’s Price Crash? Should You Buy The Dip?

Dogecoin’s (DOGE) latest price correction comes amid a larger market dip. According to CoinGlass data, the crypto market has faced nearly $870 million worth of liquidations in the last 24 hours.

Dogecoin (DOGE) and the larger market correction could be due to rising tensions between the US and other NATO allies. President Donald TRUMP has said that the US needs to take over Greenland, citing national security concerns. France, Germany, and other NATO countries have offered support to the Danish Kingdom to defend Greenland against the possibility of a US invasion. The US has announced additional tariffs for countries supporting Greenland. Investors are likely worried about the ongoing situation and are pulling out their funds from risky assets.

While Dogecoin (DOGE) and the larger crypto market face price corrections, metal prices seem to be going up. Gold and silver have hit new all-time highs as investors opt for safe havens instead of risky assets.

![]() METALS ARE PUMPING!!!

METALS ARE PUMPING!!!

Gold and silver just hit new highs as US–EU tariff tensions rise over Greenland.

Tariff threats drove a risk-off MOVE causing crypto and stocks to dip and safe havens to rally.

At today’s market open, gold surged to $4,690, while silver touched $94. pic.twitter.com/PTk27HxWUs

Dogecoin (DOGE) is a memecoin and carries some of the highest risks in the finance market. Hence, the asset may face a prolonged period of decline. DOGE’s price is unlikely to make any positive movements until the larger economy and the ongoing geopolitical tensions cool off. However, the low prices could be a good opportunity to stock up on the memecoin.