XRP Plunges Below $2 Again: Dead Cat Bounce or Final Capitulation?

XRP just got smacked back below the $2 threshold—again. The digital asset's latest rally fizzled out faster than a meme coin's utility, leaving traders staring at charts and asking the same painful question: was that brief surge just another textbook dead cat bounce?

The Pattern of Hope and Disappointment

It's a familiar script. A wave of optimism, a sharp price spike that gets everyone talking, followed by an even sharper reversal that wipes out gains and then some. This cycle of rally-and-retrace has become XRP's signature move, testing the conviction of even its most ardent supporters.

Market Mechanics vs. Market Sentiment

Technical indicators can paint one picture—oversold conditions, potential support levels—while the market's collective psychology paints another. The fear of missing out (FOMO) that fuels these bounces often collides with the cold reality of sell-pressure and profit-taking. It's the age-old battle between hope and liquidity.

Navigating the Volatility

For practitioners, these swings aren't just headlines; they're trading signals and risk management exercises. The key lies in distinguishing between a healthy correction within a larger uptrend and a genuine breakdown. One requires patience; the other demands decisive action to preserve capital. It's where disciplined strategy separates long-term players from short-term noise.

Looking Beyond the Price Chart

While the price action dominates conversations, the underlying ecosystem's health—adoption, regulatory clarity, developer activity—often tells a more important, longer-term story. A single candle on a chart is just data; the narrative around the asset provides the context. Sometimes the market just needs to throw a tantrum before getting back to business—usually right after the weak hands have been shaken out, of course.

So, dead cat bounce or springboard to the next leg up? The market will decide. In the meantime, watching XRP wrestle with this key level is a masterclass in market dynamics—a reminder that in crypto, sometimes you're the windshield, and sometimes you're the bug. Just ask anyone who bought the top, believing the analysts' price targets that assumed perpetual growth and zero gravity—a classic case of financial storytelling overriding mathematical reality.

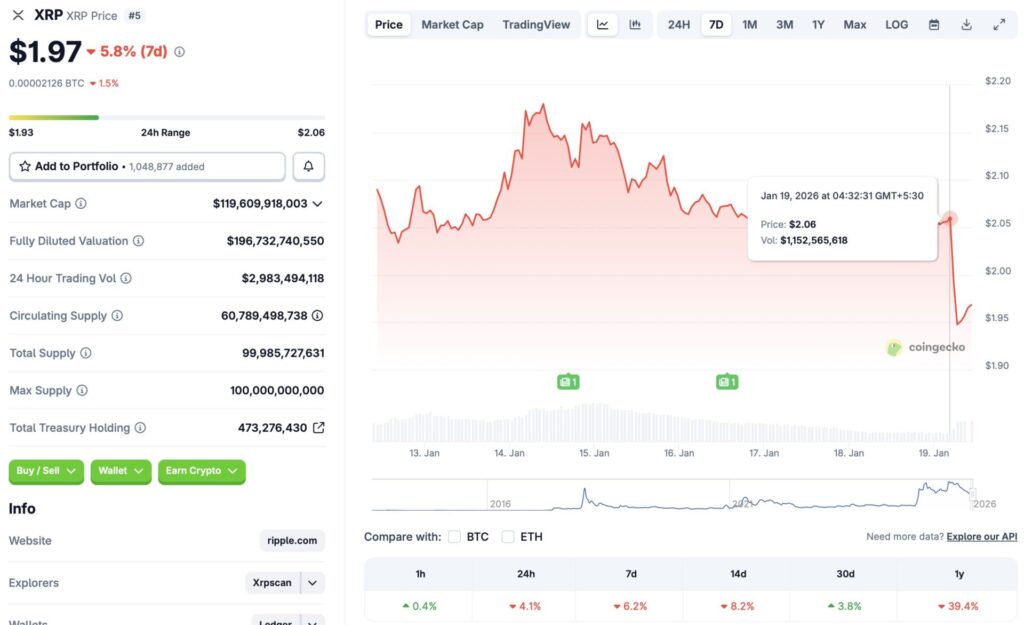

Source: CoinGecko

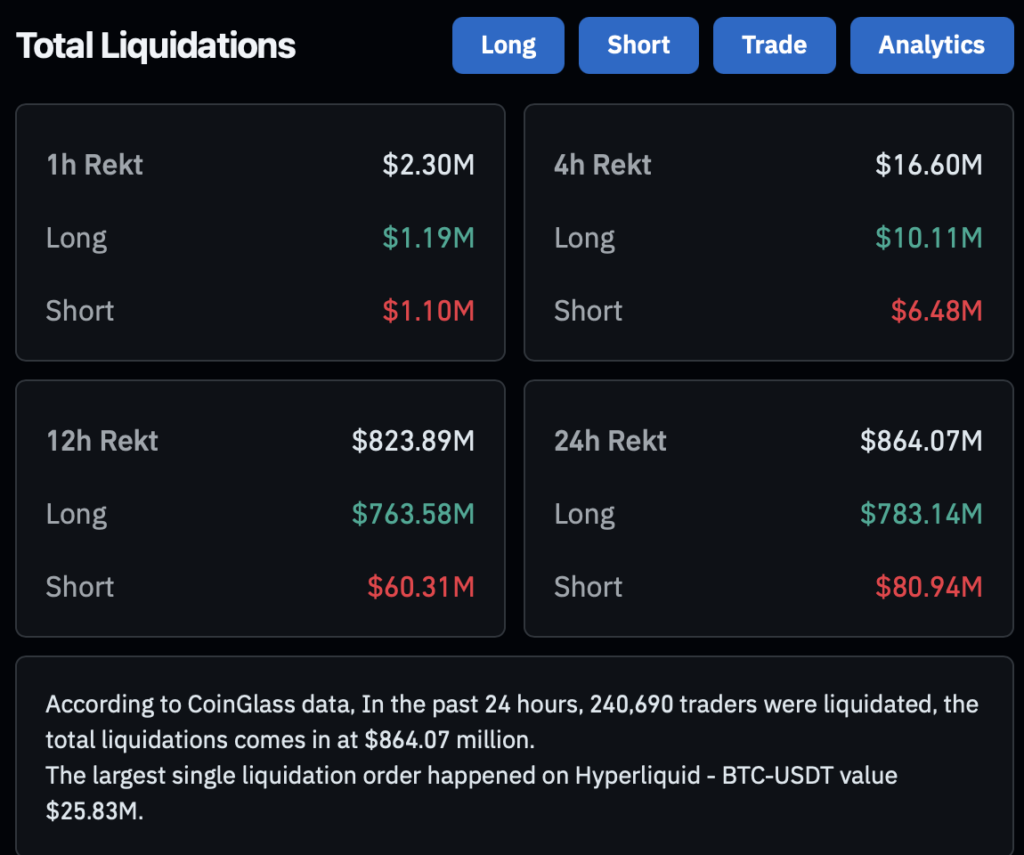

Source: CoinGecko

Why Did XRP’s Price Crash Today?

XRP’s price dip comes amid a market-wide correction phase. Bitcoin (BTC) hit the $97,000 mark last week, but has fallen to the $92,000 level today. The larger crypto market is likely following Bitcoin’s (BTC) trajectory. According to CoinGlass data, the crypto market has faced $864 million worth of liquidations in the last 24 hours.

XRP and the larger market crash could be due to geopolitical tensions arising from the recent US-Greenland debacle. President TRUMP wants the US to takeover Greenland, citing national security concerns. Other NATO countries are against the President Trump’s decision, offering military support to the Danish Kingdom to defend Greenland. The development may have led to a spike in investor worry. XRP and other crypto assets are likely suffering the consequence of the global stage.

XRP may continue to struggle over the coming weeks. The crypto market is still quite weak after the October 2025 crash. The market is far from recovered, and investors are opting for safer alternatives, like gold and silver.

Despite the current downtrend, XRP could pick up the pace later this year. The asset had quite a bullish year in 2025, and many anticipate the asset to break out in 2026. CNBC called XRP the “hottest crypto trade of 2026,” in a recent reporting.