How a $1,000 Bet on Monero Could Have Turned Into $3.6 Million

Forget the lottery—crypto's silent giant just printed a generational wealth blueprint.

The Math That Stuns Wall Street

Monero's journey from obscurity to privacy powerhouse delivered a return that makes traditional finance blush. We're talking about the kind of multiplier that turns a modest investment into life-altering capital—the exact figure that redefines 'asymmetric upside.'

Privacy Pays—And How

While regulators fretted, Monero's code did the talking. Its fungibility engine—the tech that makes every coin identical and untraceable—became its killer app. No centralized gatekeeper, no transaction ledger open to snoops. Just digital cash that actually works like cash.

The Cynic's Corner

Your bank's high-yield savings account offered 0.5% last year. Monero's run laughs at those decimal points. It's a brutal reminder: legacy finance optimizes for stability; crypto still rewards conviction in foundational technology shifts.

Looking Forward

The real question isn't about missed past gains—it's about what the next privacy-preserving protocol will be. Monero proved the demand exists. The market is now hunting for what builds on that foundation. The playbook is written. The only variable is execution.

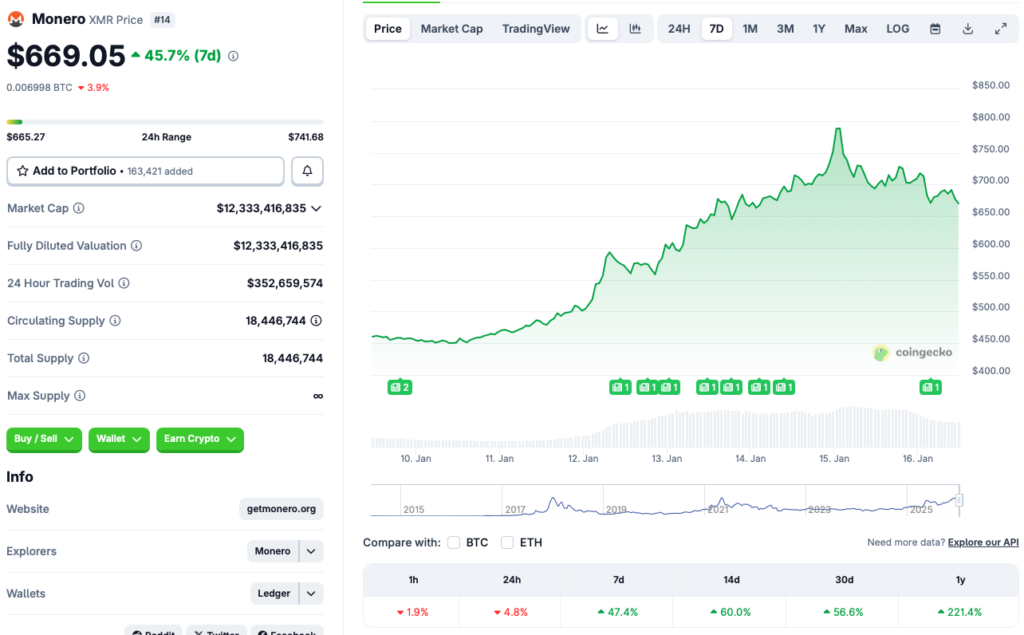

Source: CoinGecko

Source: CoinGecko

You Could Have Made $3.6 Million With Monero On a $1000 Investment

According to CoinGecko data, Monero (XMR) was at its lowest price of $0.2162 in January 2015, 11 years ago. If you had purchased $1000 worth of XMR when it was at its lowest, you WOULD have received about 4,629.63 coins. The value of the 4,629.63 XMR coins when the asset climbed to its peak of $797.73 was around $3.6 million. Your investment would have grown by about 369,253.7%.

Early investors may have made massive returns, but current investors are wondering if they can also make it big with Monero (XMR). XMR’s latest price upswing is likely due to a surge in the popularity of privacy tokens in late 2025. However, XMR’s rally was further propelled by the internal clashes at Zcash (ZEC). ZEC’s entire core developmental team quit en masse due to internal struggles. The development has likely led to investors moving away from ZEC and pouring their funds into XMR.

Monero (XMR) is currently showing signs of a slowdown, given its latest correction. Moreover, the larger crypto market is still struggling to recover from the market crash in late 2025. Given the larger bearish tone, XMR may see further price corrections as investors book profits.